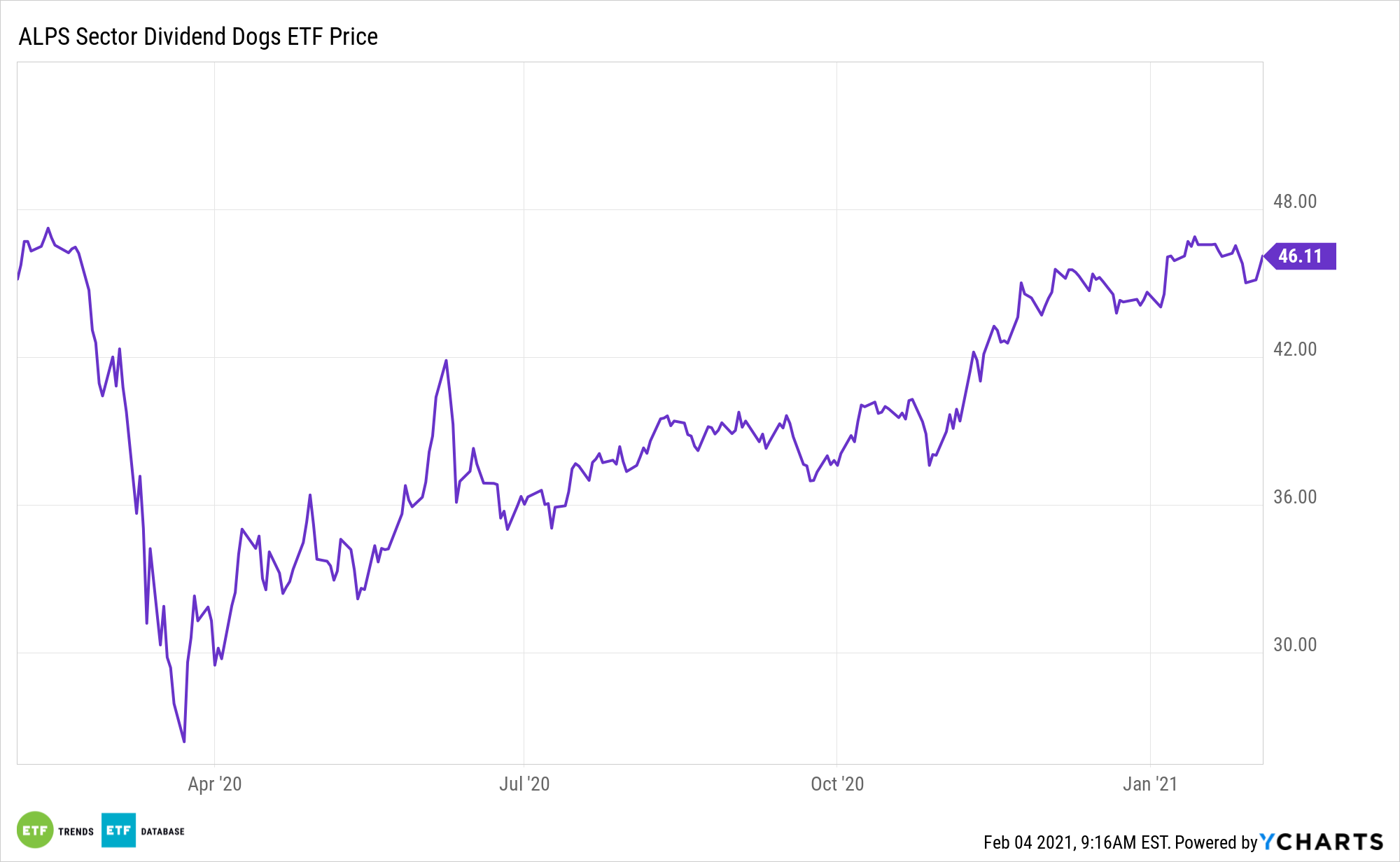

With the worst of 2020’s dividend calamity in the rearview mirror, payout stocks are solidifying and lending plenty of optimism for funds like the ALPS Sector Dividend Dogs ETF (SDOG).

SDOG tries to reflect the performance of the S-Network Sector Dividend Dogs Index, which applies the “Dogs of the Dow Theory” on a sector-by-sector basis using the S&P 500 with a focus on high dividend exposure. SDOG’s equal-weight methodology is important because it reduces sector-level risk and dependence of some groups that are considered to be imperiled value ideas.

Dividend cuts peaked in the second quarter last year. Over the past several months, there have been signs of growth, and that’s a positive catalyst for SDOG.

“Dividend cuts scared many investors away from equity-income strategies in 2020. We’re passed that now,” notes BlackRock. “Our analysis shows S&P 500 dividend cuts peaked in May and have since stabilized. We expect dividend growth to resume in 2021 as vaccine distribution and greater clarity in general give company managements the confidence to release excess cash in the form of dividends and buybacks.”

SDOG: Value and Dividends

The case for SDOG grows stronger when considering how cyclical and value stocks are coming back into vogue.

Exposure to the value factor could be in play following rotation away from high growth that has outperformed this year to cheaper cyclical sectors. Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales).

While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain-priced compared with their competitors. Value fans believe this time may be different for value stocks, pointing to improving investment sentiment measures, abating fears of a recession, and rebounding corporate profits.

SDOG also merits consideration against the backdrop of low interest rates.

“With interest rates around the world set to stay low for longer, company dividends are likely to provide better income than bonds for some time. In addition, companies can – and many often do – increase their dividends whereas bond coupons are fixed to maturity. Dividend growth that compounds over time is a compelling proposition in an environment of generation-low U.S. Treasury yields,” adds BlackRock.

Other high dividend ETFs include the SPDR S&P Dividend ETF (SDY), iShares Select Dividend ETF (NYSEArca: DVY), and iShares Core High Dividend ETF (HDV).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.