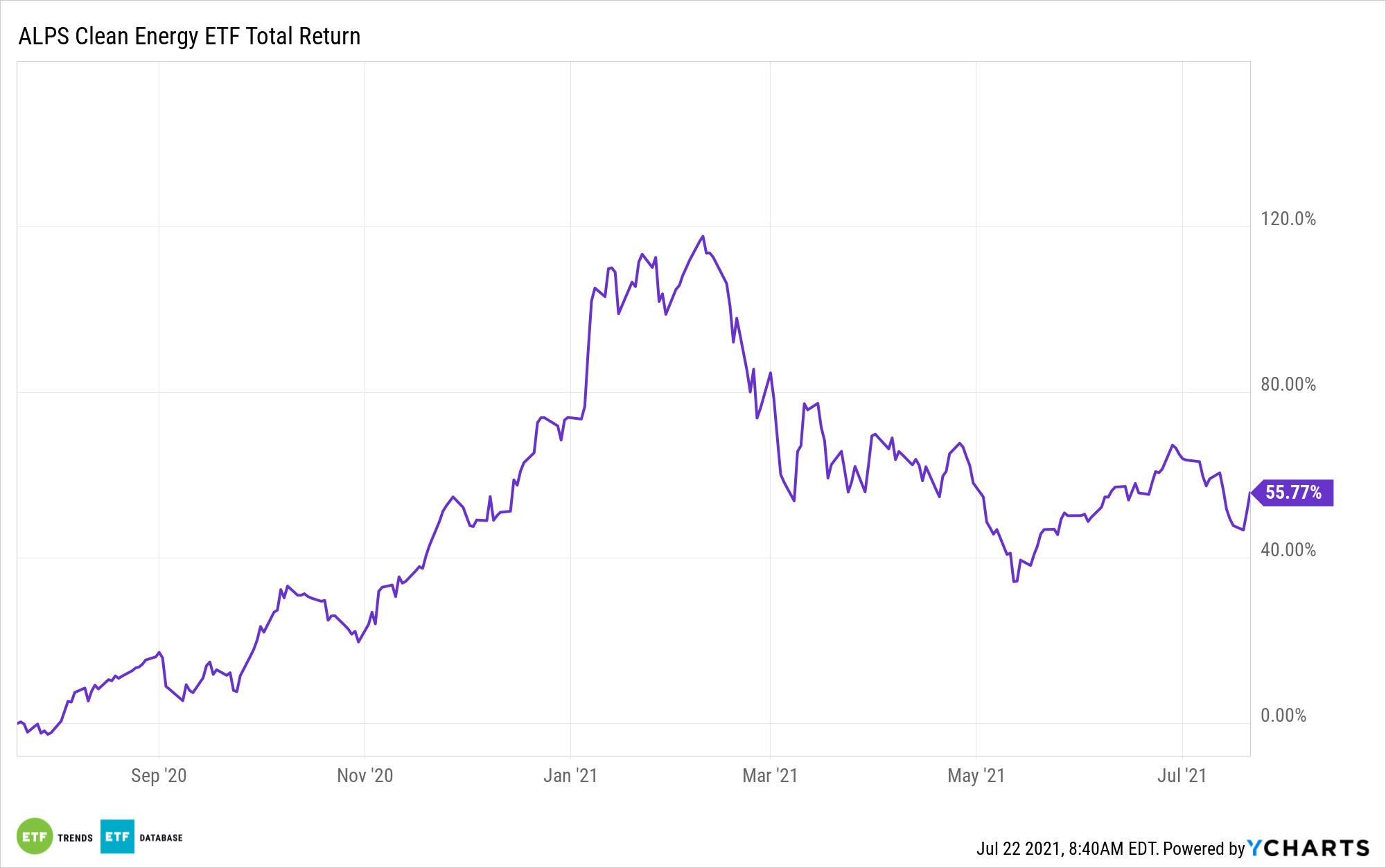

For all the political implications that come along with renewable energy exchange traded funds such as the ALPS Clean Energy ETF (ACES), investors should not gloss over the current regulatory environment.

There are synergies between the two, and the good news for ACES investors is that the regulatory climate is increasingly hospitable to renewable energy. Recent action by the U.S. Federal Energy Regulatory Commission (FERC) confirms as much.

Last week, FERC moved to “overhaul its electric transmission policies to enable planning, building, and funding of new, long-haul transmission to deliver remotely located renewable power to demand centers,” according to IHS Markit.

Making moves to bolster transmission is vital to the clean energy future so many politicians extol. It’s also relevant to investors here and now because solar and wind equities combine for over 45% of the ACES roster. The point about transmission is important to ACES investors because efficiency and grid stocks represent almost 20% of the fund.

Steps in the Right Direction

For ACES, there’s yet another source of relevance in the aforementioned FERC action: updates for a power system and grid in dire need of a refresh.

“FERC approved an advanced notice of proposed rulemaking that seeks to update decade-old policies and improve a generator interconnection system that is horribly backed up across the nation, with some 750 GW of capacity awaiting grid access,” adds IHS Markit.

New transmission and distribution policies are important because demand for clean energy, including solar and wind, is soaring and many state-level power grids aren’t adequately prepared to meet that demand. Enhancing grids and transmission is integral to meeting President Biden’s stated objective of slashing carbon emissions 80% by the start of the next decade and perhaps getting to net zero by 2035.

FERC is also looking to address another important element in the renewable energy equation: the costs utilities are facing in transmitting power to homes and businesses.

“Apart from figuring how to allocate costs for upgrades, FERC also has reopened the issue of how to properly allocate the costs of new power lines. This is because many transmission projects in the past have run into problems when state officials or utilities have claimed they are being forced to pay outsized shares of projects,” according to IHS Markit.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.