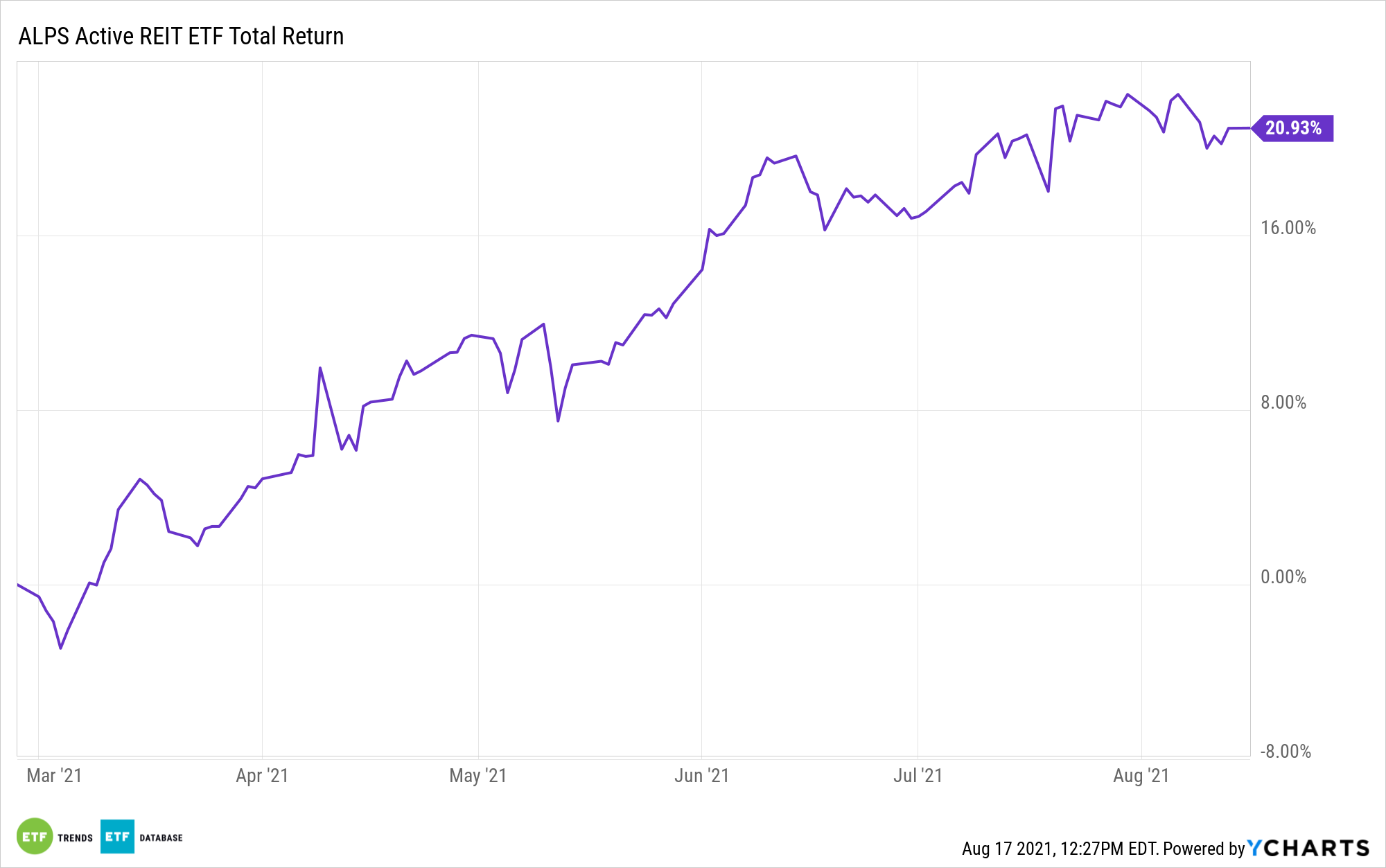

Real estate is the best-performing sector in the S&P 500 and the ALPS Active REIT ETF (NASDAQ: REIT) is up 20% year-to-date – a performance all the more impressive when considering the fact that the exchange traded fund is just six months old.

Yet some corners of the real estate market are outpacing others this year, highlighting the benefit of REIT being an actively managed fund. That means the fund’s managers can trim allocations to real estate stocks that have gotten too far ahead of themselves or possibly increase exposure to some that are lagging or recently retreated.

“After a big run-up for many of the shares in the REIT sector, there is a wide range of opinion from Wall Street analysts on which stocks will perform the best moving forward. A down week has left a buying opportunity for some of the names, analysts said,” reports Jason Gewirtz for CNBC.

Some residential REITs pulled back last week and those retrenchments could mark buying opportunities.

“Avalon Bay, Apartment Income REIT, American Homes 4 Rent and UDR all fell in the two percent range while Essex Property Trust fell just more than three percent,” according to CNBC.

Avalon Bay was REIT’s third-largest holding at the end of the first quarter, commanding a weight of 6.74%. REIT is an active semi-transparent ETF, meaning its holdings aren’t disclosed on a daily basis as is the case with traditional passive ETFs and index funds.

Yet several analysts are bullish on Avalon Bay.

“We expect strong demand to continue for several quarters and certainly into 2022,” said BTIG analyst James Sullivan. “High current occupancy rates will allow owners to push rates.”

Even with last week’s pullback, Avalon Bay, which yields 2.83%, is higher by 40% year-to-date. Another REIT component generating buzz amongst analysts is American Homes 4 Rent (NYSE: AMH). That stock represented almost 3% of the ETF’s weight at the end of the first quarter.

“American Homes 4 Rent operates in 22 states and specializes in renting single family homes. The stock has jumped 36% so far this year but has dropped in the last few weeks, now hovering about 4 percent from the high it hit in late July,” according to CNBC.

The residential REIT yields less than 1%, implying ample room for dividend growth.

Other REIT ETFs include the Schwab US REIT ETF (NYSEArca: SCHH) and the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.