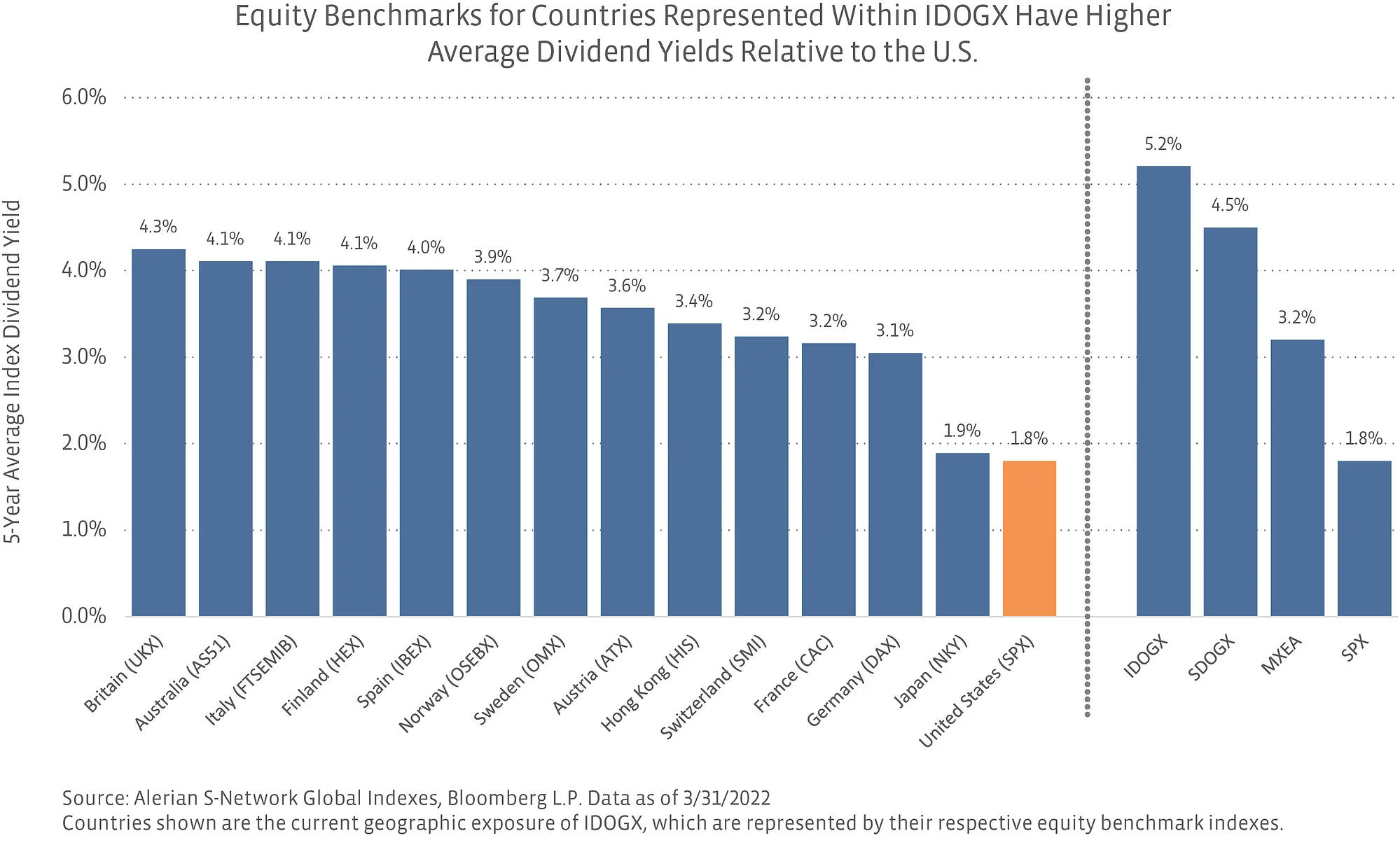

While international equities can often be overlooked by U.S. investors, an international dividend strategy can provide an additional layer of diversification to a portfolio along with potentially higher dividend income. When looking at the broad U.S. equity market relative to developed international equities, the S&P 500 Index (SPX) has a five-year average dividend yield of 1.8%, while the MSCI EAFE Index (MXEA) has an average dividend yield of 3.2% over the same time period.

International equities typically pay higher yields than domestic equities.

There are several reasons why international dividend yields are often higher than U.S. dividend yields. First of all, the U.S. equity market has become increasingly weighted toward technology stocks (the SPX has a 28.0% weighting in technology stocks as of March 31, 2022). These stocks typically focus on growth and reinvesting in the business rather than paying dividends. In comparison, developed international equity markets, which can be measured by the MXEA are tilted toward sectors like financials (17.6% weighting), industrials (15.3% weighting), and healthcare (13.0% weighting), which tend to focus more heavily on dividend payouts.(1) For companies in these countries, dividends may help retain more investors when stock price returns may not be as attractive. Many countries also have more “dividend-friendly” policies which encourage dividend investing relative to the U.S. For example, Australia avoids double taxation on its dividends through franking credits.(2)

The difference in yields becomes more obvious when looking at dividend indexes. The S-Network Sector Dividend Dogs Index (SDOGX)—a domestic equity income index—has a five-year average yield of 4.5% compared to the S-Network International Sector Dividend Dogs Index (IDOGX)—a developed international equity income index—which has a five-year average yield of 5.2%. The countries currently represented in IDOGX (shown in the chart below) all have higher average dividend yields compared to the U.S.

While higher yields can mean higher risks, there are added diversification benefits.

While higher yields often come at the cost of potentially higher risk (and potentially lower total return), international dividend strategies can offer an extra layer of diversification to a portfolio by reducing geographic biases—which are particularly relevant during times of global conflict. Certain dividend index strategies (e.g., equal weighting methodologies) can also reduce sector biases. IDOGX uses a similar strategy to its domestic counterpart, SDOGX, that is applied to international developed equities outside of North America. The index utilizes a version of the “Dogs of the Dow” strategy (see a more in-depth explanation in the note here) with a sector overlay that weights stocks equally across each sector. This reduces concentration to sectors like financials and healthcare, which are heavily weighted in broader international dividend indexes. The strategy is constructed to pick stocks with the highest dividend yields (assumed to be the cheapest in their sector) with the assumption that prices will appreciate throughout the year and revert to the mean.

Bottom Line:

International equities can often be intimidating to U.S. investors, and many U.S. investors may not realize the benefits of adding an international equity income allocation to a portfolio. An international dividend strategy can provide a potentially higher dividend yield than domestic equities, while adding geographic diversification.

The S-Network International Sector Dividend Dogs Index (IDOGX) is the underlying index for the ALPS International Sector Dividend Dogs ETF (IDOG).

The S-Network Sector Dividend Dogs Index (SDOGX) is the underlying index for the ALPS Sector Dividend Dogs ETF (SDOG).

For more news, information, and strategy, visit the ETF Building Blocks Channel.

Related Research:

SDOGX Fetches Higher Yields and YTD Outperformance

Will Your Equity Allocation Miss Out on the Value Trade?

Income Opportunities: MLPs, CEFs, and Return of Capital

Income Opportunities: Examining Price and Total Return in 2021

Income Opportunities: Finding Income in an Inflationary Environment

[1] Weightings are from the iShares MSCI EAFE ETF (EFA) as of 3/31/2022

[2] Australia’s Dividend-Friendly Rules in the U.S.? – Dividend.com