During the worst days of the coronavirus pandemic, it appeared that working from home would become permanent for most computer-based workers. As a result, office real estate investment trusts (REITs) were among the most repudiated real estate equities.

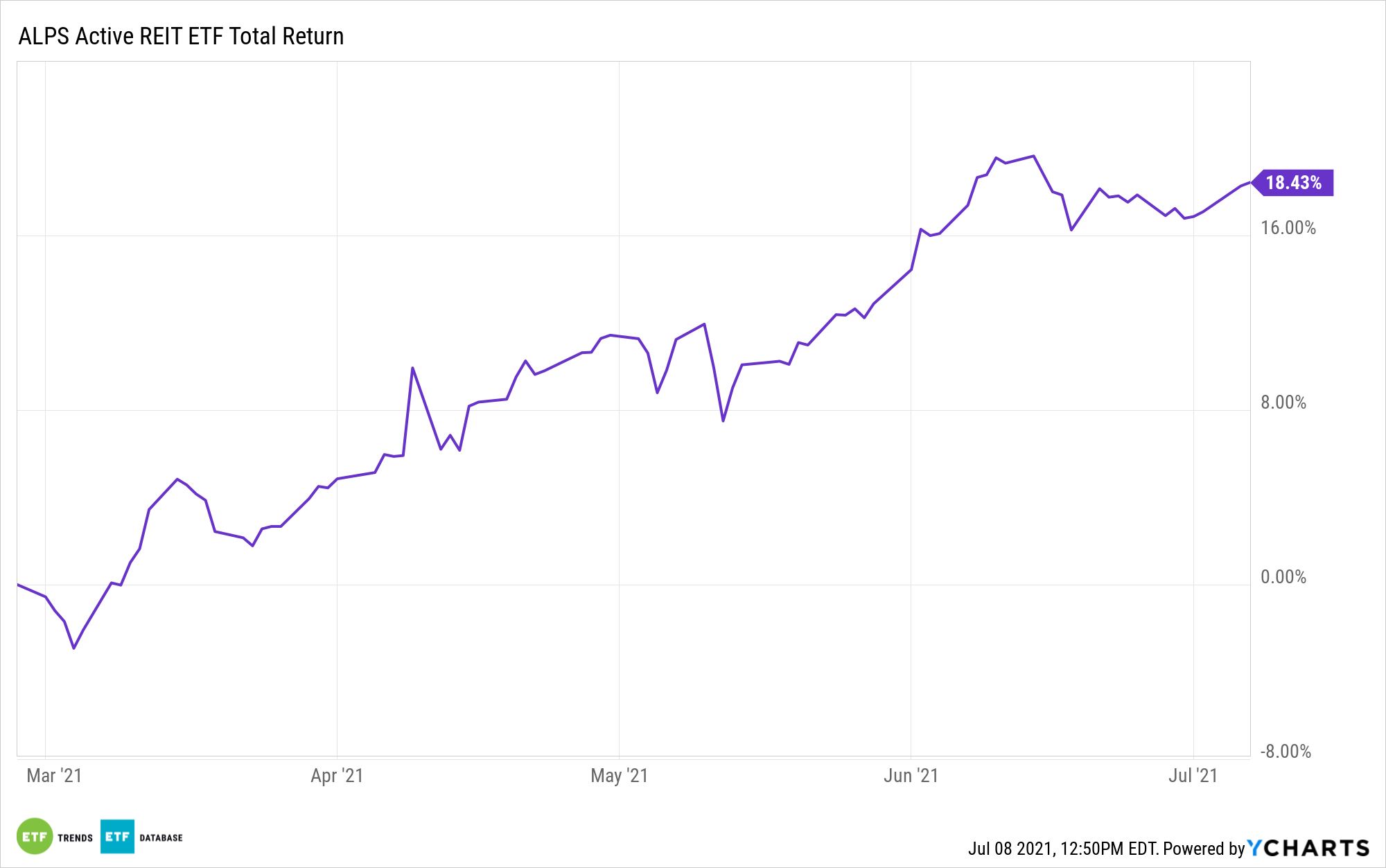

Fast-forward to mid-2021 and real estate stocks are bouncing back, as highlighted by the ALPS Active REIT ETF (NASDAQ: REIT). The ALPS exchange traded fund, which debuted in March, is highlighting the benefits of active management with a 17.22% gain since inception.

As an actively managed fund, REIT more ably navigates what could be a tricky environment for office REITs. Today, many companies are ushering staff back to offices while others are offering hybrid roles – a few days in the office and a few working from home. Others have gone all-in on remote work. There’s a lot to consider.

“The pandemic has led to widespread remote working, raising doubts about the future of offices. We believe the office is far from dead, but expect the impact of flexible working to vary across assets and locations. We see the restart and higher inflation driving up rental income and a more muted response of interest rates to rising inflation than in the past supporting real estate valuations,” according to BlackRock research.

The Right Mix with REIT?

As an active semi-transparent ETF, REIT isn’t required to disclose its holdings on a daily basis, as is the case with traditional index funds.

On that note, the fund’s roster at the end of the first quarter – the period for which data are most current – wasn’t heavily tilted toward office REITs, though it had some exposure to that group. Rather, the fund was well-positioned in data center and industrial REITs, among other real estate high-fliers.

While warehouse and technology REITs are producing enviable cash flow and attracting plenty of interest, there’s still reason to consider office REITs. It’s possible REIT could pivot a bit more to that group as it gains momentum.

“Flexible working will likely reduce aggregate demand for offices in some markets, but the effect may not be as large as one may expect – due to tenants’ desire for less density and the need to accommodate peak demand days, in our view,” adds BlackRock.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.