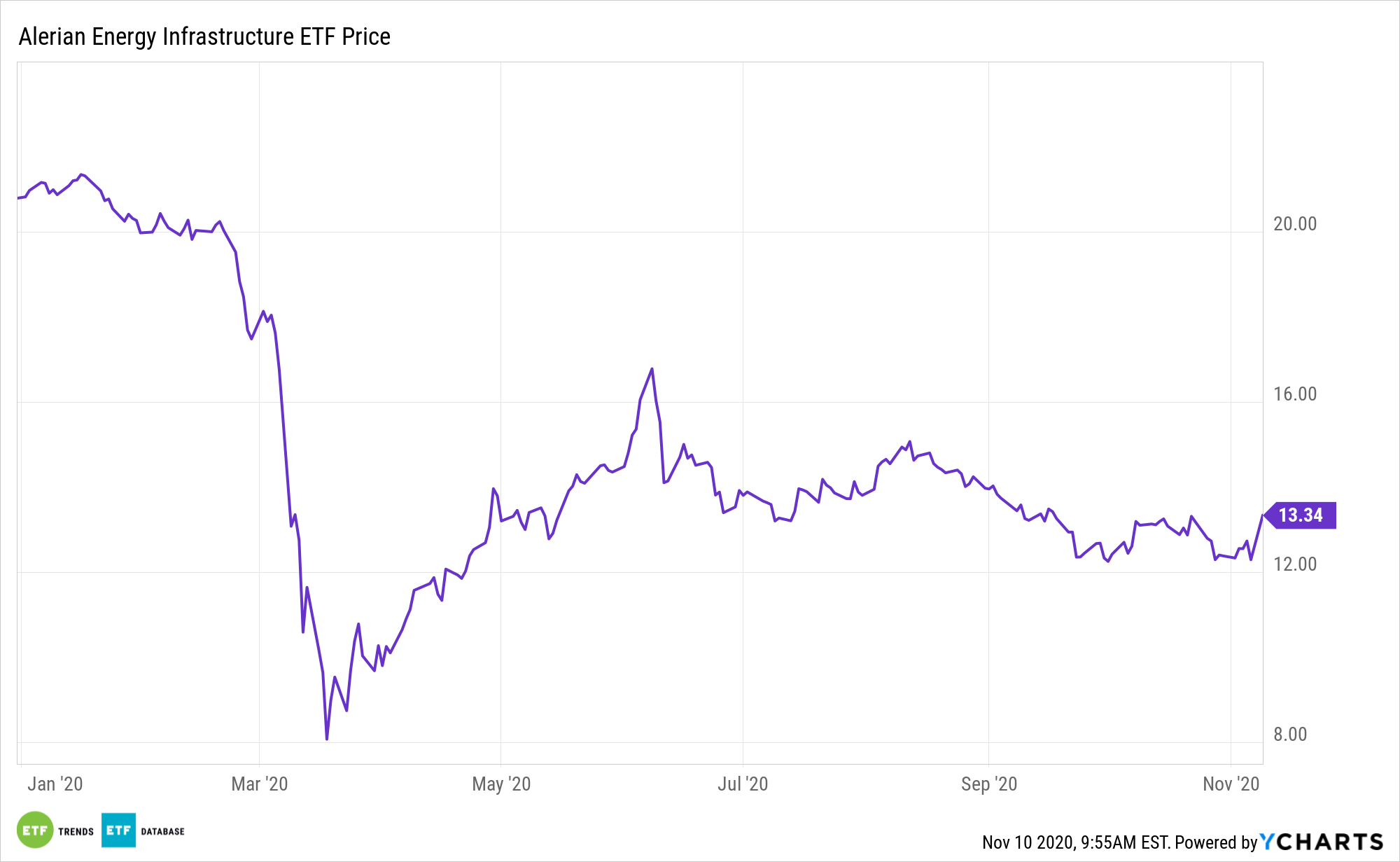

It’s clear Joe Biden will be the next president of the United States, but a blue wave has not quite materialized yet, breathing life into exchange traded funds such as the Alerian Energy Infrastructure ETF (ENFR).

What markets are looking at now when it comes to the traditional energy sector are two Georgia Senate races that move to January. If the Democrats win both, they’d have a Senate majority, perhaps providing a runway for clean energy at fossil fuels’ expense.

“A divided government will make it tough for Biden to pass ambitious climate legislation that would have effectively restrained the oil and gas industry, analysts at Morgan Stanley said in a note Wednesday,” according to Business Insider.

ENFR tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs but limits the tax hit from solely owning MLPs.

ENFR Has Renewables Leverage

Even if Biden pushes forward an oil-destructive agenda, the case for ENFR isn’t dead. It’s actually very much alive.

Renewable energy, which includes solar, wind, geothermal, hydroelectric, and other low carbon sources, is commanding an increasing share of the energy landscape, meaning it’s not only prescient for midstream operators to move into the space, but potentially profitable too.

And without control of the Senate, Biden will struggle to appease the progressive faction of his party when it comes to renewables.

“It’s pretty clear that Biden’s legislative agenda vis-a-vis climate will go absolutely nowhere in Mitch McConnell’s Senate,” Pavel Molchanov, an Analyst at Raymond James, said. “The changes that he will be able to make will be limited to executive actions.”

ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs but limits the tax hit from solely owning MLPs. Moreover, many traditional MLP funds don’t provide adequate renewables exposure, but ENFR is changing that conversation.

Consider this when it comes to the midstream’s foray into renewables: integrated oil companies have been doing for years.

Other MLP funds include the Global X MLP ETF (NYSEArca: MLPA) and the JPMorgan Alerian MLP Index ETN (NYSEArca: AMJ).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.