Real estate investment trusts (REITs) were repudiated at the height of the onset of the coronavirus pandemic, and retail REITs were among the most vulnerable owing to increasing adoption of e-commerce.

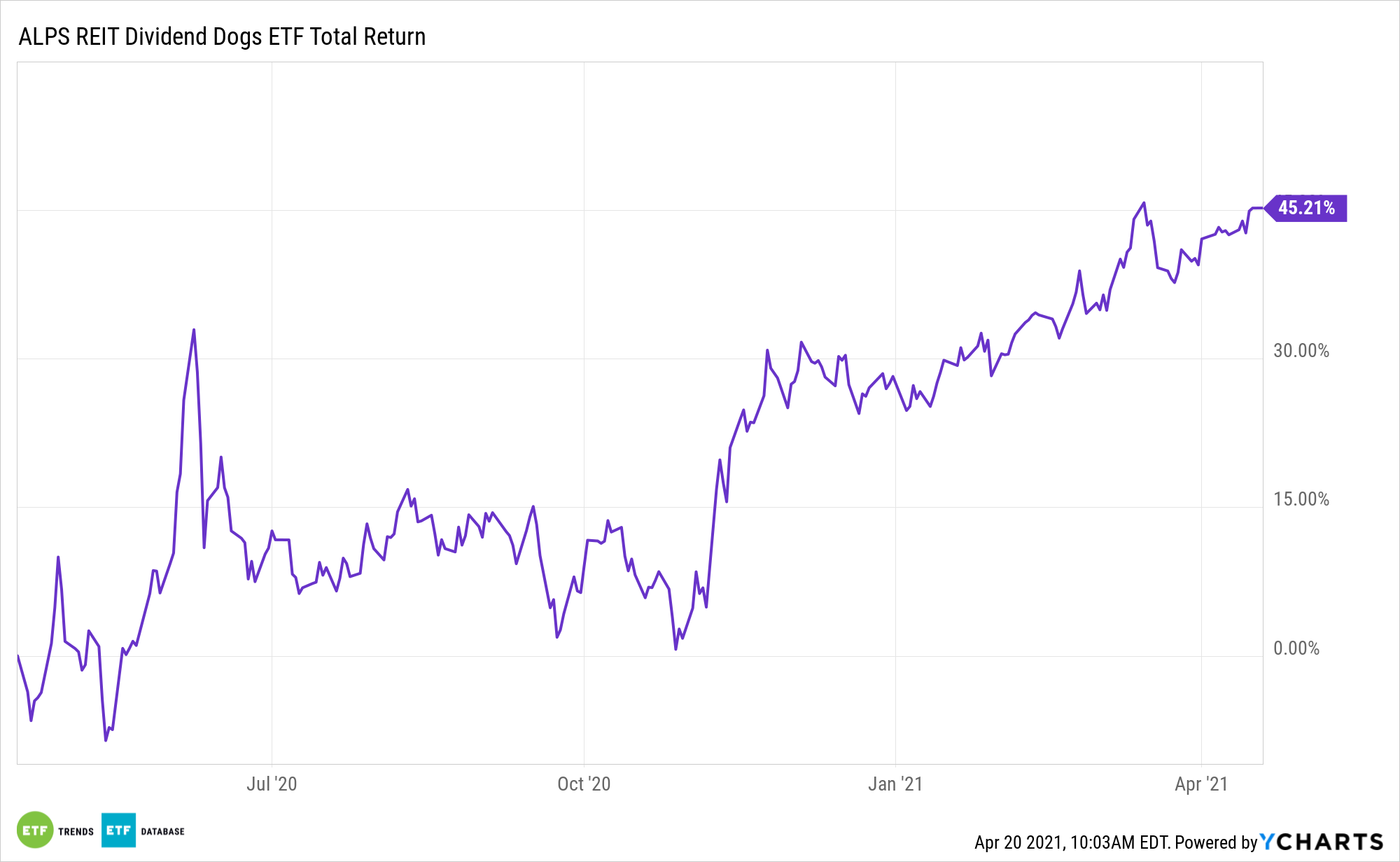

However, some analysts see opportunities reborn with retail REITs. Investors can wade back into the group with diversified exchange traded funds like the ALPS REIT Dividend Dogs ETF (NYSEArca: RDOG).

RDOG tracks the S-Network REIT Dividend Dogs Index, a benchmark that’s similar to those found on ALPS’s other dividend dogs ETFs.

“Many investors are concerned that the continued growth of e-commerce is a large, structural negative trend for brick-and-mortar retail,” writes Morningstar analyst Kevin Brown. “However, we believe the omnichannel strategy–e-commerce sales by traditional retailers–that is being increasingly pursued by most national retailers favors the high-quality portfolios owned by the retail real estate investment trusts.”

The Surprising Case for Retail

There has been plenty of talk about the rise of e-commerce and online retail companies, with much of that coming at the expense of traditional brick-and-mortar retailers. While the number of store closures across the U.S. is expected to jump in the coming years, writing obituaries for shopping malls may be a bit premature.

“While many retailers are indeed closing stores, these are typically at lower-quality malls and shopping centers, which lack the demographics like population density that generate high foot traffic or average household income to lead to high average sales per ticket for tenants at the center,” says Brown. “Stores in lower-quality properties are likely to be less profitable and therefore more likely to be targeted for closure when a retailer decides to reduce its physical footprint.”

See also: Who Let the Dividend Dogs Out?

Real estate investors also enjoy attractive dividend yield-generation, which provides an alternative to bonds as a source of income. The sector offers yields that exceed sovereign and corporate investment bonds. Unlike bond coupons, real estate dividends can grow over time, which is invaluable in periods of high growth and inflationary environments. Additionally, real estate’s long-term leases provide a more reliable source of dividends than many other equities.

“As retailers increasingly shift to an omnichannel strategy, maintaining these stores as places where consumers can buy online/pick up in store remains an essential part of their plans despite e-commerce’s increasing penetration of retail sales,” adds Brown. “Additionally, the brick-and-mortar store can be a showroom for the company’s products, provide marketing for its online storefront, and act as a place to return products that were purchased online.”

Other REIT ETFs include the Schwab US REIT ETF (NYSEArca: SCHH) and the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.