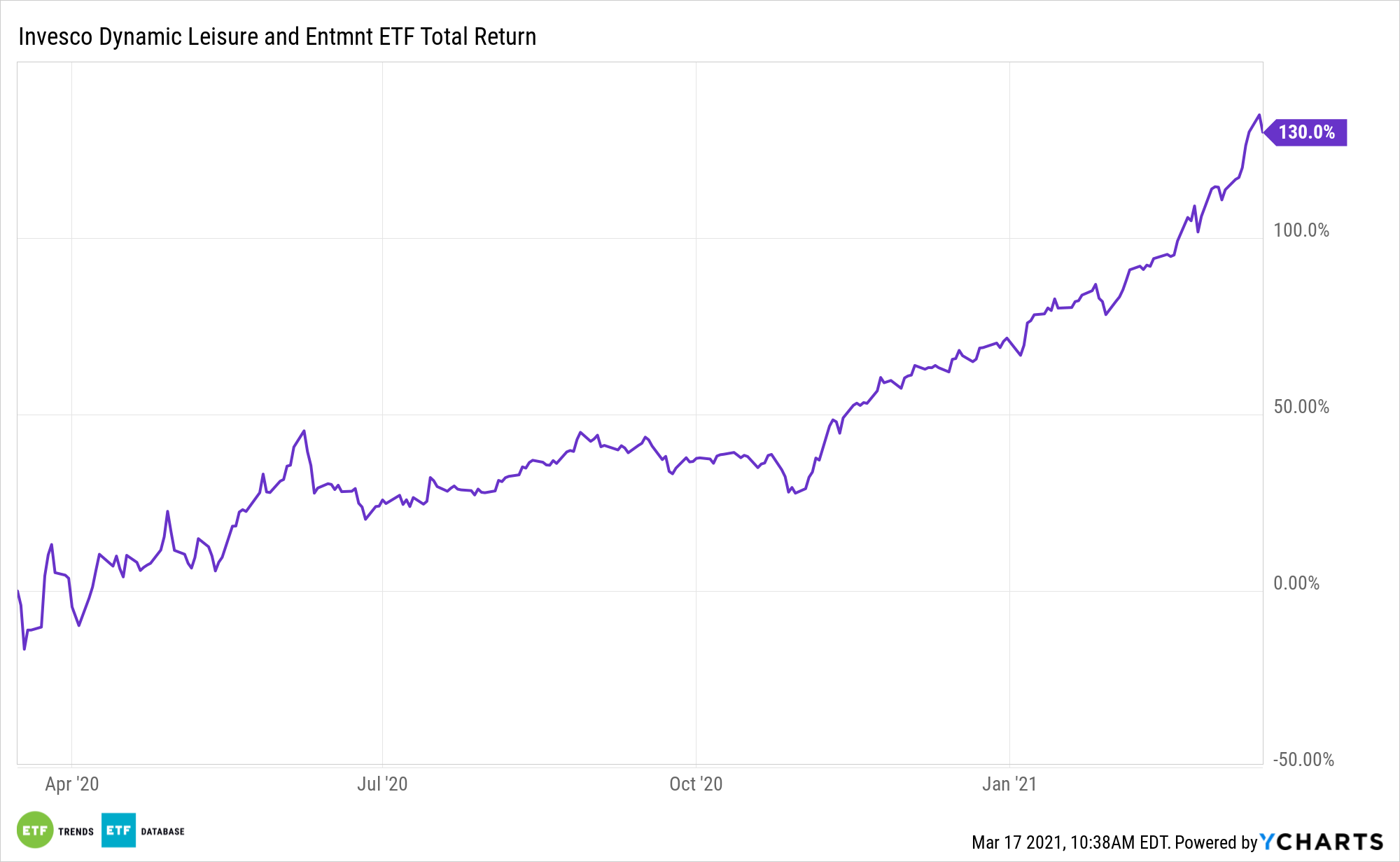

With coronavirus vaccinations increasing and many consumers flush with cash courtesy of Uncle Sam, reopening stocks are rallying. That’s good news for the Invesco Dynamic Leisure and Entertainment ETF (PEJ).

PEJ is based on the Dynamic Leisure & Entertainment Intellidex℠ Index (Index). The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index.

The Index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value. The Index is comprised of common stocks of 30 US leisure and entertainment companies. The Invesco ETF is hot, jumping 8.45% over the past week.

“After the Covid-19 pandemic evaporated demand for travel and leisure, the industry is finally coming back as the vaccines roll out and states begin to ease lockdown restrictions. Air travel over the weekend hit its highest level in more than a year and many investors and economist expected a boom in travel from pent-up demand,” reports Maggie Fitzgerald for CNBC.

The Reopening Rally: ETFs Like PEJ Can’t Wait

PEJ consists of a variety of market cap allocations. ETF investors can capture the stability of large caps, the growth of small caps, and the best of both worlds via mid caps.

As a global vaccine rollout continues, the leisure and entertainment industry should continue its healing process. That’s a boon for PEJ and its components.

“Now, with COVID ending and the labor market improving, it stands to reason that people who receive a check but that also might now be experiencing financial hardship will use it for more discretionary spending, including booking future travel and going out to eat. As such, we view the stimulus as tangentially positive for PEJ, the Invesco Dynamic Leisure and Entertainment ETF,” said Tom Essaye, editor of the Sevens Report.

The recent divergence between tech and cyclical plays suggests that the bull market is still going strong, according to Mike Wilson, the chief U.S. equity strategist at Morgan Stanley. Investors also cheered news from the Centers for Disease Control and Prevention, which recently stated that people who’ve been fully vaccinated against coronavirus can meet safely indoors without masks.

“Boosting sentiment further, the government pushed through a $1.9 trillion stimulus package last week that is sending $1,400 direct payments to million of Americans,” concludes CNBC.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.