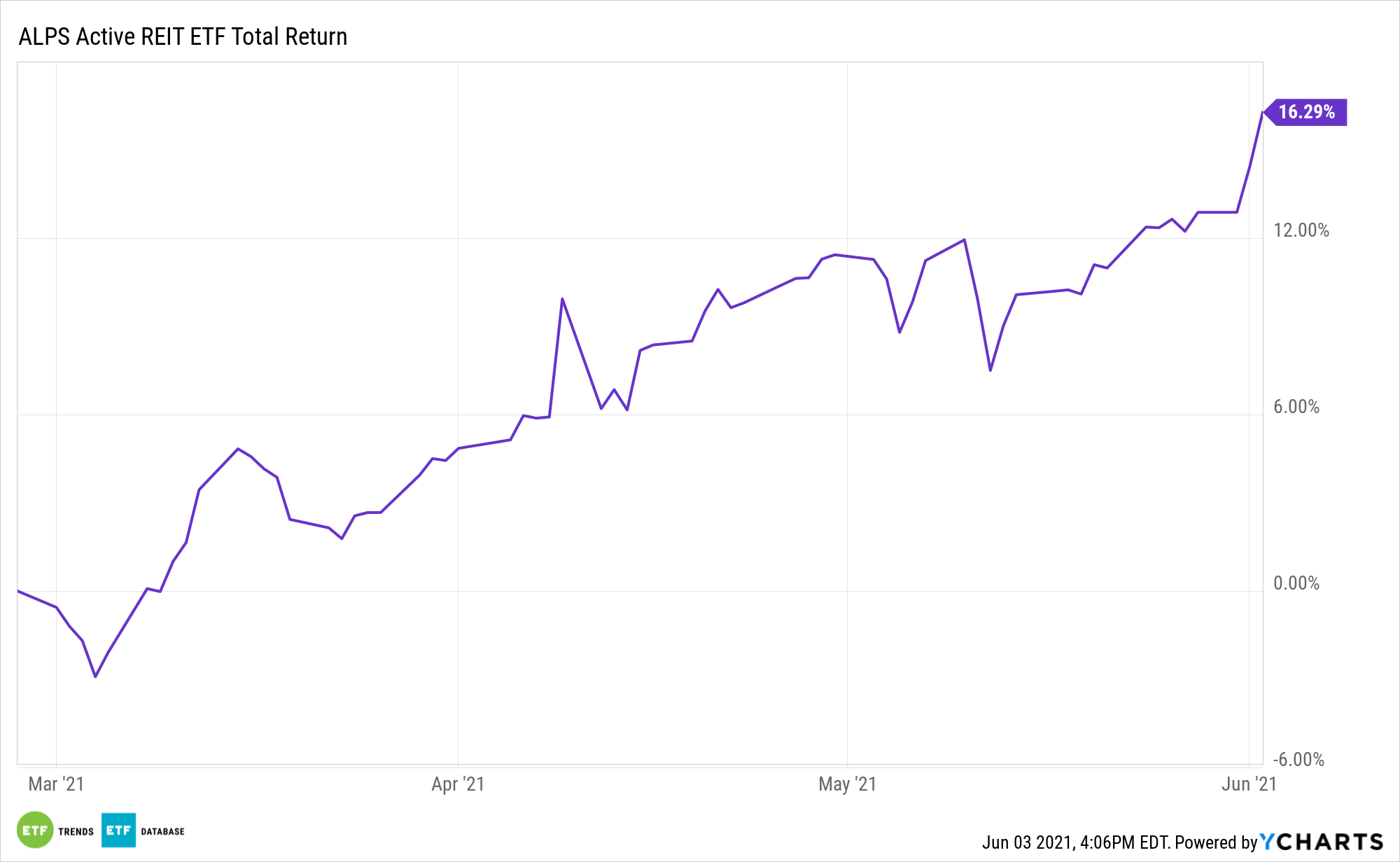

As interest rates rise, the ALPS Active REIT ETF (NASDAQ: REIT) is proving remarkably resilient against a challenging backdrop.

The actively managed REIT, one of the newest additions to the crop of real estate exchange traded funds, is up almost 14% since its March debut, confirming real estate assets don’t always have to wilt when Treasury yields aren’t cooperating.

What makes REIT’s performance out of the gates impressive is that the real estate sector is sensitive to gyrations by Treasury yields. Think back to the “taper tantrum” of 2013 when yields surged in May and real estate spent the last seven months of that year lagging the broader market.

Inflation Helping REIT’s Case

With the specter of inflation getting more attention, so are alternatives to bonds and gold as inflation-fighting tools. To the benefit of REIT, hard assets – an asset class including real estate – are generating more buzz as avenues for combating rising consumer prices.

“One of the reasons for their recent relatively stable performance might be explained by the cause for the rising bond yields and changing weights structure of the listed real estate sector,” notes FTSE Russell. “Higher inflation expectations are particularly supportive of residential real estate prices. We have witnessed recently that residential is one of the best performing components of listed real estate.”

For REITs, another benefit of rising inflation is that it plays into the hands of real estate companies’ pricing power. Said another way, many commercial REITs build rent increases into client contracts and those hikes occur regardless of the inflationary environment. When inflation does arrive, those increases work in favor REITs and their investors.

Managed by GSI Capital Advisors, REIT emphasizes property sector allocations and is a concentrated ETF where the top 10 holdings will usually represent about 60% of the portfolio. The ALPS fund yields 2.15%.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.