The reopening trade took some lumps this year. First, it was the Delta variant of the coronavirus pandemic. More recently, it’s been the Omicron strain.

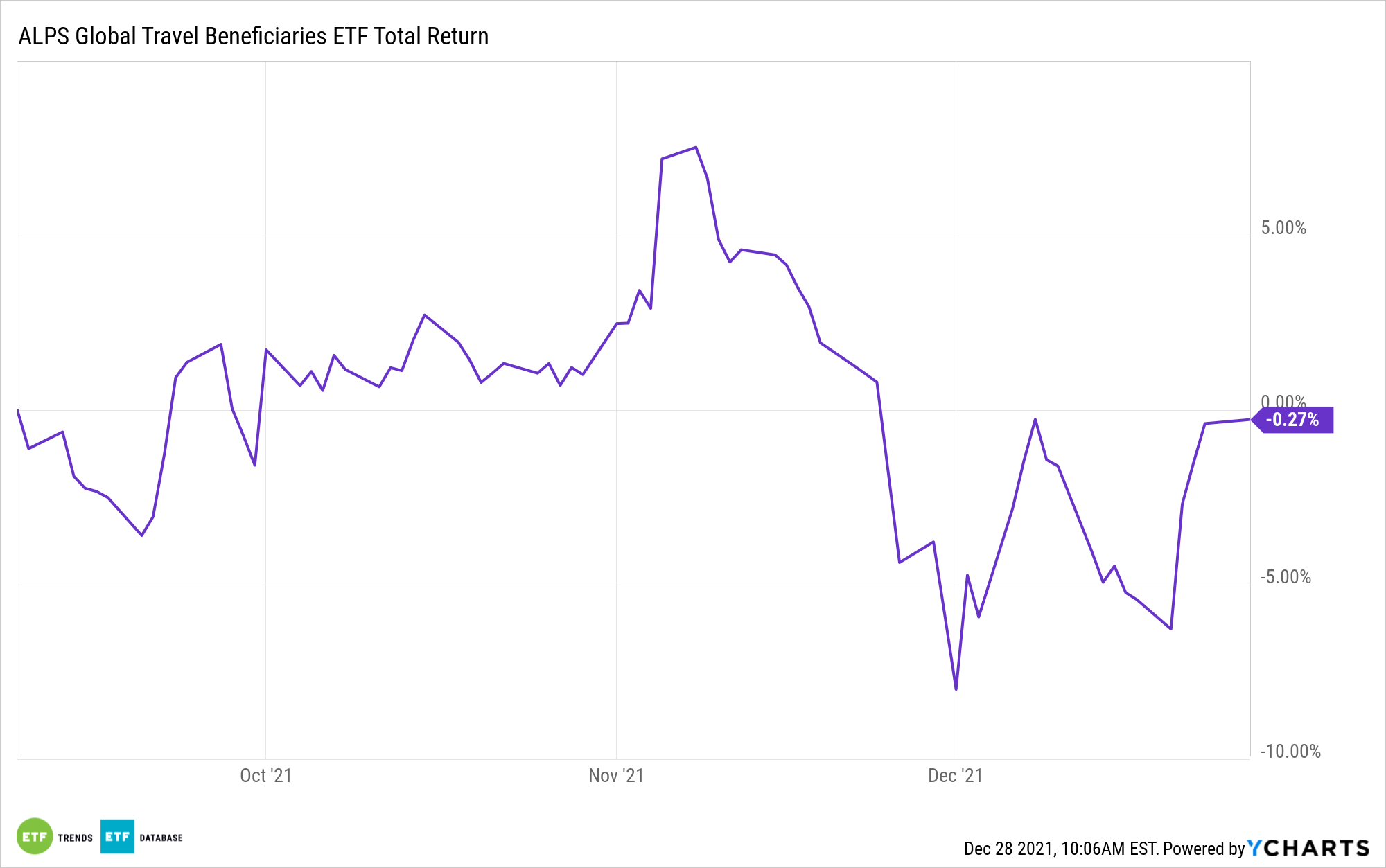

Add it all up, and it’s been tough sledding for some travel and leisure equities and exchange traded funds, including the newly minted ALPS Global Travel Beneficiaries ETF (NYSEARCA: JRNY). However, some experts believe that reopening stocks, which JRNY is full of, are poised to bounce back in 2022.

In a recent note to clients, JPMorgan equity analysts led by Dubravko Lakos-Bujas contend that investors got too bearish too rapidly regarding Omicron and the specter of the Federal Reserve raising interest rates next year.

“They added that the current setup in the market is ‘very attractive’ for high beta stocks. On the value and cyclical side, they see reopening stocks such as travel, leisure, hospitality and experiences, as well as energy stocks worthy of consideration,” reports Business Insider.

JRNY follows the S-Network Global Travel Index, giving it ideal leverage to a reopening resurgence. That index is home to airlines, hotels, casinos, and cruise lines, as well as companies that support travel activities, luxury retailers, and purveyors of leisure activities. While airlines are enduring some holiday travel lumps at the hands of Omicron, the January Effect could lift other JRNY components.

“We expect the upcoming ‘January effect’ to be even more pronounced this time around given extreme positioning and sentiment,” notes JPMorgan.

While airlines and cruise operators are vulnerable to Omicron and any other new variants of COVID-19 that might emerge, JRNY can augment some of those potential risks with its other holdings, including casino operators. Consider this: Despite COVID-19 challenges, 2021 was a record year of gross gaming revenue (GGR) on the Las Vegas Strip.

“In spite of the Omicron variant, we remain bullish on the domestic casino recovery, particularly in Las Vegas, where record earnings are poised to accelerate with the expected return of international visitors and convention business throughout 2022 and 2023,” said CBRE analyst John DeCree.

In particular, DeCree is bullish on shares of MGM Resorts International (NYSE:MGM) and Caesars Entertainment (NASDAQ:CZR), the two largest operators on the Las Vegas Strip. Those two casino giants combine for 3% of JRNY’s roster.

Other travel and leisure ETFs include the VanEck Vectors Gaming ETF (BJK) and the U.S. Global Jets ETF (JETS).

For more news, information, and strategy, visit the ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.