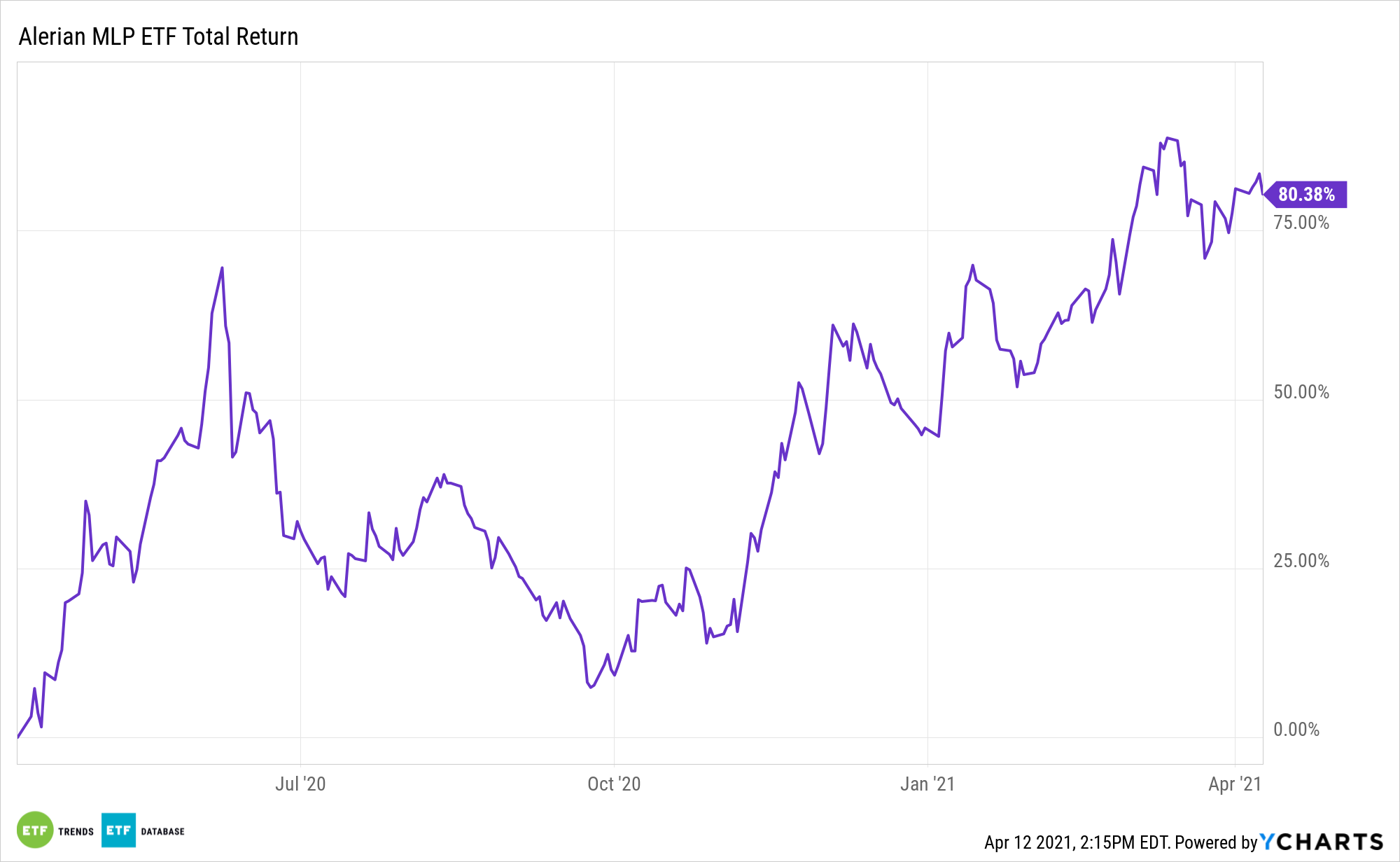

The energy sector was a star in the first quarter, but with much of the group’s near-term upside already priced in, investors need to emphasize quality. The ALPS Alerian MLP ETF (NYSEArca: AMLP) can help with that objective.

