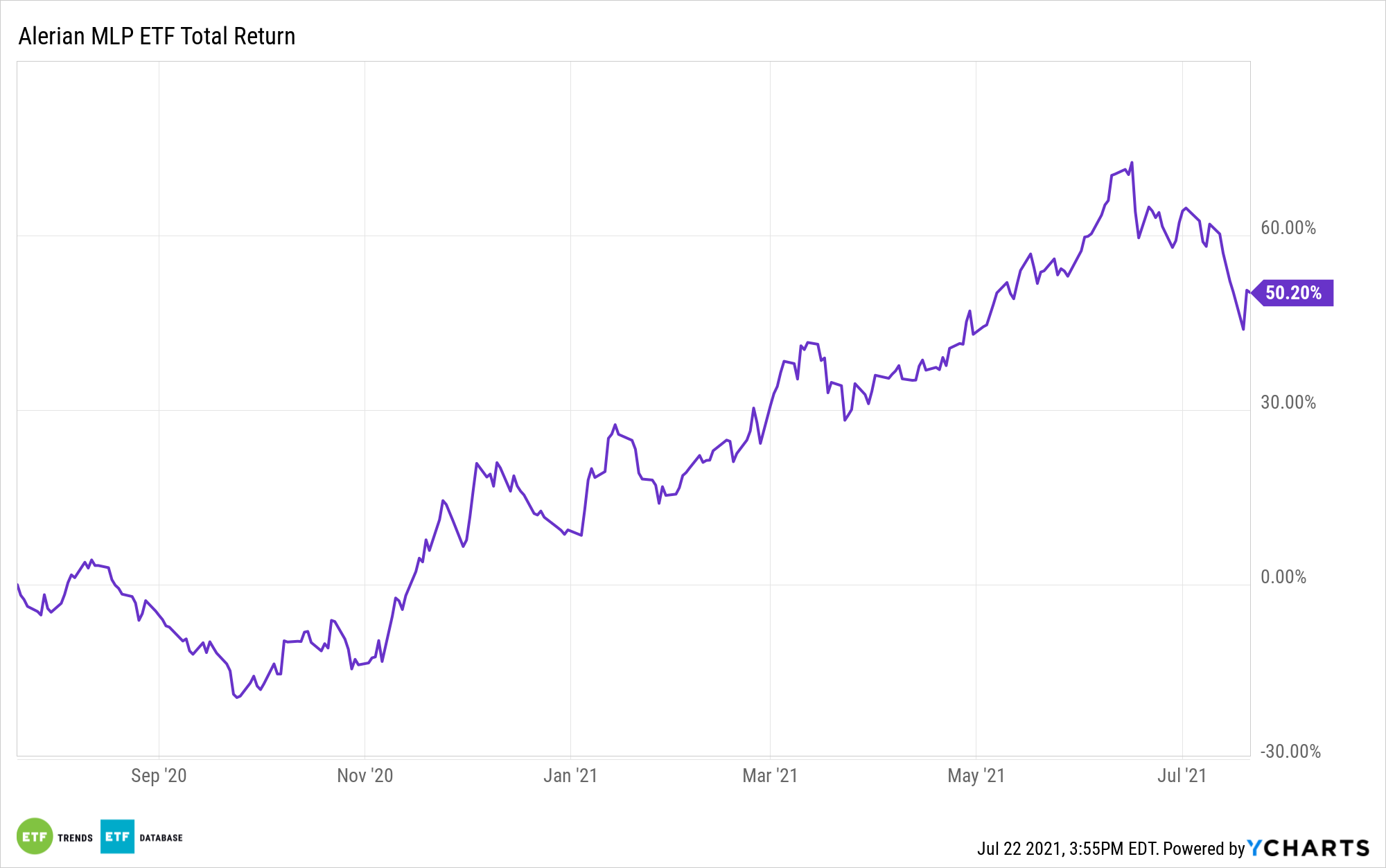

The ALPS Alerian MLP ETF (NYSEArca: AMLP) and its midstream components are dealing with a near-term uptick in volatility as oil prices decline amid the expansion of the delta variant of the coronavirus pandemic as the Organization of Petroleum Exporting Countries (OPEC) moves to boost output.

Experienced energy investors know those are legitimate headwinds and likely explain why AMLP is lower by almost 3% over the past week. However, the recent malaise could be an opportunity to consider buying midstream assets on the dip.

As Alerian analyst Mauricio Samaniego points out, midstream energy companies have unique abilities to endure commodity price fluctuations, especially when compared to exploration and production stocks.

“While uncertainties over renewed lockdowns and its effect on oil demand are still premature—and have not led to downward revisions in economic growth forecasts—midstream stands out amongst the energy space for its fee-based business model and contract protections that support cash flow stability and help insulate the space from a volatile crude oil environment,” he says.

Less Correlation to Oil Prices

AMLP’s underlying index – the Alerian MLP Infrastructure Index – has some favorable history on its side regarding correlations to oil prices. It’s rolling five-year correlation of 0.464 to West Texas Intermediate prices is well below comparable metrics on the Energy Select Sector Index and the PHLX Oil Services Index.

Additionally, midstream energy names are deriving some support from sturdy natural gas demand and the related export market for that commodity.

“Despite volatility inflicted upon the crude oil market, the midstream space continues to benefit from resilient natural gas demand as the summer heat wave, rising liquified natural gas (LNG) exports, and tighter supply have kept natural gas prices hovering around a two-and-half-year high,” adds Samaniego.

At the end of the day, AMLP offers investors not only yield-based advantages, but perks by way of the midstream’s fee-based business model, improving balance sheets, and increasing cash flow generation.

“Fee-based business and contract protections equip the midstream space to better withstand commodity price volatility while delivering attractive income and greater cash flow stability relative to its energy peers. In addition, vast exposure to natural gas help alleviate the effects of oil price fluctuations amid resilient natural gas prices and steady demand,” concludes Samaniego.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.