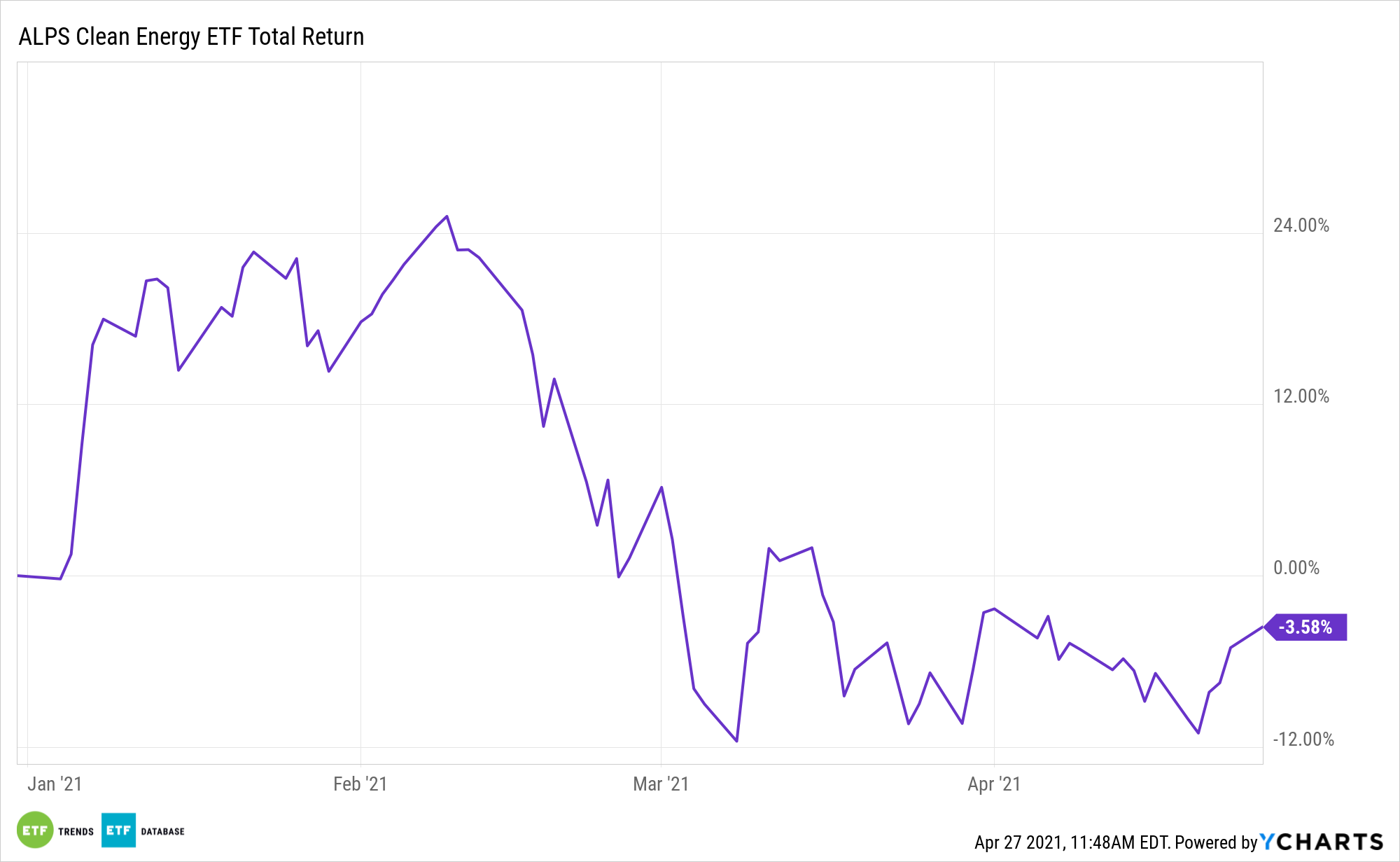

Renewable energy assets like the ALPS Clean Energy ETF (ACES) are often viewed by investors through a domestic lens.

Investors, Americans and otherwise, notoriously possess a strong home country bias, and renewable energy is seen as a industry that can be moved by political decisions and outcomes. However, investing in this arena offers more international diversification and opportunity than many investors may initially realize.

“As national and regional economies continue to recover from the recessions induced by the COVID-19 pandemic, more than 800 power generation projects, dominated by renewables, are now in the Asian pipeline outside China, representing at least $316 billion in investment opportunities, according to a recent EY report,” notes IHS Markit.

Angles on Clean Energy in Asia

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

Asia is adopting renewables at a rapid rate, and that could be a long-term boost for ACES.

“Of that total, about $306 billion will pour into the renewables sector, with offshore wind and solar photovoltaic facilities accounting for 85% of these projects. The consulting firm identified a total of 811 projects in three north Asian jurisdictions — Japan, South Korea, and Taiwan — as well as Southeast Asian nations Indonesia, Malaysia, Thailand, the Philippines, and Vietnam,” notes IHS Markit.

Joo Yeow Lee, associate director, power at IHS Markit, notes power demand is growing so rapidly in Asia that traditional fuels need to be part of the current mix. Yet that strong demand and the global economic recovery also set up for the further adoption of clean energy through greater economies of scale.

“Also, corporate power purchase agreements (PPAs) are in a relative infancy in Southeast Asia, Lee said. PPAs are common in the US and Europe, and project developers rely on them to show a guaranteed revenue stream that can ensure payback of the investment in their projects,” according to Markit.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.