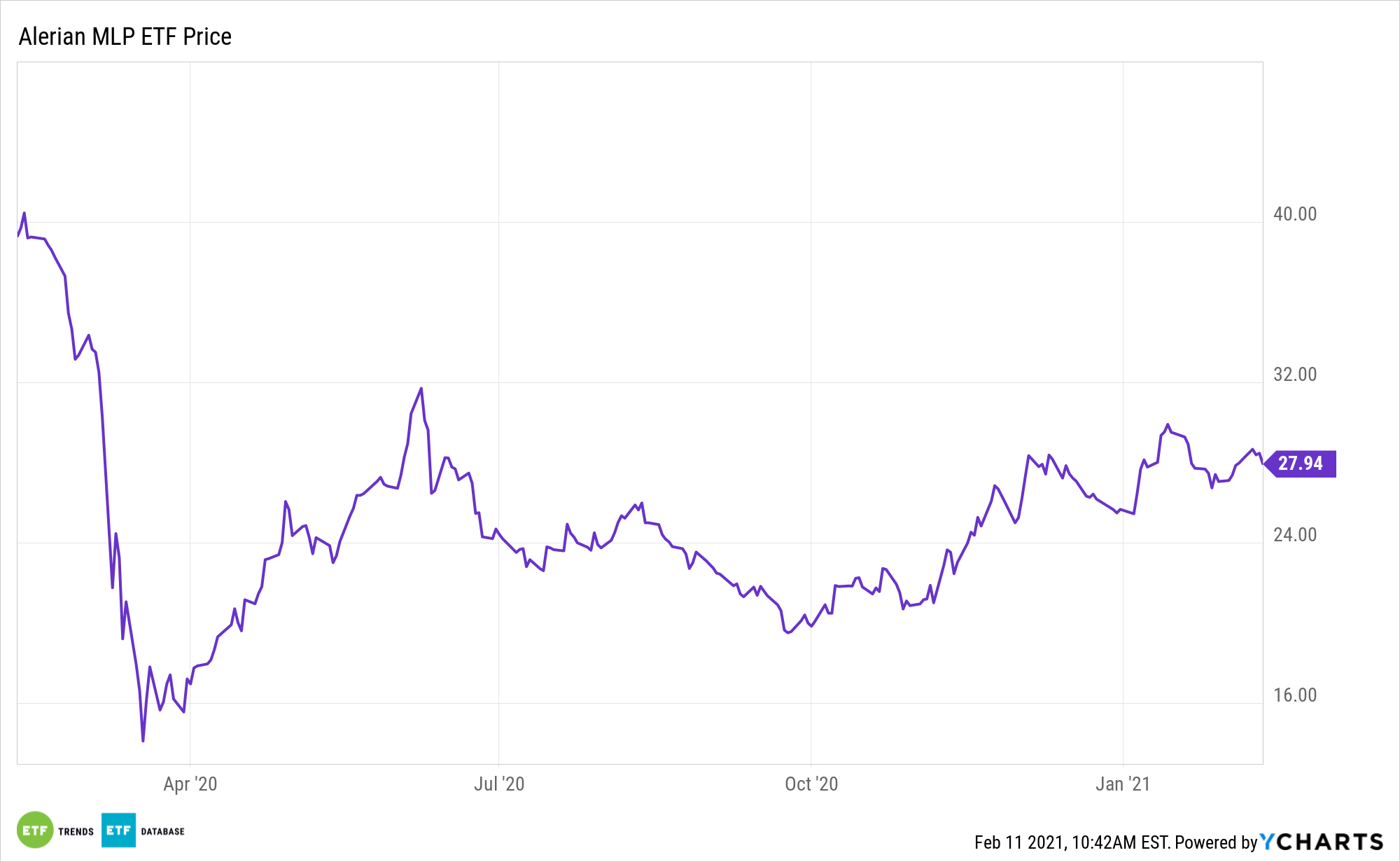

The energy sector is piecing together some momentum, and master limited partnerships (MLPs) are getting on the act. The ALPS Alerian MLP ETF (NYSEArca: AMLP), the dominant exchange traded fund in this category, is higher by almost 11% year-to-date.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

MLPs are publicly traded partnerships known for a ‘pass-through’ feature that helps investors generate stable, predictable cash flows. Investors are required to pay income taxes in states where the MLP operates and report taxes on the K-1 form.

“MLPs remain popular today, and can still play a role in portfolios — especially for investors interested in certain industries. At its core, an MLP combines the tax benefits of a private partnership arrangement with the liquidity and accessibility of a public company,” reports Business Insider.

The AMLP ETF: Quarterly Distributions, Tax Breaks, and More

Energy has been one of the top-performing sectors so far in 2021. Yet rather than getting a run-of-the-mill energy fund with a handful of heavy allocations toward big oil, investors can opt for an alternate play with AMLP.

MLPs have become very popular in recent years for two reasons: (1) required quarterly distributions provide a steady stream of current income, and (2) because they are partnerships, MLPs avoid corporate income taxes at both the federal and state level as the the tax liability is passed through to the individual partners.

There are some tax breaks that come along with the MLP income distribution structure that income investors may want to consider.

“Then there’s the way the quarterly distributions can be classified. Sometimes, it’s as income. But distributions can also be classified as a return of capital — which is not taxable when the unitholder receives it. It’s only when the investor actually sells their units that any profit would be taxable — and then it’s at the capital gains tax rate, which generally lower than the regular income tax rate,” adds Business Insider.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.