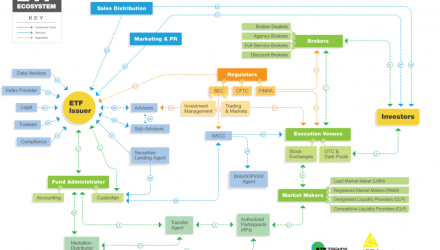

18. FINRA monitors Brokers to ensure federal regulations are being followed. It also seeks to protect Investors from unscrupulous sales tactics.

19. Compliance monitors the ETF issuer and funds for compliance with regulations, policies, and procedures.

20. The Trustees monitor vendors and the general management of the trust to ensure shareholders’ rights and interests are being protected.

21. The Legal team assists the ETF Issuer with contracts and provides general counsel. It also sets the agenda for regular and special meetings of Trustees.

Distribution and Record-Keeping

Lastly, the ETFs make their way to the capital markets and as they are bought or sold, the necessary parties keep adequate records for distribution to the proper channels.

22. The Index Provider transmits daily index constituents to the ETF for the purpose of tracking the portfolio.

23. Data Vendors communicate various data points such as securities pricing, corporate action information, and website informatics to the ETF Issuer and its service providers.

24. The Sales Distribution team of an ETF issuer is usually in-house, but can be outsourced to a 3rd party.

25. The Sales Distribution team works to sell the ETF to Investors.

26. Marketing and PR sets messaging strategy as well as methods of communicating the ETF Issuer’s products to investors.

27. Marketing and PR communicates key information about the ETF to Investors by shaping branding, educational content, and messaging, as well as arranging media opportunities and appearances.

28. The investment Advisor monitors and manages the day-to-day operations of the ETF and its other service providers.

29. A Sub-advisor, if engaged, manages all or part of the investment portfolio of the ETF.

30. A Sub-advisor may be engaged on behalf of the primary investment advisor to manage some, or all, of the portfolio’s assets.

31. The Securities Lending Agent acts as agent of the Fund to manage the lending of portfolio securities. This service generally does not start until the fund has some scale.

32. The Custodian and Securities Lending Agent work in tendem to facilitate the borrowing of securities with proper record-keeping.

33. The Custodian transmits creation/redemption baskets nightly to the NSCC (National Securities Clearing Corporation) who then disseminates it to all member firms including back to the custodian.

34. The NSCC (National Securities Clearing Corporation) transmits ETF constituents to the IOPV (Indicative Optimized Portfolio Value) calculation agent each morning to generate estimated intra-day share price.

35. The NSCC (National Securities Clearing Corporation) transmits official creation/redemption basket to Exchanges for public dissemination.

For more baseline knowledge regarding ETFs, visit the ETF Education category.