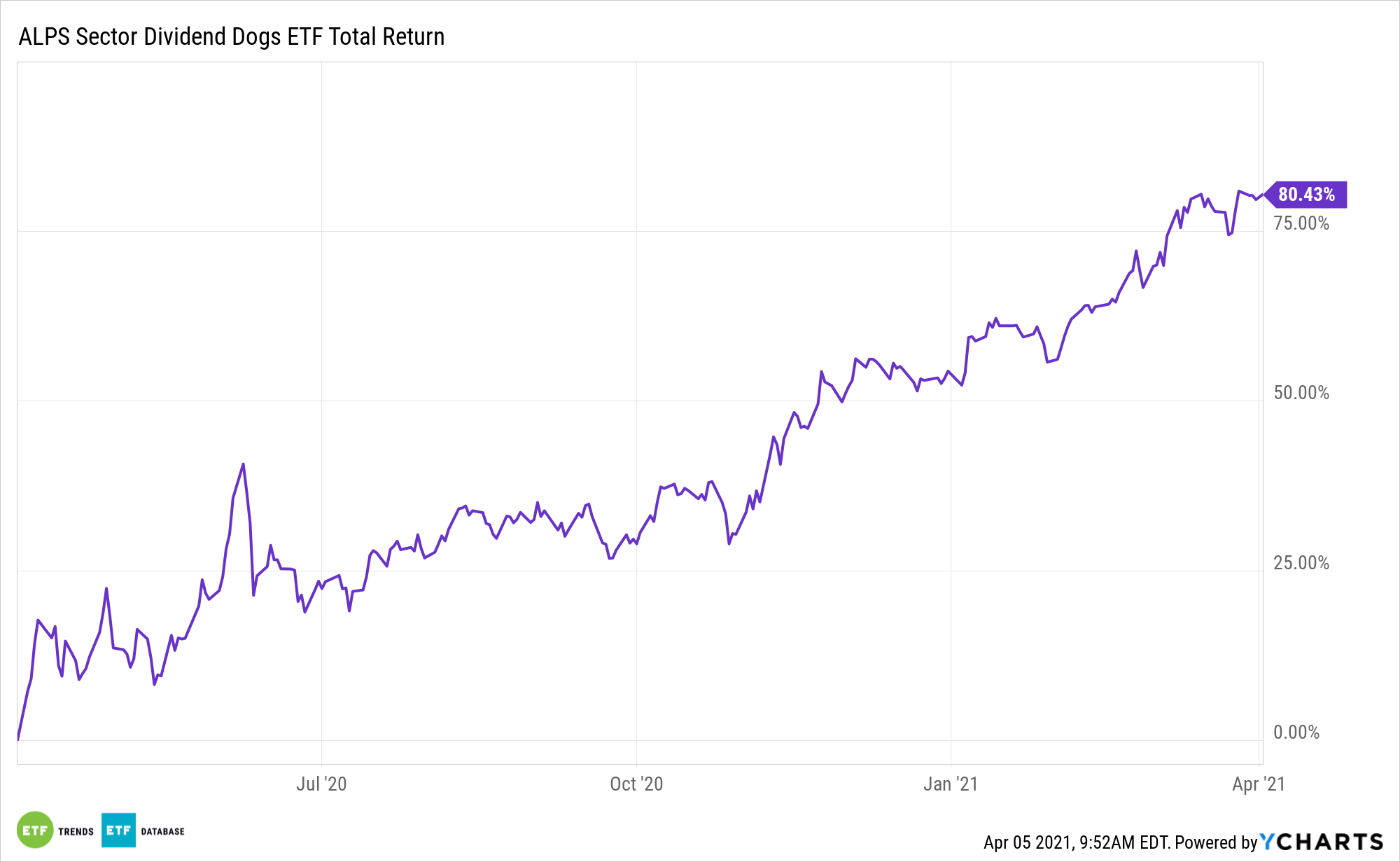

The ALPS Sector Dividend Dogs ETF (SDOG) is a high dividend/value asset. With both styles soaring this year, the ETF boasts considerable momentum.

SDOG tries to reflect the performance of the S-Network Sector Dividend Dogs Index, which applies the “Dogs of the Dow Theory” on a sector-by-sector basis using the S&P 500 with a focus on high dividend exposure. SDOG’s equal-weight methodology is important because it reduces sector-level risk and dependence of some groups that are considered to be imperiled value ideas.

While much attention has been paid to the value resurgence in recent months, there are reasons to believe this value rebound could last for awhile. Additionally, SDOG can be paired with still-viable growth funds.

“Our research also reveals that growth and value are essentially anti-correlated: One generally thrives in an environment where the other lags, and vice versa,” according to BlackRock research. “This means investors can build a more resilient, all-weather portfolio by incorporating the relative strengths of both growth and value – and can potentially enhance those results by working with astute managers that can consistently beat their growth/value benchmarks.”

SDOG: Bright Prospects for 2021

While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain-priced compared with their competitors. Value fans believe this time may be different for value stocks, pointing to improving investment sentiment measures, abating fears of a recession, rebounding corporate profits, and lessening trade tensions between the U.S. and China. Furthermore, value stocks are now trading at some of their most attractive prices in years, as the growth/value gap is as wide as it’s been in decades.

“While both growth and value extend benefits, portfolios may have room for greater value exposure. Market indexes typically tilt toward growth stocks,” adds BlackRock. “Because investors assign higher prices to growth stocks, they carry higher market capitalizations – and greater representation in market-cap-weighted indexes. The S&P 500 Index was 67% growth stocks as of mid-February 2021. Value is similarly underrepresented in investor portfolios.”

Adding to the near-term tailwinds for SDOG is the current state of value allocations, meaning a significant percentage of advisors came into 2021 largely underweight value. As that changes, the tide could lift the SDOG boat.

Other high dividend ETFs include the SPDR S&P Dividend ETF (SDY), iShares Select Dividend ETF (NYSEArca: DVY), and iShares Core High Dividend ETF (HDV).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.