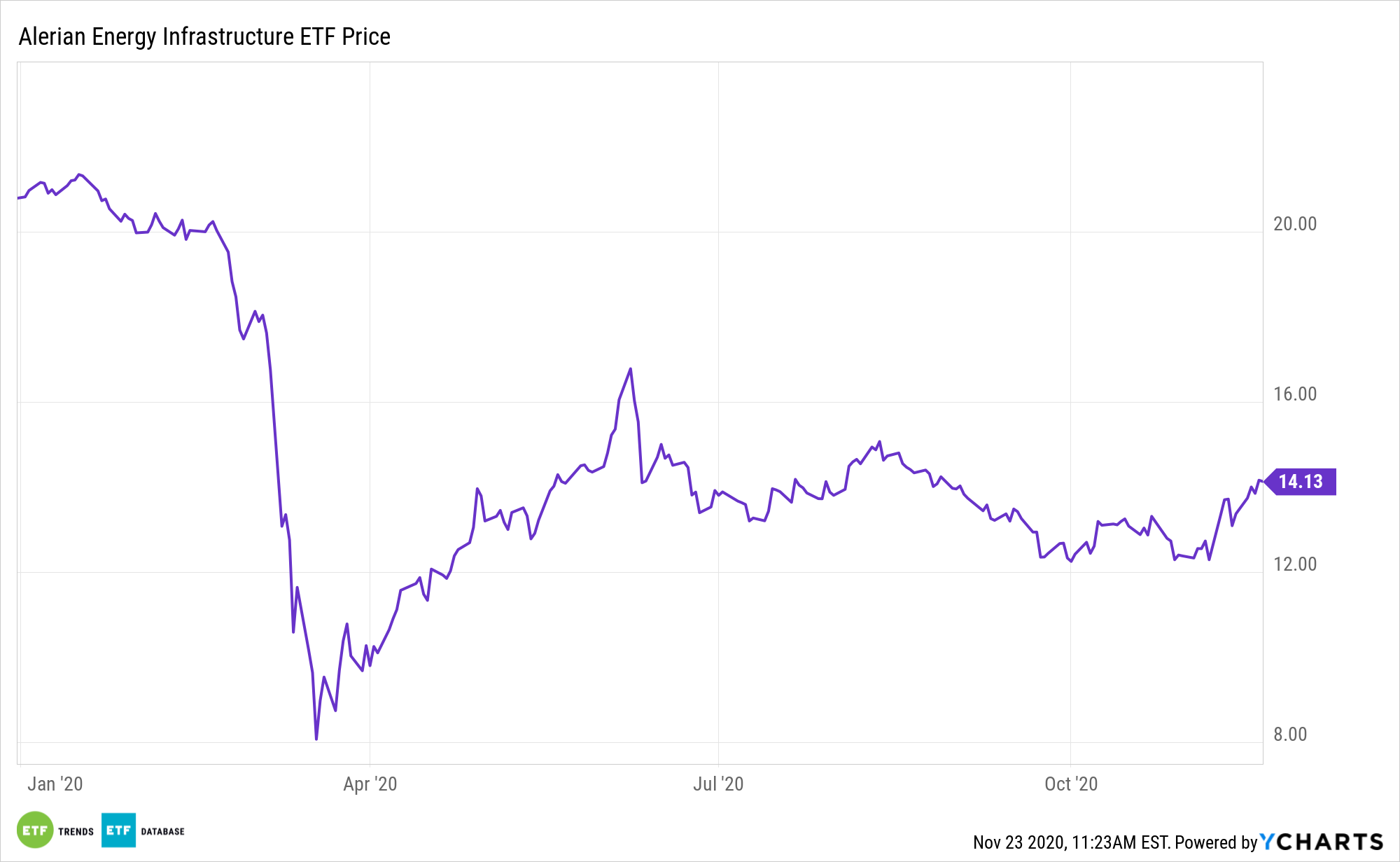

Amid another round of encouraging news on the coronavirus vaccine front, previously downtrodden energy stocks and exchange traded funds soared last week. The Alerian Energy Infrastructure ETF (ENFR) took part in that rise, jumping 5.68%.

ENFR tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

Some analysts say a successful COVID-19 vaccine is crucial to the energy sector’s hopes of rebounding in 2021.

“We agree that a vaccine is crucial to energy stocks, although we had already expected one or more successful vaccines to be deployed in the first half of 2021,” writes Morningstar’s Preston Caldwell. “Once broad vaccination occurs, most economic activity has the potential to return to normal. Not only will this spur a broad recovery in GDP, but we also expect the ratio of oil demand to GDP to essentially recover to prepandemic levels. Altogether, this will make for a near-complete recovery in oil demand to our prepandemic expectations.”

Reasons for ENFR (and Energy) ETF Optimism

Last week, Moderna and AstraZeneca/Oxford University delivered encouraging news about their vaccine efforts, and it appears the U.S. is getting closer to a safe vaccine that could be widely distributed at some point by mid-2021, which would be a boon for the beaten up energy sector and assets such as ENFR. Still, there are some other issues to consider.

What markets are looking at now when it comes to the traditional energy sector are two Georgia Senate races that move to January. If the Democrats win both, they’d have a Senate majority, perhaps providing a runway for clean energy at fossil fuels’ expense.

On the upside, many of ENFR components are simply transporters of energy and aren’t as sensitive to oil price changes as, say, exploration and production companies or oil services names.

“Once a vaccine is available, however, we expect a very strong recovery in global air travel, in line with Morningstar’s travel analysts. 9/11 is an instructive episode: While the fear created by the attacks had a temporary depressing effect on air travel, that effect faded over time and eventually air travel more or less fully recovered,” according to Morningstar.

Bottom line: ENFR could be a solid 2021 idea if a safe vaccine comes to market.

Other MLP funds include the Global X MLP ETF (NYSEArca: MLPA) and the JPMorgan Alerian MLP Index ETN (NYSEArca: AMJ).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.