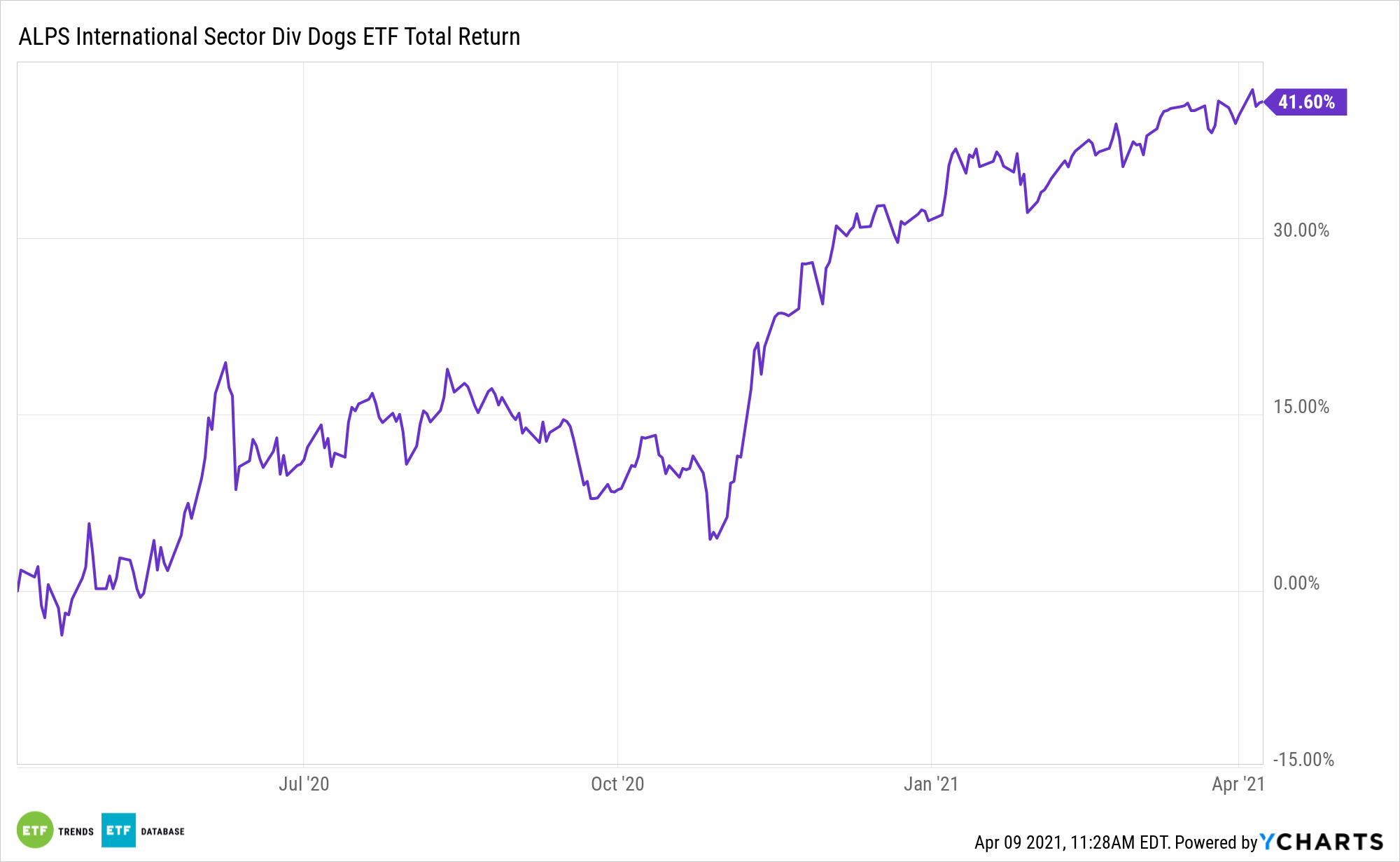

The following concepts are working this year: dividends, cyclical/value stocks, and international equities. That trifecta is efficacious for the ALPS International Sector Dividend Dogs ETF (NYSEArca: IDOG).

ALPS identifies the five highest-yielding securities in the 10 GICS sectors on the last trading day of November. From there, IDOG is rebalanced quarterly in an effort to keep sector weights in the area of 10% and individual holdings at around 2%.

International stocks rallied in the first quarter with some help from the sectors IDOG features robust allocations to.

“Energy and financials–the hardest-hit sectors in 2020–led the way. The Morningstar Global Energy Index and Morningstar Global Financial Services Index posted the largest gains of 18.8% and 11.1%, respectively, as energy prices recovered from lockdown lows and the yield curve steepened,” notes Morningstar analyst Eric Schultz.

Higher Yields for the Win

Stocks in Europe and in international developed markets often have higher yields than those in the U.S. That means it’s possible to take advantage of a dividend growth strategy and relatively high dividend yields. International dividend growth stocks also come without the added U.S. interest rate sensitivity of high dividend-paying stocks.

Ex-U.S. developed market dividend payers often feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications.

“Value stocks’ resurgence relative to growth stocks, which started in late 2020, picked up steam last quarter. The foreign large-value Morningstar Category gained 8% versus foreign large-growth’s 0.6%,” adds Schultz. “Similarly, foreign small/mid-value gained 8.8% against foreign small/mid-growth’s 1.3%. U.S. stocks followed the same pattern, with value beating growth across the market-cap spectrum.”

Not all markets are currently offering value propositions. Fortunately, for investors considering a value wager, some of the larger, least volatile developed markets outside the U.S. are showing some signs of value rebounds. Those include the U.K. and Japan, among others.

“Developed-markets stocks outperformed emerging-markets stocks, with the Morningstar Developed Markets ex U.S. Index gaining 4.3% last quarter versus the Morningstar Emerging Markets Index’s 2.8%,” according to Schultz.

Other international developed market dividend ETFs include the FlexShares International Quality Dividend Dynamic Index Fund (NYSEArca: IQDY), ProShares MSCI EAFE Dividend Growers ETF (CBOE: EFAD), and the SPDR S&P International Dividend ETF (NYSEArca: DWX).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.