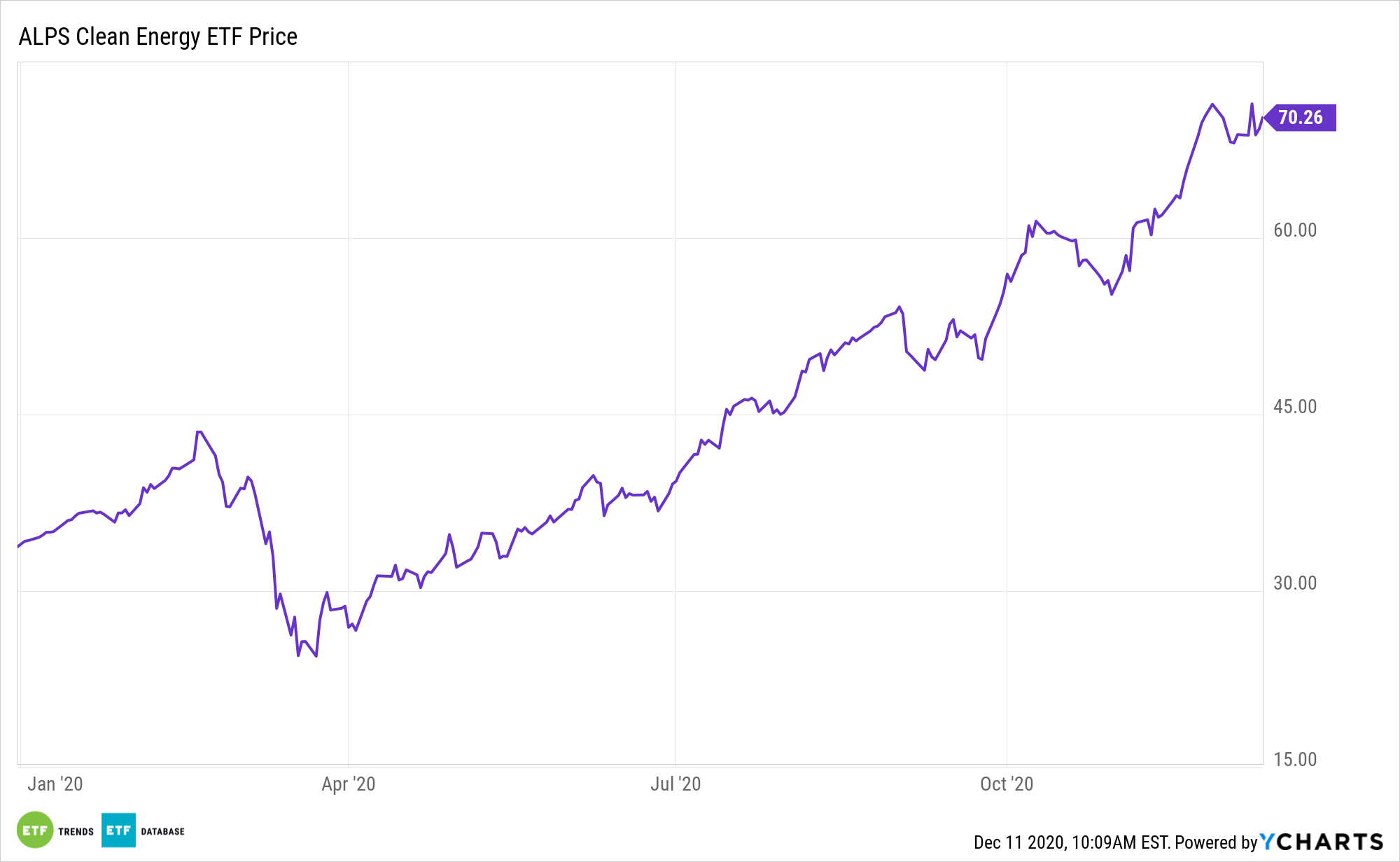

A star among renewable energy exchange traded funds, the ALPS Clean Energy ETF (ACES) more than doubled this year. While the U.S. has been a main contributor, investors shouldn’t ignore other regions’ contributions to the renewable energy investment thesis.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

Europe is one of the big drivers of renewable energy adoption. ACES is levered to that theme.

“Despite cautious positions on the energy transition adopted by certain governments in the region, the potential for growth in renewable power in Eastern Europe toward 2030 is significant,” according to IHS Markit. “Even Poland – where the government has so far held off from agreeing to the EU’s 2050 net-zero target – activity in the power sector itself gives cause for optimism.”

Eastern Europe Is Queuing Up for Sustainable Energy

ACES takes a different approach than what is seen in other traditional clean energy ETFs. Many of the legacy funds in this space focus on one alternative energy concept, such as solar or wind power. Buoyed by double-digit growth rates in global solar installations over the next decade, ACES, with a substantial solar weight, could be a long-term winner.

Additionally, ACES offers substantial wind power exposure, which is one of Europe’s preferred sources of clean energy.

“And then there is the offshore wind potential. In Poland, the growth opportunity for offshore wind is huge. IHS Markit expects Poland will have 0.7 GW of installed capacity in 2025, rising to 4.2 GW in 2030, 8.3 GW in 2035, and 12.3 GW in 2040. There are already three projects at the design/permitting stage totalling around 3.4 GW. Under Poland’s draft Offshore Wind Act, Poland will hold auctions for 5 GW of capacity in two rounds of 2.5 GW each in 2025 and 2027. Bidders will compete for contracts-for-difference (CFD) remuneration,” according to IHS Markit.

Eastern Europe is forecast to auction 8.3 gigawatts of clean energy by 2022.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.