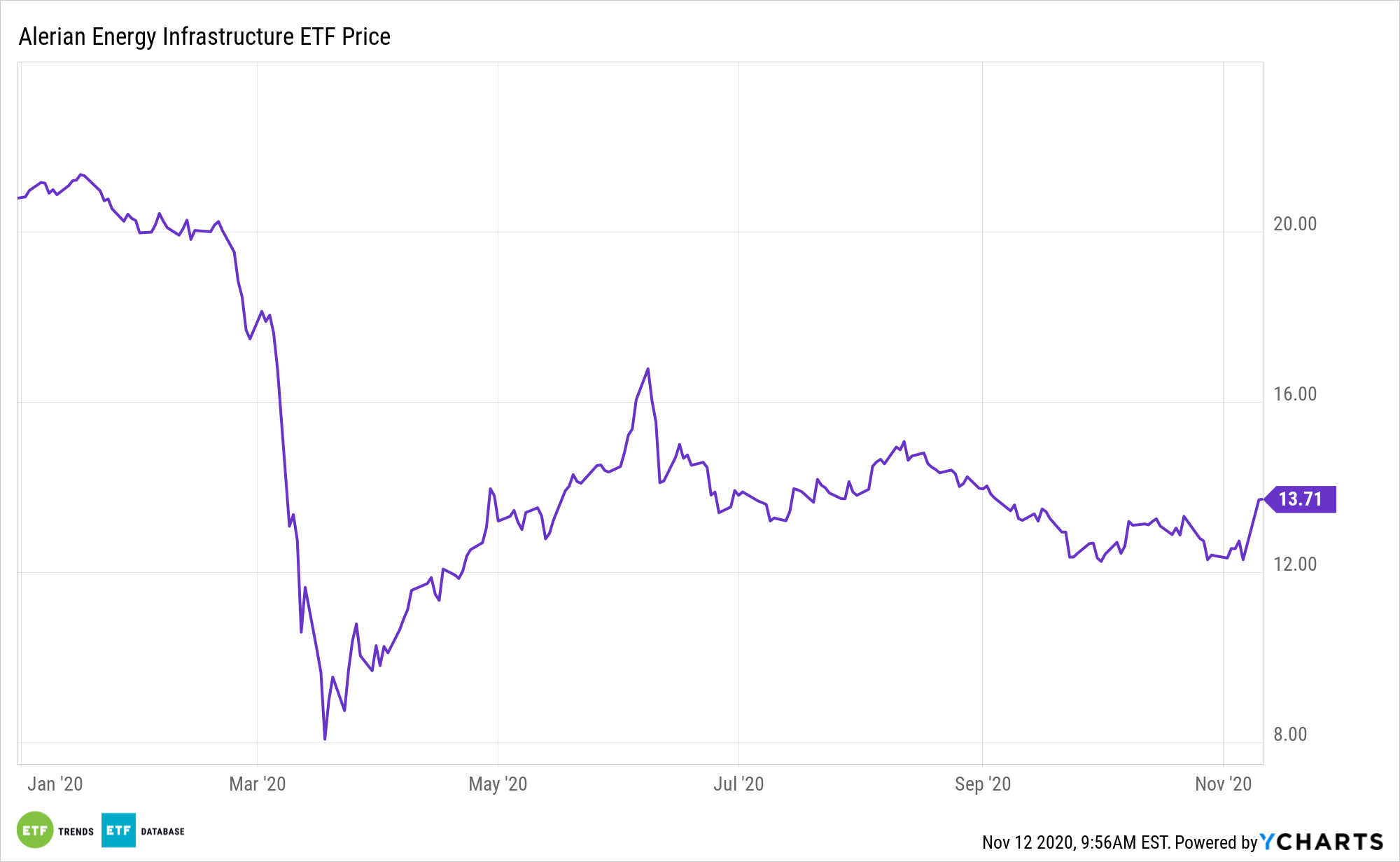

The direct implications of Joe Biden’s presidency for traditional energy sector and exchange traded funds, including the Alerian Energy Infrastructure ETF (ENFR), are not totally clear.

ENFR tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

“Overall, the impact of the election is probably a slight drag on crude prices, argues Rebecca Babin, Senior Energy Trader at CIBC Private Wealth Management. That’s particularly true if Congress remains split, and President-Elect Biden can’t pass his proposed $2 trillion climate change package,” reports Avi Salzman for Barron’s.

More to Ponder

What markets are looking at now when it comes to the traditional energy sector are two Georgia Senate races that move to January. If the Democrats win both, they’d have a Senate majority, perhaps providing a runway for clean energy at fossil fuels’ expense.

On the upside, many of ENFR components are simply transporters of energy and aren’t as sensitive to oil price changes as, say, exploration and production companies or oil services names.

“On the domestic front, Biden’s energy plans could have an impact too. His policy on oil exploration became a point of conflict toward the end of the campaign, as Trump claimed his opponent would ban hydraulic fracturing, or fracking, a technique to extract oil and gas from shale,” according to Barron’s.

Income-minded investors may find pockets of opportunity in the energy segment through infrastructure-focused Master Limited Partnerships (MLPs) and corporations that generate robust yields. Unlike oil producers and services companies, energy infrastructure companies provide real business-line diversification in the energy sector, as they deal with the transportation, storage, and processing of energy, which are far less reliant on commodity prices.

“Biden denied that he would ban fracking, and the energy plan posted on his campaign site made it clear that he instead plans to stop issuing new fracking leases on federal land. That would impact less than 10% of potential oil production. If extended to leases in the Gulf of Mexico, it could have a larger impact—perhaps curtailing as much as 25% of future production,” reports Barron’s.

Other MLP funds include the Global X MLP ETF (NYSEArca: MLPA) and the JPMorgan Alerian MLP Index ETN (NYSEArca: AMJ).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.