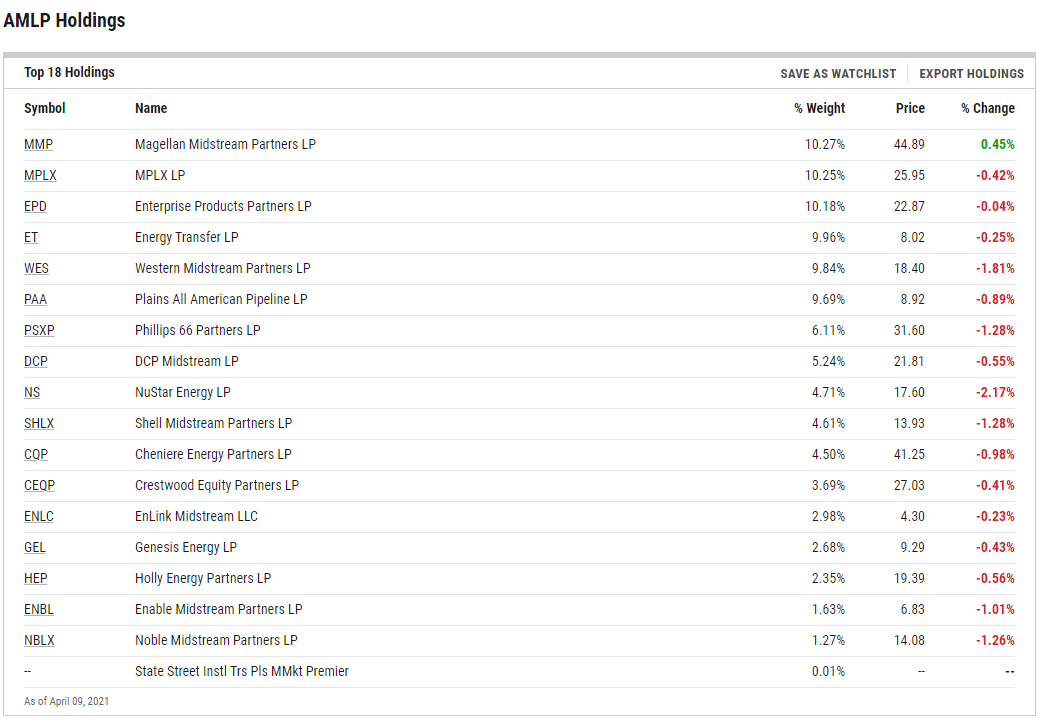

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

“The ongoing rollout of COVID vaccinations is the primary driver, since the reopening of the global economy should eliminate the need for the stay-at-home orders and travel restrictions that have been suppressing crude demand in the last 12 months,” writes Morningstar analyst Dave Meats.

Assessing the ‘AMLP’ Opportunity Set

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

For patient investors, AMLP could pay off as the runway to pre-pandemic oil demand levels is lengthy.

“We still think global consumption will be back at 2019 levels within two years. Nonetheless, their offer has challenges. European countries are on the brink of extending lockdowns into April, given rising infections and the safety and effectiveness of the AstraZeneca vaccine, in particular, has been called into question in some parts of the world,” adds Meats.

Investors can look to the midstream space for more compelling cash flow-generating prospects. Free cash flow is the cash a company has left over after accounting for capital spending and it’s a vital evaluation metric in capital-intensive industries such as energy. Fortunately, the outlook on this front is bright for midstream names. The midstream space is also usually more defensive and less volatile than other energy segments due to steady, reliable cash flows.

Those factors add to the AMLP case as do the fund’s status as being home to an array of stocks that are still trading at attractive multiples.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.