MIDSTREAM RISES LAST WEEK WHILE RENEWABLES LAG

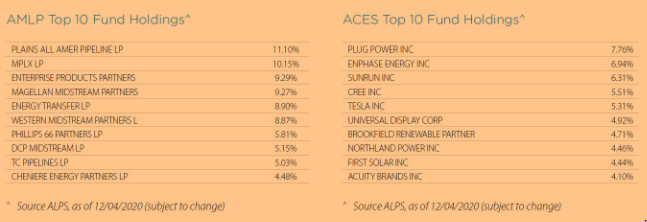

- Last week, the Alerian MLP ETF (AMLP) surged over 9% on the heels of a 16% gain from its Gathering & Processing MLPs. Crude oil gained roughly 2% last week after OPEC + (Organization of the Petroleum Exporting Cooperation + Russia) agreed to a smaller than expected increase in its daily crude output with planned monthly meetings to reassess the quota as the pandemic plays out into 2021.

- Since the end of October, AMLP has returned over 40% as midstream energy infrastructure continues its price recovery with the market’s rotation to value stocks. The price of crude oil has jumped over 27% during the same period with optimism growing that COVID-19 vaccines will begin to be rolled out by year-end.

- In the renewable clean energy space, the ALPS Clean Energy ETF (ACES) posted losses last week on weakness from its Solar, Fuel Cell, and Electric Vehicle (EV) segments that account for over 42% of the fund*, collectively. Delayed contract wins, valuation downgrades, and a solar battery recall acted as the catalyst for investors taking profits in clean energy names last week.

- While ACES underperformed last week, the fund has climbed over 100% year-to-date as the transition to clean energy production and consumption has been kickstarted, globally, under the premise of green stimulus plans.

THE LOOMING ENERGY TRANSITION WON’T OCCUR OVERNIGHT

- The IEA (International Energy Agency) now predicts that renewables will be the leading global power source by 2025. Importantly, the increasing share of renewable power will come at the cost of coal, rather than natural gas, which the IEA expects to continue to increase to over 25% of global power generation by 2025.

- Similarly, long-term growth in oil demand will be tamed by the switch to more efficient or electric vehicles, the IEA forecast. However, oil consumption will still increase by about 750,000 barrels a day each year to reach 103.2 million a day by 2030. That’s about 2 million a day less than predicted in last year’s IEA report, but still portends to continued growth in midstream infrastructure.

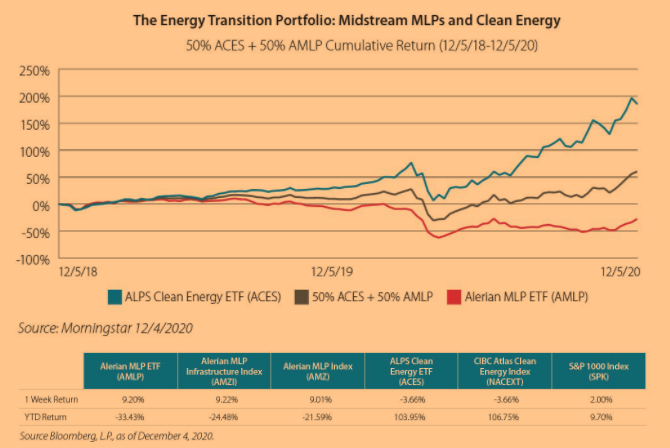

- An equal blend of ACES and AMLP may offer improved risk-adjusted returns and an impressive historical yield of 6.04% with its exposure to the midstream MLP sector and high growth clean energy names.

- AMLP and ACES have exhibited fairly opposite total returns over the past eighteen months. While the causation of the opposite returns has been more specific to the unfavorable market conditions for midstream, rather than cannibalization from clean energy, pairing AMLP and ACES may help capture both sides of the expected growth in the global energy market over time.

Performance data quoted represent past performance. Past performance is no guarantee of future results so that shares, when redeemed may be worth more or less than their original cost. The investment return and principal value will fluctuate. Current performance may be higher or lower than the performance quoted. For the most current month end performance data please call 844.234.5852. Performance includes reinvested distributions and capital gains.

Past performance is not indicative of future results. For standardized performance of the fund please click here: AMLP | ACES.

* Weights in ACES as of 12/4/2020

Originally published by ALPS

Important Disclosure & Definitions

An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus which contain this and other information call 866.675.2639 or visit www.alpsfunds.com. Read the prospectus carefully before investing.

Shares are not individually redeemable. Investors buy and sell shares on a secondary market. Only market makers or “authorized participants” may trade directly with the fund, typically in blocks of 50,000 shares.

There are risks involved with investing in ETFs including the loss of money. Additional information regarding the risks of this investment is available in the prospectus.

The Fund is subject to the additional risks associated with concentrating its investments in companies in the market sector. Diversification does not eliminate the risk of experiencing investment losses.

Basis points – One basis point is equal to 1/100 of a percent.

Clean Energy Sector Risk. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions can significantly affect companies in the clean energy sector. In addition, intense competition and legislation resulting in more strict government regulations and enforcement policies and specific expenditures for cleanup efforts can significantly affect this sector. Risks associated with hazardous materials, fluctuations in energy prices and supply and demand of alternative energy fuels, energy conservation, the success of exploration projects and tax and other government regulations can significantly affect companies in the clean energy sector. Also, supply and demand for specific products or services, the supply and demand for oil and gas, the price of oil and gas, production spending, government regulation, world events and economic conditions may affect this sector. Currently, certain valuation methods used to value companies involved in the clean energy sector, particularly those companies that have not yet traded publicly, have not been in widespread use for a significant period of time. As a result, the use of these valuation methods may serve to increase further the volatility of certain clean energy company share prices.

Concentration Risk. The fund seeks to track the underlying index, which itself may have concentration in certain regions, economies, countries, markets, industries or sectors. Underperformance or increased risk in such concentrated areas may result in underperformance or increased risk in the fund.

NACEX Index – The CIBC Atlas Clean Energy Index is an adjusted market cap weighted index designed to provide exposure to a diverse set of U.S. or Canadian based companies involved in the clean energy sector including renewables and clean technology.

SPK Index – The S&P 1000 combines two leading indices, the S&P MidCap 400 & the S&P SmallCap 600, to form an investable benchmark for the midsmall cap universe of the U.S. equity market. S&P 1000 measures the performance of widely available and highly liquid stocks, making the S&P 1000 the appropriate mid-small cap index for investors seeking to replicate the performance of the U.S. equity market.

The Alerian MLP Infrastructure Index is a composite of energy infrastructure Master Limited Partnerships (MLPs).

Alerian MLP Index is the leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price return basis (AMZ) and on a total-return basis (AMZX).

Under current law, the AMLP is not eligible to elect treatment as a regulated investment company due to its investments primarily in MLPs. The Fund must be taxed as a regular corporation for federal income purposes. Whereas the NAV of Fund Shares is reduced by the accrual of any deferred tax liabilities, the Alerian MLP Infrastructure Index is calculated without any tax deductions.

An investor cannot invest directly in an index.

The Fund employs a “passive management”- or indexing- investment approached and seeks to track the investment results of an index composed of global companies that enter traditional markets with new digital forms of production and distribution, and are likely to disrupt an existing market or value network. Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble unless that security is removed from the CIBC Atlas Clean Energy Index. Similarly, the Fund does not buy a security because the security is deemed attractive unless that security is added to the CIBC Atlas Clean Energy Index.

ALPS Portfolio Solutions Distributor, Inc. is the distributor for the ALPS Clean Energy ETF.