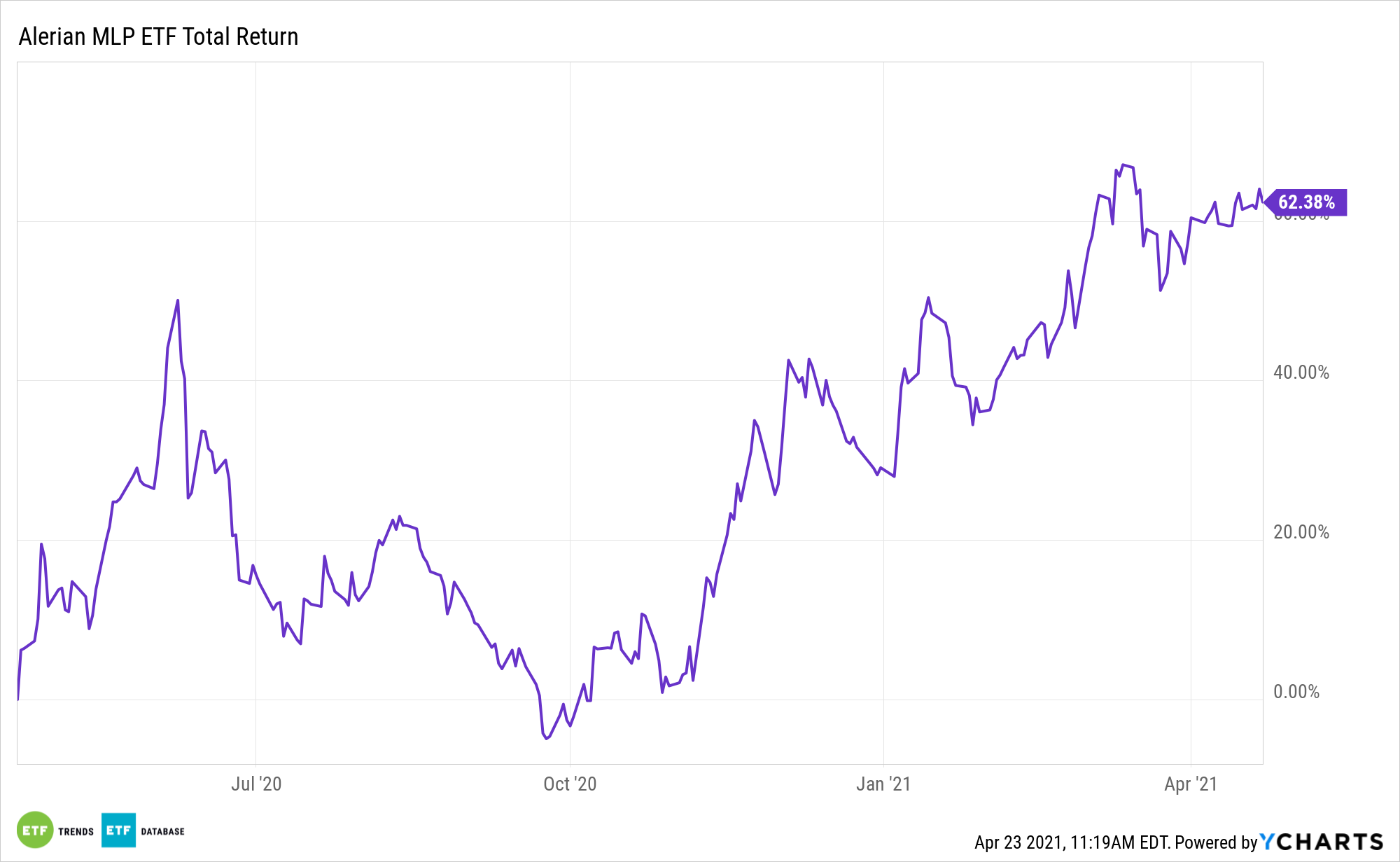

As energy stocks rebound, the ALPS Alerian MLP ETF (NYSEArca: AMLP) is looking strong, and may have more tailwinds than investors realize.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

Adding to the allure of AMLP are rising prospects for private equity interest in midstream energy assets.

“At various times in recent years, private equity acquisitions in midstream have served as catalysts for the space by highlighting the value of fee-based energy infrastructure assets and providing validation for the midstream business model,” says Alerian analyst Stacey Morris. “Activity understandably slowed in 2020 amid the volatile macro environment. Could a more stable energy landscape lead to more examples of private equity investment in midstream in 2021? With a few transactions announced already this year, it certainly seems possible.”

The Advantages of Energy Infrastructure

It remains to be seen whether or not consolidation activity in the midstream space picks up, but it is clear AMLP components offer advantages.

Those include strong levels of free cash flow, steadying distributions, and lower volatility relative to other energy segments. It’s not a stretch to assume private equity buyers are aware of those positive traits.

“Thus far in 2021, there have been some examples of private equity purchasing non-controlling interests in midstream assets. In late February, Kinder Morgan (KMI) and Brookfield Infrastructure Partners (BIP) announced the sale of a 25% minority stake in Natural Gas Pipeline Company of America to ArcLight Capital Partners for $830 million,” according to Morris.

With cash flow strong, oil prices rebounding, and the broader economy improving, the time could be appropriate for more private equity deals in the midstream arena.

“A more stable macro environment could pave the way for additional private equity involvement in midstream beyond the examples of recent transactions. Private equity deals can serve as a catalyst for the space, providing important valuation markers and validation for the multi-year outlook for the midstream business model,” adds Morris.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.