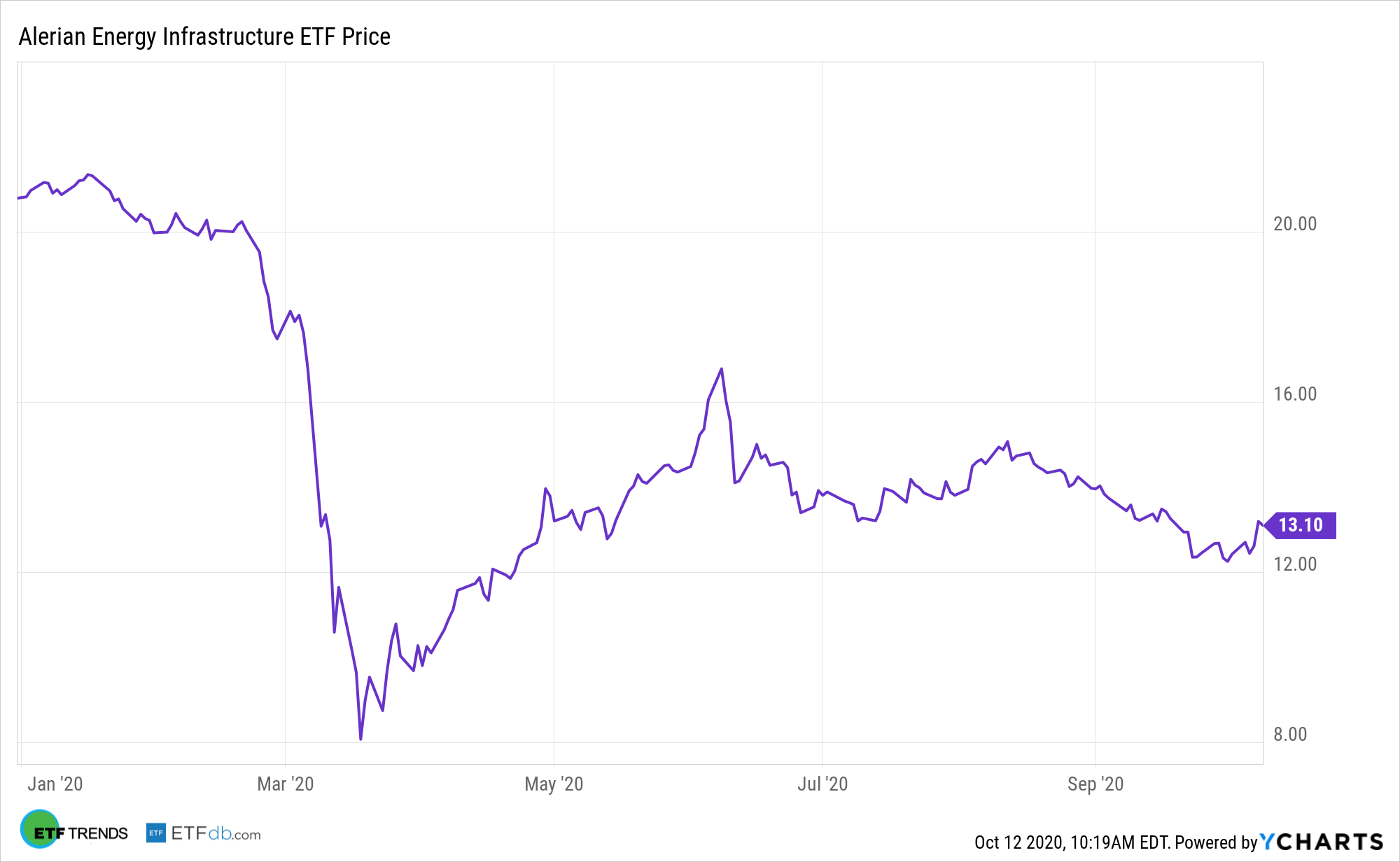

The energy sector’s road to redemption is going to be lengthy, but investors looking for a less risky way of positioning for that rebound can consider the Alerian Energy Infrastructure ETF (ENFR).

ENFR tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs but limits the tax hit from solely owning MLPs.

For investors looking to get into the energy patch while reducing some of the volatility associated with instruments that are more correlated to crude price, ENFR makes some sense due to its midstream exposure.

Additionally, the midstream space is usually more defensive and less volatile than other energy segments due to steady, reliable cash flows.

“To mitigate the impact of record stockpiles on crude prices, producers, including the OPEC+ group and U.S. shale firms, have made dramatic production cuts, and very little development activity is taking place,” said Morningstar analyst Dave Meats. “As a result, we think worldwide production will also decline by about 5.7 million barrels a day this year.”

The Steadiness of ENFR

ENFR has recently been steady and that could be a sing of positive things to come for midstream energy assets, particularly if the economy continues rebounding from the impact of the coronavirus.

Midstream companies are exposed to demand for export infrastructure, liquefied natural gas (LNG) demand, and wider differentials, among other factors. Data confirm midstream’s correlations to oil prices isn’t tight compared with other energy assets.

“We continue to expect catch-up growth in 2021 and 2022, bringing long-term demand almost back in line with pre-COVID projections,” notes Meats.

MLPs don’t make their money based on oil or gas prices. Unlike other energy sector stocks, MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they can move around.

ENFR yields 8.47% and jumped 5.47% last week.

Other MLP funds include the Global X MLP ETF (NYSEArca: MLPA) and the JPMorgan Alerian MLP Index ETN (NYSEArca: AMJ).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.