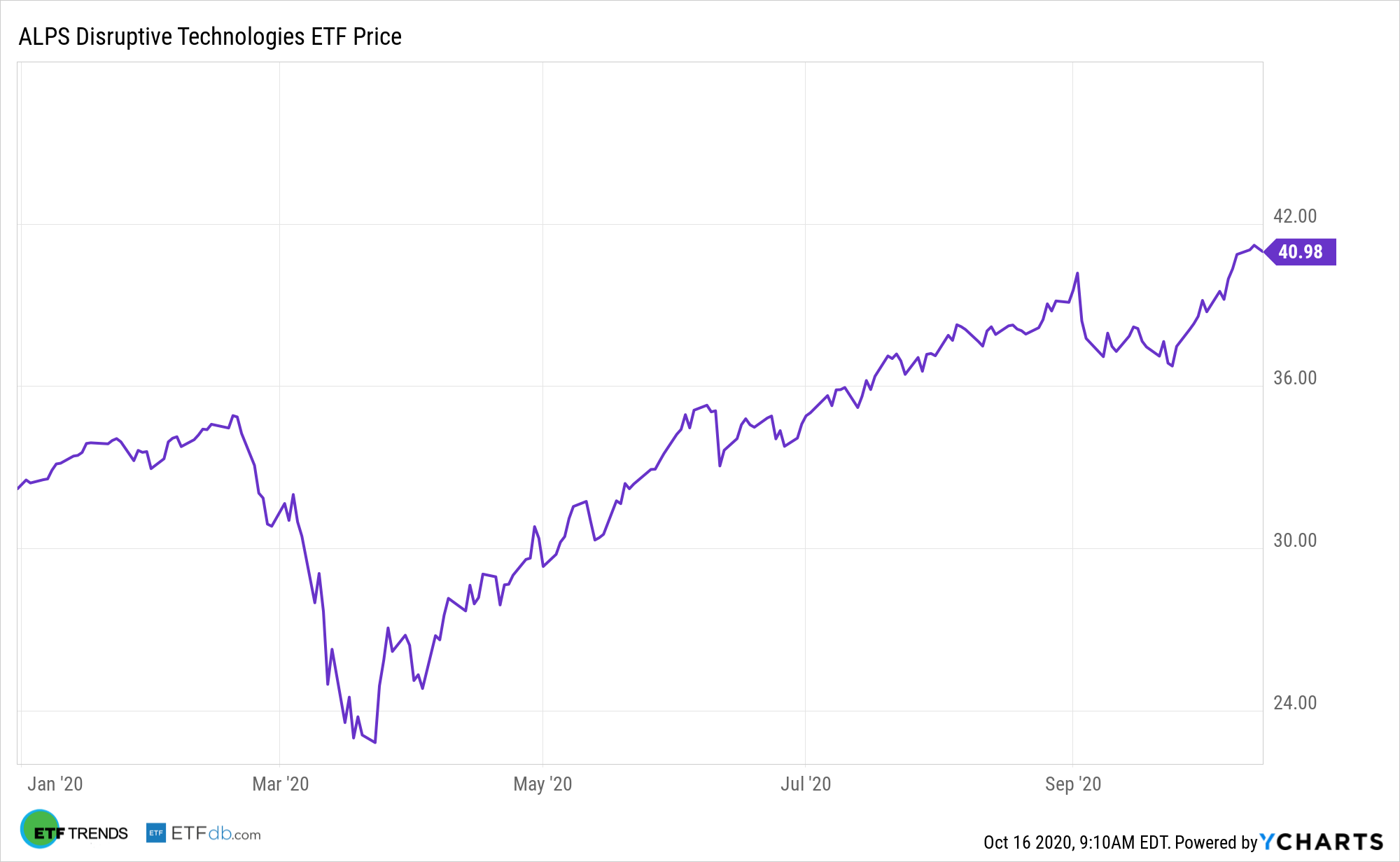

Fintech is one of the premier disruptive themes and there are several exchange traded funds devoted to it, but for investors that want exposure to fintech without a 100% commitment, the ALPS Disruptive Technologies ETF (CBOE: DTEC) is an idea to consider.

DTEC tracks the Indxx Disruptive Technologies Index, which identifies companies using disruptive technologies across ten thematic areas, including Healthcare Innovation, Internet of Things, Clean Energy and Smart Grid, Cloud Computing, Data and Analytics, FinTech, Robotics, and Artificial Intelligence, Cybersecurity, 3D Printing, and Mobile Payments.

The changing landscape in the retail payments space underscores the utility of DTEC in the current market climate.

“Competition in the retail payments sector is intensifying around the world,” said Moody’s Investors Service. “Fast-changing technologies are driving a rapid increase in online and mobile payments with new players, offering slick, single-click digital wallets and smartphone apps, grabbing part of the retail payments market, an area traditionally dominated by banks.”

DTEC Fintech Exposure Is a Plus

Some DTEC fintech components are already encroaching upon territory previously dominated by traditional banks, including smaller business loans, payment processing, and business payroll. Plus, there are advantages for fintech companies in pursuing bank charters even if it doesn’t mean those companies will open brick-and-mortar branches.

Social distancing may have kept customers away from brick-and-mortar banks more often than not, giving financial technology time to shine. As consumers forge on following the pandemic, the ease of use provided by fintech could be a major disruptor for banks.

Moreover, fintech companies are becoming legitimate thorns in the sides of old guard banks.

Cash might be king, but financial technology (fintech) might have something to say about that. The Covid-19 pandemic may have spurred an increase usage of digital forms of payment. Proving that DTEC components are disrupting banks is the theory that over time, banks may need to pay up to retain customers, something the companies are likely loathe to do as interest remains low.

“Historically, banks have been the main providers of retail payment services and have used their relationships with customers to sell consumer loans and other financial products,” said Moody’s. “In a digital world, as banks lose market share in retail payments they may lose their competitive advantage in consumer finance as well as valuable consumer financial data.”

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.