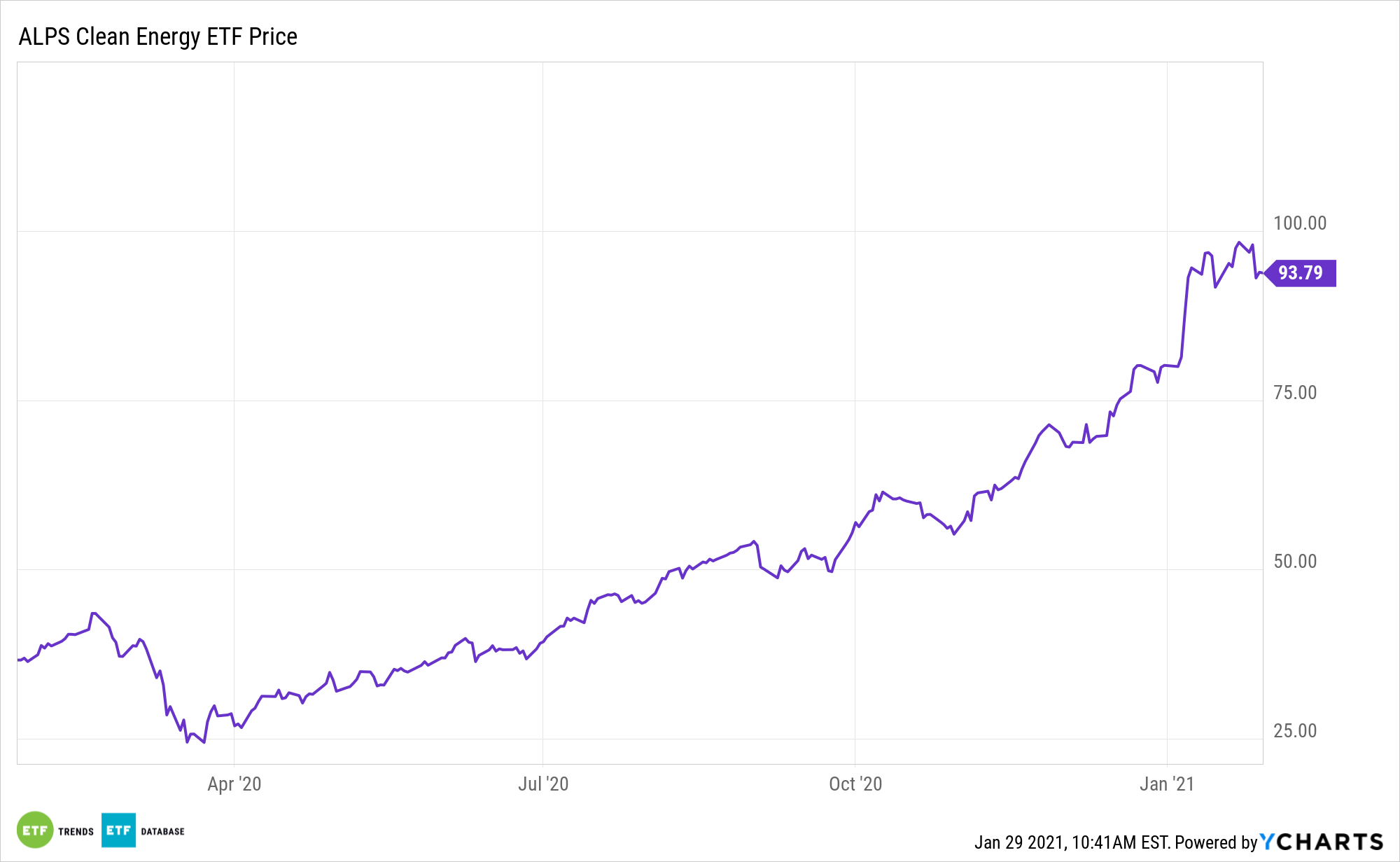

Renewable energy exchange traded funds like the ALPS Clean Energy ETF (ACES) are among the best-performing non-leveraged ETFs since 2020. Now, some ACES components are capitalizing on stock surges, issuing equity at or near record highs.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

Some ACES holdings are “among those that have taken advantage of Wall Street’s appetite for all things renewable to raise $4.4 billion in stock offerings in January, setting a monthly record, according to data compiled by Bloomberg. It’s the third consecutive monthly record after solar, hydrogen and other clean-tech companies raised $1.76 billion in December and $1.15 billion in November,” reports Bloomberg.

The Right Time and Right Place for Clean Energy ETFs

Clean energy was one of the stellar performers in 2020, and that strength should continue through the new year, especially as Joe Biden brings favorable policies to the sector.

A catalyst for ACES this year is increased ESG awareness in corporate America, which has only contributed to clean energy’s overall growth. Looking ahead, regulators could also lay out guidelines to help investors better invest in the green industry.

Investors could be banking on future governmental policies like more subsidies for clean energy technology. This will only help consumers get more access to clean energy, which is still prohibitively expensive for many.

“The flood of stock offerings comes as Biden pushes to fully green the country’s electrical grids by 2035 — and as investors seek out companies that meet their ESG benchmarks. These trends have sent share prices of clean-energy companies soaring, and now they’re cashing in,” according to Bloomberg.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.