With dividends perking up around the world, income-starved investors are reminded that there are some compelling payout opportunities in ex-U.S. developed markets.

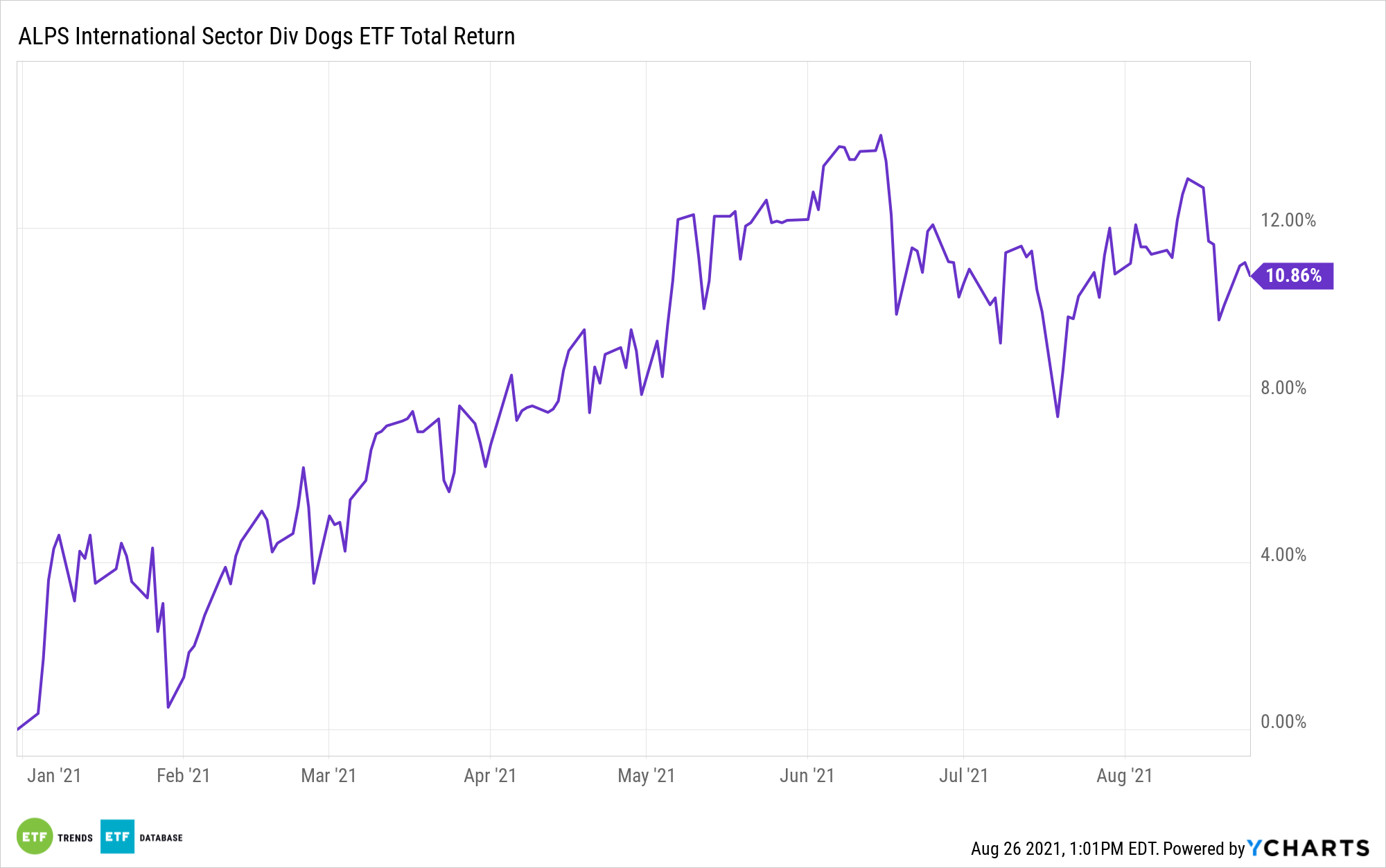

On that note, the ALPS International Sector Dividend Dogs ETF (NYSEArca: IDOG) is ready for some time in the spotlight. IDOG, which tracks the S-Network International Sector Dividend Dogs Index, yields 3.50%, or 125 basis points more than the MSCI EAFE Index.

Yield is nice, particularly in today’s low-yield environment, but with inflationary pressures mounting, dividend growth is all the more important. Fortunately, that growth is arriving around the world.

“The global total of $471.7bn was boosted by delayed 2020 dividend payments returning to their normal timetable, but also by higher special dividends and positive exchange-rate effects. Underlying growth was 11.2%,” according to Janus Henderson.

Here’s how international dividend growth relates to IDOG. The ALPS fund provides exposure to stocks from 13 ex-U.S. developed markets, with Japan being the largest geographic exposure at 20.45%. That’s a positive for investors mulling IDOG because the world’s third-largest economy is home to some rapidly rising payouts. As the Janus report notes, Japanese dividends are up nearly 12% over the past year.

“Japanese dividends proved to be very resilient through the first year of the pandemic as low payout ratios and healthy cash flow meant most companies continued to pay. Having seen so little downside, it was very encouraging to see 11.9% underlying growth in the second quarter of 2021,” according to Janus Henderson.

IDOG also features significant European exposure. In the second quarter, France and Sweden, which combine for 12% of the fund’s weight, impressed on the dividend growth front. The U.K., which accounts for almost 12% of IDOG, is making contributions to the fund’s payout outlook, too.

“Underlying growth was 42.2%, as 85% of the UK companies in our index increased, restarted or held their dividends steady,” adds Janus Henderson.

At the sector level, materials led global second-quarter dividend growth, with consumer discretionary and industrial stocks providing upside as well. Those three sectors combine for about 31% of IDOG’s roster. Defensive sectors also provided steady, though not spectacular, payout growth in the June quarter. Consumer staples, utilities, and healthcare stocks combine for 30% of IDOG’s weight.

Other international developed market dividend ETFs include the FlexShares International Quality Dividend Dynamic Index Fund (NYSEArca: IQDY), ProShares MSCI EAFE Dividend Growers ETF (CBOE: EFAD), and the SPDR S&P International Dividend ETF (NYSEArca: DWX).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.