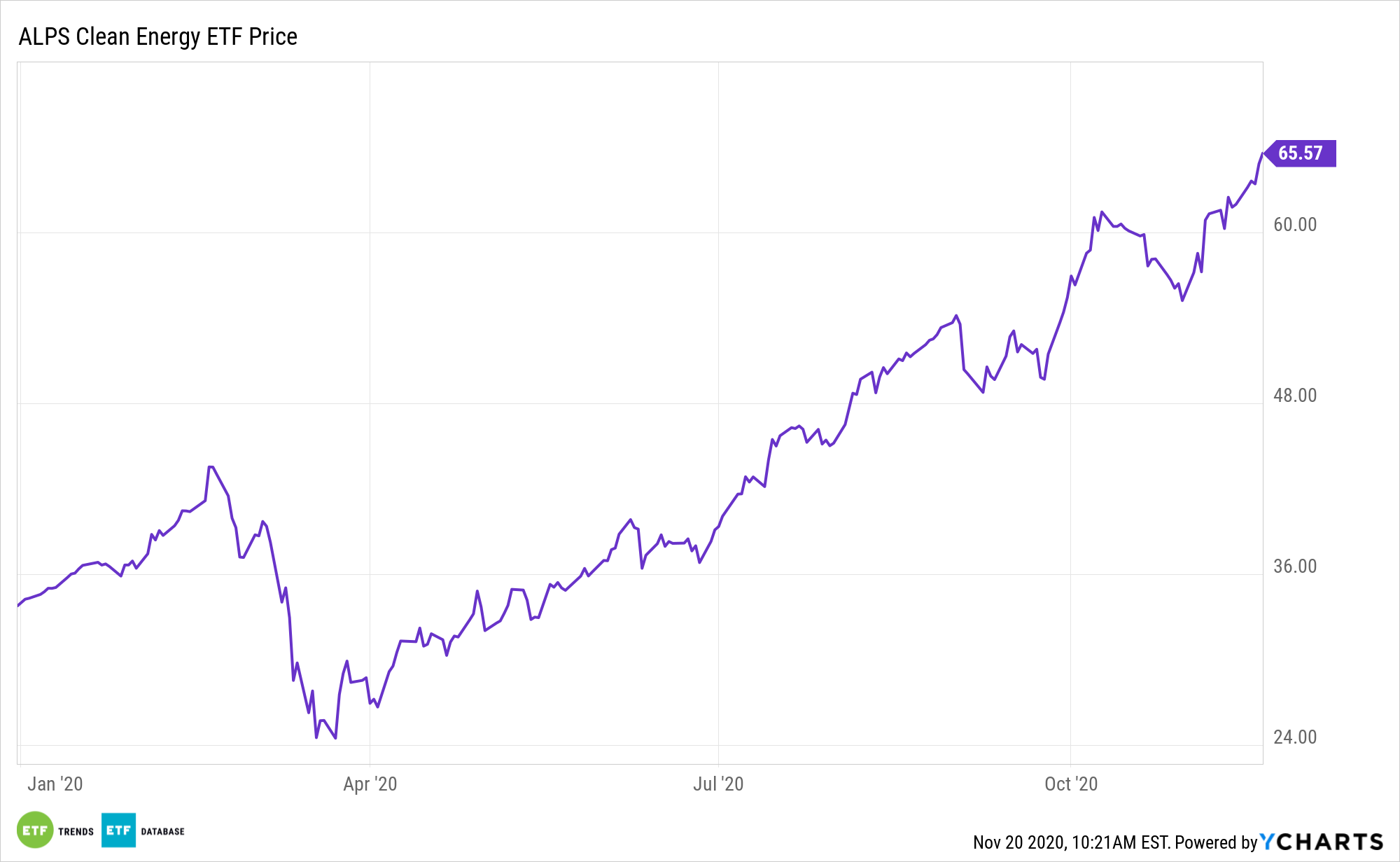

The ALPS Clean Energy ETF (ACES) and its renewable energy peers are benefiting from Joe Biden’s recent win. Yet governments regardless of style will be the main drivers of global clean energy adoption.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

In the U.S., state and local governments can and do drive renewable energy policy to a limited extent. That’s been beneficial to ACES over time. The national government is the one to instigate a long-term clean energy rollout.

“Governments are taking bigger steps to cut carbon emissions. The EU and Japan plan to go carbon neutral by 2050, and China aims to do the same 10 years later. These goals will boost “greentech” as the world’s largest industries look to benefit from government investment and subsidies,” reports Business Insider.

More Than a Biden Boost

ACES’ underlying index utilizes a rules-based methodology developed by CIBC National Trust Company, which is designed to provide exposure to a diverse set of U.S. and Canadian companies involved in the clean energy sector including renewables and clean technology. The fund is non-diversified.

Biden’s presence in the White House can certainly help clean energy.

“An aggressive push towards 100% renewable energy would save Americans as much as $321bn in energy costs, while also slashing planet-heating emissions, according to a new report,” an article in The Guardian noted. “Joe Biden, the Democratic presidential nominee, has vowed to eliminate greenhouse gases from the US power grid within 15 years and essentially zero out emissions by 2050, a plan assailed by Donald Trump as costly and detrimental to the American economy.”

However, there’s more to the ACES thesis than just Biden or just the United States.

“Countries will push the transition by swapping fossil-fueled power generation with renewable energy, replacing traditional vehicles with electric counterparts, using hydrogen in place of gas in industrial applications, and finding digital solutions for boosting efficiencies, according to UBS. Accordingly, the renewable energy, hydrogen, and battery industries are those best positioned to benefit,” reports Business Insider.

Other popular alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.