Amid supply wranglings via the Organization of Petroleum Exporting Countries (OPEC) and a surge in Delta variant coronavirus cases, energy stocks slumped during the three summer months.

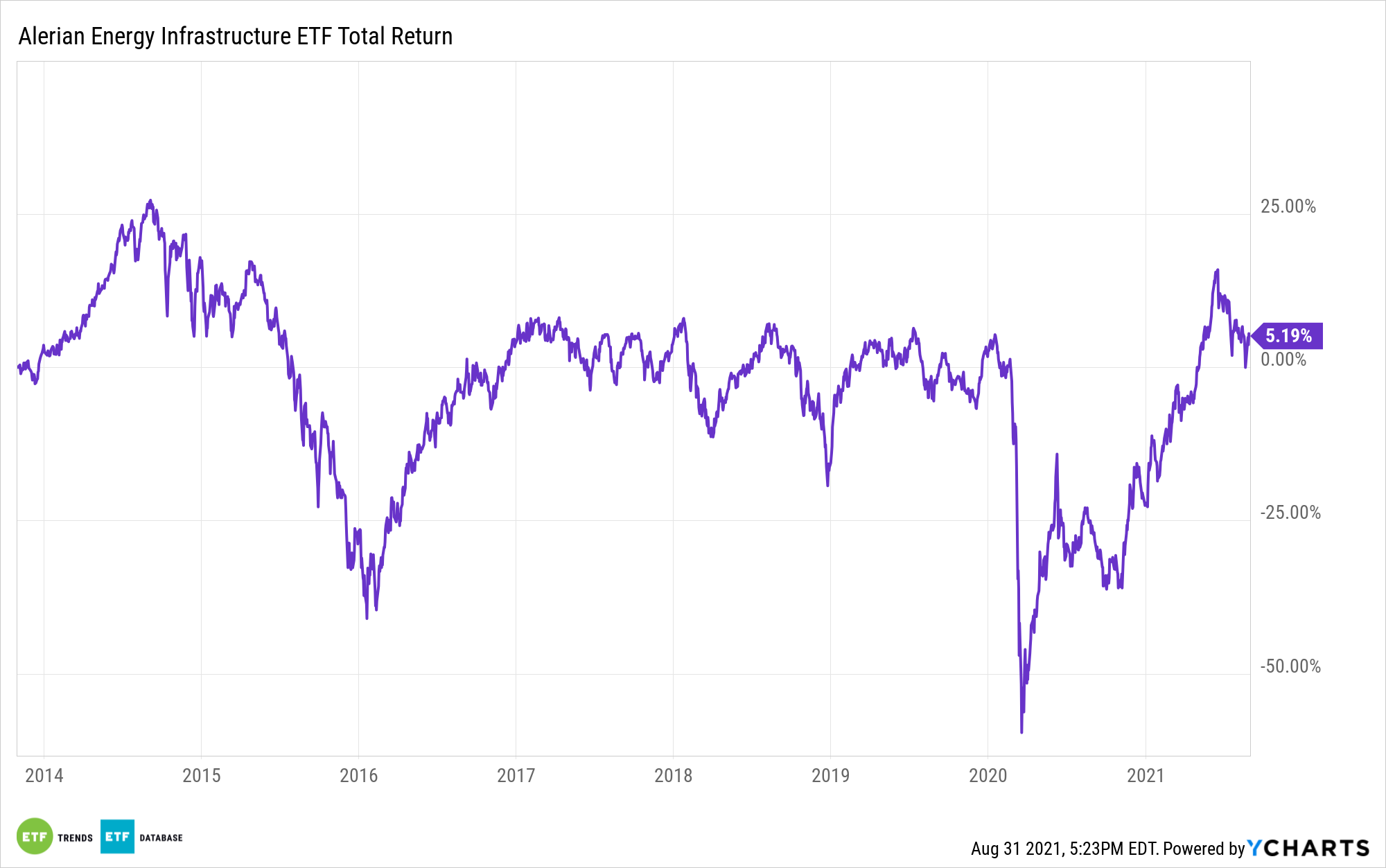

Midstream energy names and master limited partnerships (MLPs) weren’t immune to the summer weakness, but some market observers believe that the selloff is overdone and opportunity could be afoot with exchange traded funds, such as the Alerian Energy Infrastructure ETF (ENFR).

ENFR holdings include C-corps and MLPs. The fund’s recent lethargy appears to be more the result of a tricky macro setting for oil, not an array of holding-specific issues.

“For the last several weeks, the oil supply and demand narrative has been dominated by OPEC+ policy and the demand impact related to the resurgence in COVID-19 cases as the Delta variant spreads,” says Alerian analyst Stacey Morris. “Oil prices tumbled by more than 7% on July 19 following the OPEC+ agreement to increase production by 400,000 barrels per day each month starting in August.”

Since then, midstream energy assets traded lower. However, the aforementioned factors are macro in nature, indicating that market participants who used those situations to lighten up on ENFR components may have glossed over the midstream’s increasingly sturdy fundamental outlook.

That includes renewed prudence when it comes to expenditures, dedicated focus on balance sheet strength, prioritizing cash flow and boosting buybacks and distributions. As Alerian’s Morris notes, midstream’s fundamentals are positive today.

“Oil prices today are lower than in July, but has much really changed for midstream? It seems like the answer is no. Of course, a higher oil price helps sentiment, but from a midstream perspective, fundamentals continue trending in the right direction,” she says.

Adding to the case for ENFR is that midstream valuations are compelling, if not downright relative to the aforementioned positive fundamentals.

“With midstream equities down from their relative high and EBITDA estimates increasing, valuations have only improved and remain compelling as other pockets of the market sit at or near record highs,” according to Morris.

Combine low valuations, the energy sector’s low weight in broad market benchmarks, and midstream’s increasing role in the renewable energy revolution, and it’s not a stretch to say that the midstream endured undue punishment this summer. That could bring opportunity for astute investors.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more news, information, and strategy, visit the Energy Infrastructure Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.