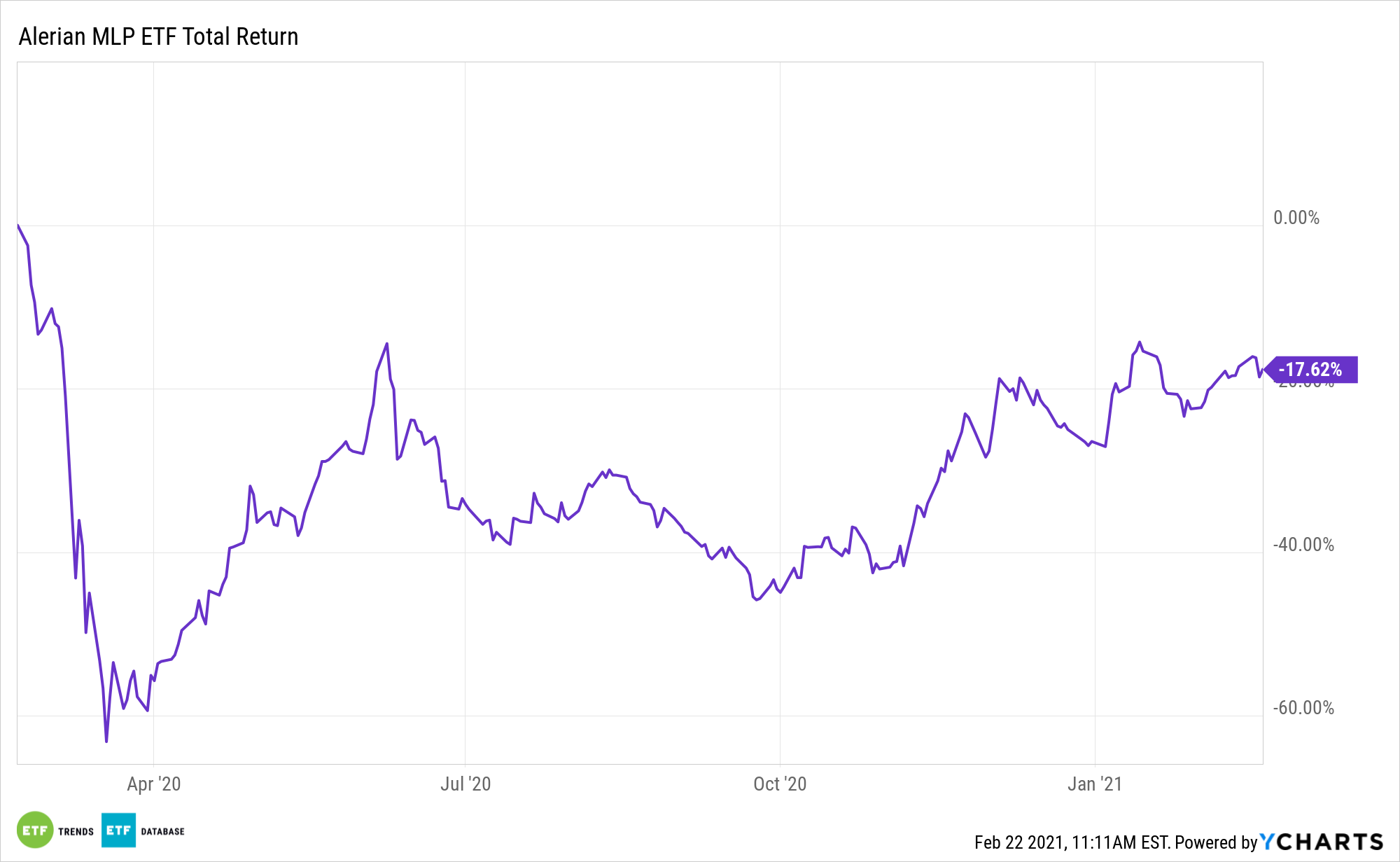

Master limited partnerships (MLPs) and their related exchange traded funds, including the ALPS Alerian MLP ETF (NYSEArca: AMLP), are joining the broader energy sector in the upside to start 2021. Many market observers believe there’s more to come for income-generating energy assets.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

While MLPs weren’t immune from oil’s slide last year, the overall health of the business model remains steady.

“The underlying business model remains compelling – relatively easy access to capital, comparably inelastic consumer demand, and an economic backdrop pointing to an industrial revival,” according to Seeking Alpha.

The Continued Case for the AMLP ETF

Currently, a confluence of harsh weather, geopolitical events, and OPEC supply cuts are continuing to move in favor of higher oil prices.

When dealing with oil prices, the basic economic tenets of supply and demand are an obvious factor. Right now, harsh weather is hurting supply, which is boosting oil prices in turn.

Regarding AMLP, “as future capital investments in pipelines, storage and processing facilities are constrained by more green-focused government energy policies, existing assets may conceivably appreciate. Additionally, a tighter legislative environment may possibly lead midstream energy plays to curtail investment – providing additional liquidity to pay down existing debt,” notes Seeking Alpha.

MLPs have become very popular in recent years for two reasons: (1) required quarterly distributions provide a steady stream of current income, and (2) because they are partnerships, MLPs avoid corporate income taxes at both the federal and state level as the the tax liability is passed through to the individual partners.

“All in all, existing, well-established, and financially resilient master limited partnerships are likely to benefit from a renewal in crude oil prices, a revival in industry, and long-term changing trends in the global energy mix,” adds Seeking Alpha. “Midstream energy plays are more than just a bet on crude oil. Intrinsically linked to industrial growth through significant exposure to petrochemicals, midstream energy ventures play a central role in the economy.”

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.