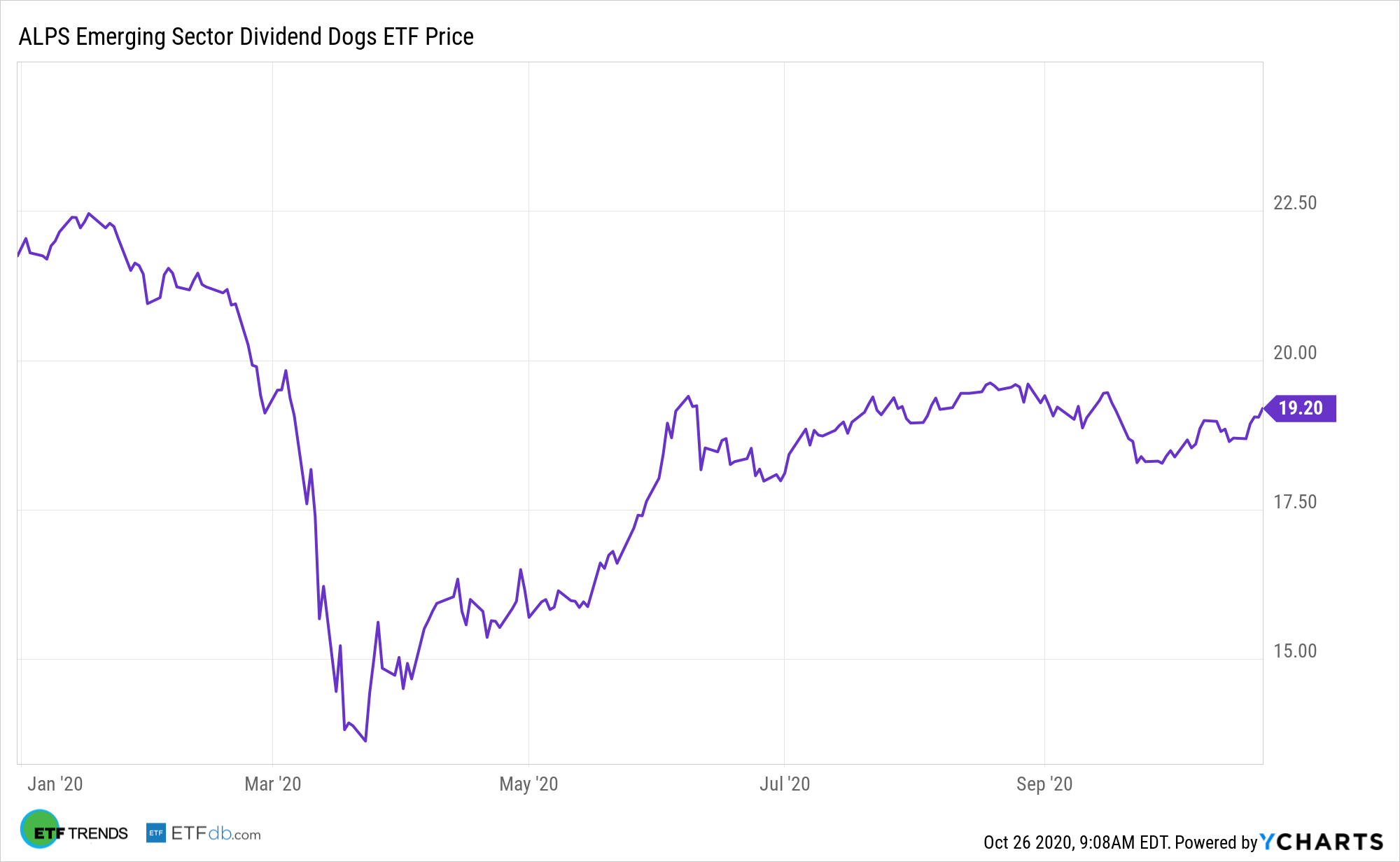

The results of the upcoming presidential election carry implications for assets beyond domestic fare, including emerging markets equities. The ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) is an idea for investors looking to access developing economies while potentially reducing some Election Day Volatility.

EDOG, which debuted over six years ago, tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or “Dividend Dogs,” from the S-Network Emerging Markets Index, which holds large-cap, emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

“Under either a Trump or Biden administration, we expect that there will continue to be a significant amount of friction between the United States and China,” according to Morningstar. “Threats of a trade war or additional tariffs would be amplified under Trump, who has taken a publicly antagonistic stance toward negotiations.”

Giving EDOG a Look?

Some emerging markets dividend payers feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications. EDOG’s high-yield offering stands out in an emerging markets space populated by marginal payouts.

Certain electoral outcomes could be of benefit to EDOG investors.

“We anticipate that the Biden administration would take a traditional, diplomatic approach to negotiating with China; yet even so, underneath the publicly made statements, we expect tensions between the two countries to continue as China looks to expand its global influence,” notes Morningstar. “For example, we may not see existing trade tariffs lifted immediately, but those tariffs may be used as a bargaining chip for negotiating with China.”

Emerging markets investors are once again back as world economies begin the recovery process from Covid-19, but they’re not simply throwing darts at a board. EM investors are exercising more due diligence and thus, are more picky with their investments.

A victory by former Vice President Joe Biden on Election Day could lift emerging markets assets because it’s expected his tone toward China – the largest developing economy – will be far less bellicose than President Trump’s has been.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and the WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.