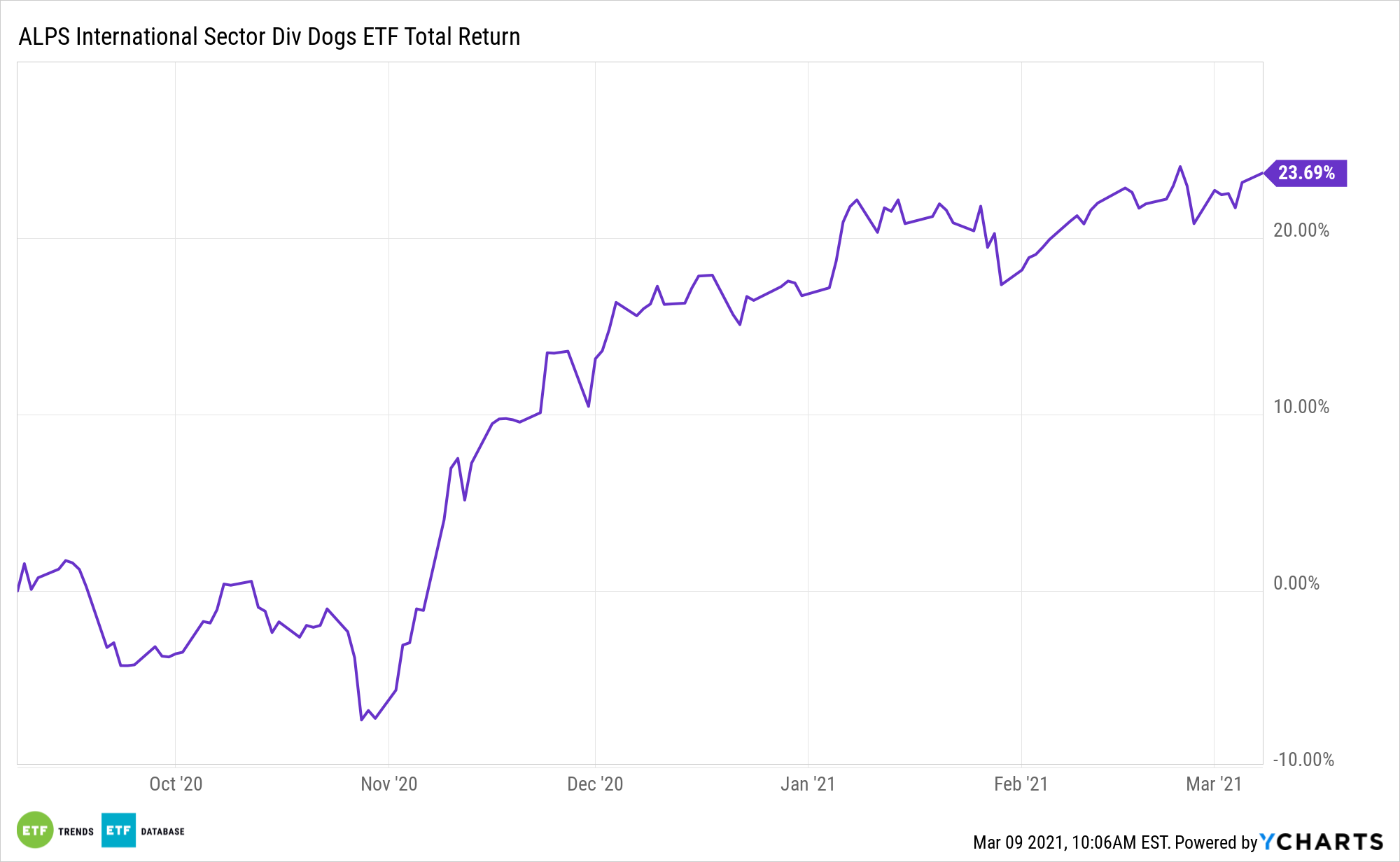

Resurgent value and cyclical stocks can support upside for ex-U.S. developed market equities. Investors can get in on the action with dividends to boot through the ALPS International Sector Dividend Dogs ETF (NYSEArca: IDOG).

ALPS identifies the five highest-yielding securities in the 10 GICS sectors on the last trading day of November. From there, IDOG is rebalanced quarterly in an effort to keep sector weights in the area of 10% and individual holdings at around 2%.

“UK and euro area stocks lagged the global market in 2020. UK stocks, skewed toward sectors that typically fare poorly during cyclical downturns and weighed down by Brexit uncertainties, were the worst performer among developed market (DM) peers. With the risk of a no-deal Brexit lifted and the UK leading the vaccine rollout among DMs, we see a broad activity restart in the summer,” according to BlackRock research.

A Good Time to Investigate IDOG

With more looking to foreign markets as a way to diversify away from U.S. equities, investors will face certain risks associated with international exposure. Nevertheless, there are a number of smart beta global exchange traded fund strategies that can help investors better-manage risks, including IDOG.

Stocks in Europe and other international developed markets often have higher yields than those in the U.S. That means it’s possible to take advantage of a dividend growth strategy with relatively high yields. International dividend growth stocks also come without the added U.S. interest rate sensitivity of high dividend-paying stocks.

IDOG may help investors gain improved risk-adjusted returns to European markets by diminishing downside risk while still hooking in upside potential. Furthermore, its dividend focus also helps investors focus on quality companies with a history of growing dividends.

Value-seeking investors could look to ex-U.S. developing markets like Europe if they want to stay away from the heightened risk posed by investing in emerging markets.

See also: Economic Progress in Europe Can Lift the ALPS IDOG ETF

“We expect a vaccine-led reopening to enable activity to return to pre-Covid levels by late 2021 or early 2022 in the euro area and the UK, with a well of pent-up demand fueling spending, especially in services,” notes BlackRock. “Activity data last week were stronger than expected, suggesting services have not been as severely hit as by the initial lockdowns as in 2020. We see ongoing fiscal support for the most affected households and sectors, and expect central banks to keep financial conditions easy. We expect the ECB to likely reiterate such a commitment at this week’s policy meeting, pushing back against higher bond yields.”

Other international developed market dividend ETFs include the FlexShares International Quality Dividend Dynamic Index Fund (NYSEArca: IQDY), ProShares MSCI EAFE Dividend Growers ETF (CBOE: EFAD), and the SPDR S&P International Dividend ETF (NYSEArca: DWX).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.