One of the biggest incentives with midstream energy assets and master limited partnerships (MLPs) is the big yields found in the segment.

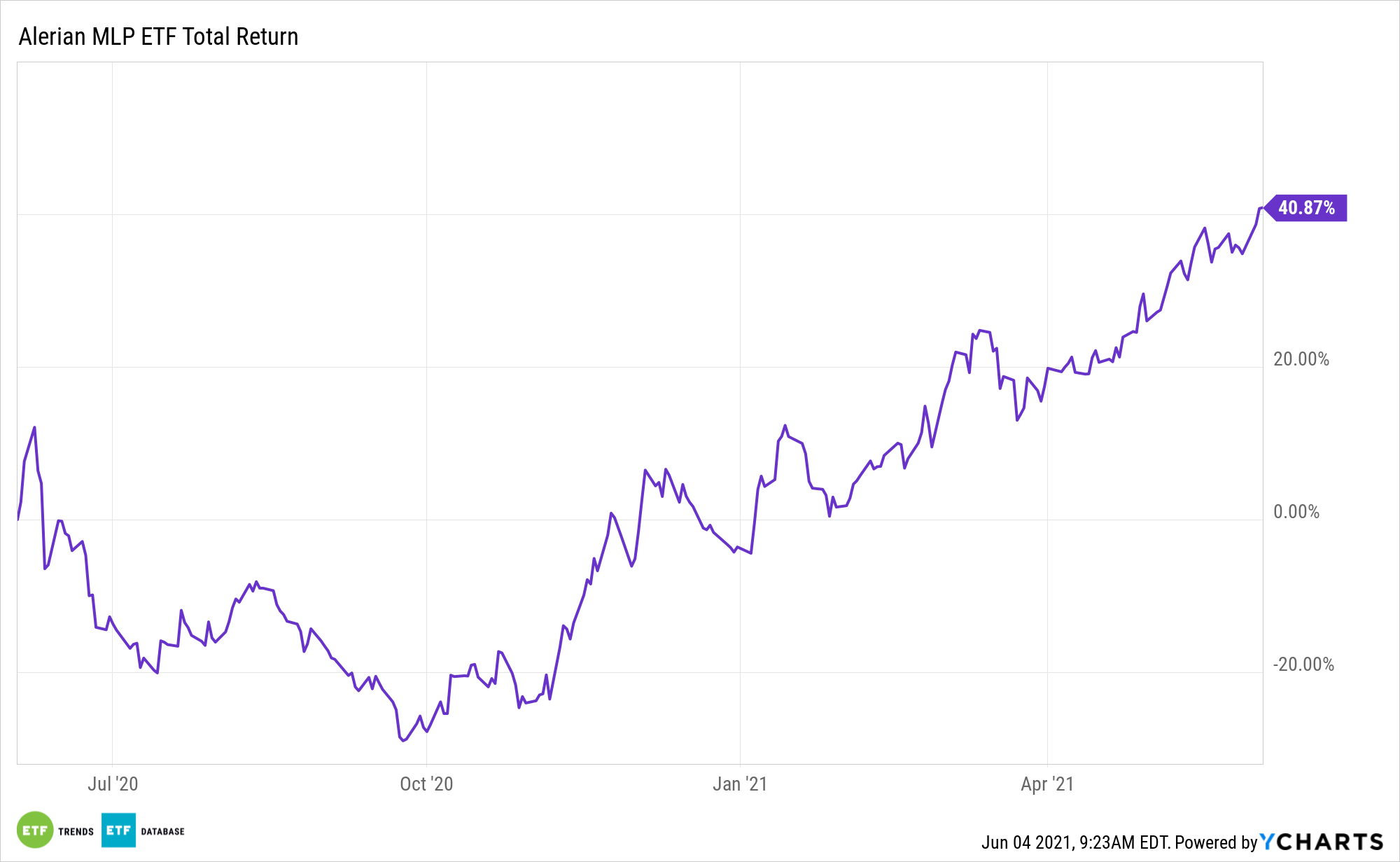

For example, the ALPS Alerian MLP ETF (NYSEArca: AMLP) yields 9.73% as of June 3 and that’s with the benefit of a year-to-date gain of almost 40%. Dividend yields and equity prices move inverse of each other so when AMLP’s price rises, its dividend yield declines.

If there’s a rub, it’s that when midstream dividend cuts arrive, those actions are often painful for investors. In fact, some midstream payout cuts in 2020 were as high as 50% owing to the coronavirus pandemic. Investors considering AMLP want to know that payouts are steady.

It appears that’s happening, as midstream companies have emphasized prudence and balance sheet strength following the oil bear market caused by the pandemic.

“With lower capital expenditures compared to prior years, midstream companies are beginning to generate more free cash flow, which provides financial flexibility to maintain or grow dividends,” writes Alerian analyst Roxanna Islam. “During the past few quarters, several constituents have placed an emphasis on positive free cash flow (FCF) after dividends.”

An Improving Dividend Outlook for ‘AMLP’

In the first quarter, no AMLP components reduced dividends. None pared payouts in the fourth quarter, and a few even boosted dividends. One – Western Midstream Partners LP (NYSE: WES) – modestly increased its payout in the the January through March period. That MLP accounts for 9.59% of AMLP’s roster.

See also: Consider Dividend ETFs in an Inflationary Market

With plenty of midstream names, forecasting recoveries in free cash flow (FCF) this year, the environment could be right for increased shareholder rewards, including buybacks and dividends.

“Higher free cash flow gives companies more options to either pay off debt or pay for dividends/repurchases,” adds Islam. “Although repurchases are becoming more popular, dividends are still the primary method of returning capital to shareholders within the midstream space.”

Fortunately, some AMLP components were FCF-positive in 2020, even after paying dividends. Couple that with rising oil demand and prices, and the balance sheets of midstream operators can continue improving, supporting payout growth along the way.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.