ETF analysis relies on many indicators and patterns, but there’s one that offers a particular spin: the RSI indicator. The Relative Strength Index (RSI) measures the speed and magnitude of changes in an ETF’s price. That helps investors understand whether markets have overbought or oversold an ETF or security. With equal-weight dividend ETF ALPS Sector Dividend Dogs ETF (SDOG) nearing oversold territory, investors are nearing a new entry point.

The RSI indicator hits “overbought” territory when it rises to or above 70, and it enters oversold territory when it hits 30. Right now, SDOG is sitting just above the latter value at 34.9. That’s coincided with a steady drop in price for the strategy nearing a one-year low. Previous oversold periods have coincided with solid gains, and the equal-weight dividend ETF has the opportunity to go again.

See more: “Avoid Value Trap in Value Dividend ETF SDOG”

Digging Into Equal-Weight Dividend ETF SDOG

What does an equal-weight approach entail? SDOG allocates about the same amount of assets to each of 10 different sectors. The ETF employs the “Dogs of the Dow” approach and carves out 10 components via the Dow Jones Industrial Average. It adds current income to investor portfolios via its preference for the highest dividend yields available in each of those sectors.

Its value approach could benefit from a swingy moment in the U.S. market. While the debt ceiling deal looks set to happen, rising rates are still out there. So too does inflation still linger, and a still-possible recession threatens a strange year for the markets. An ETF like SDOG that combines current income and value could be an appealing option in such an environment.

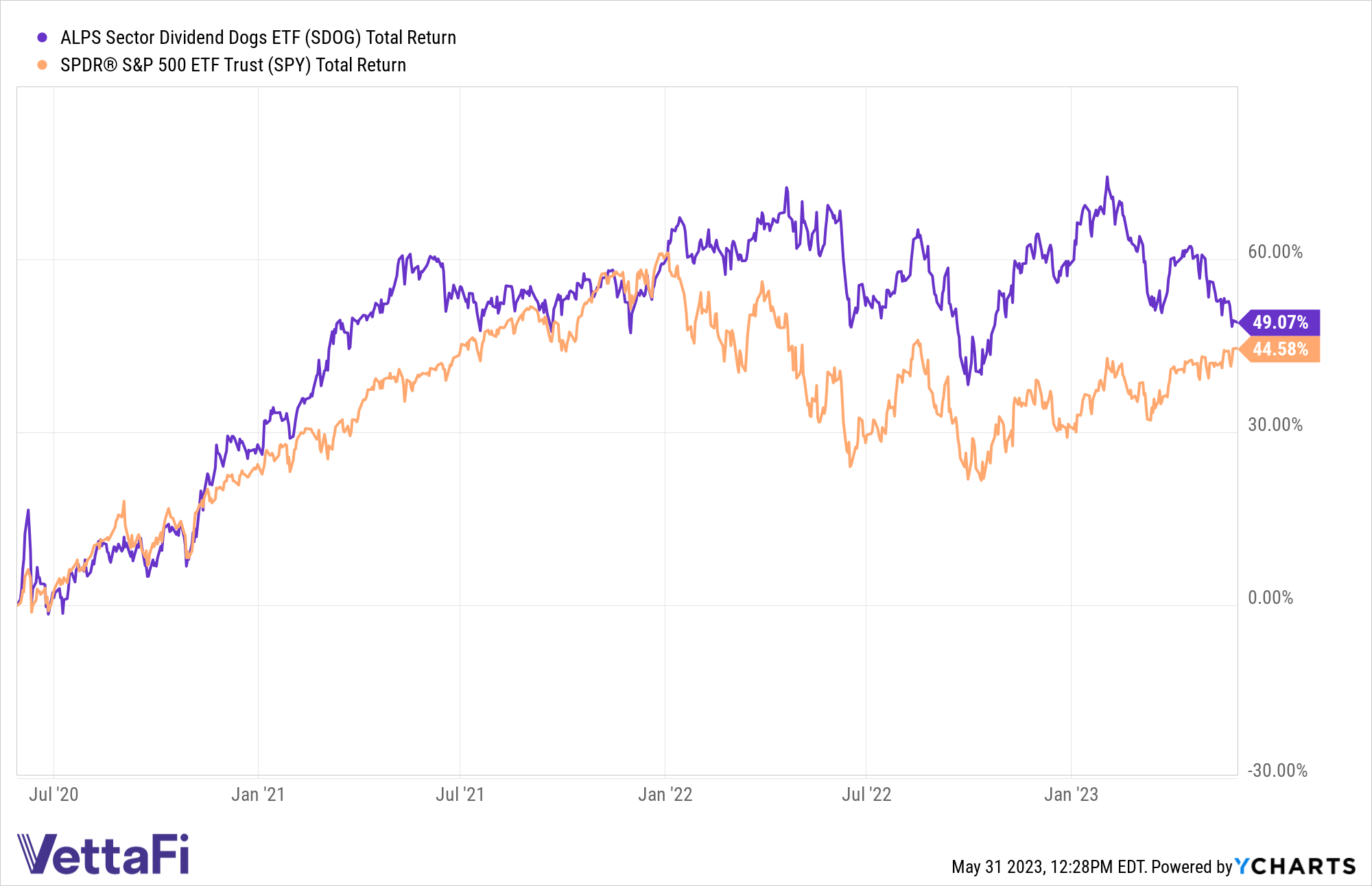

SDOG’s price and proximity to oversold status may make it a long-term buy opportunity right now. SDOG has outperformed the SPDR S&P 500 ETF Trust (SPY) over the last three years. For a long-term value, current income play, SDOG merits a look, offering a 4.2% annual dividend yield, according to VettaFi.

SDOG has outperformed SPY over a longer time frame of three years.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for SDOG, for which it receives an index licensing fee. However, SDOG is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of SDOG.