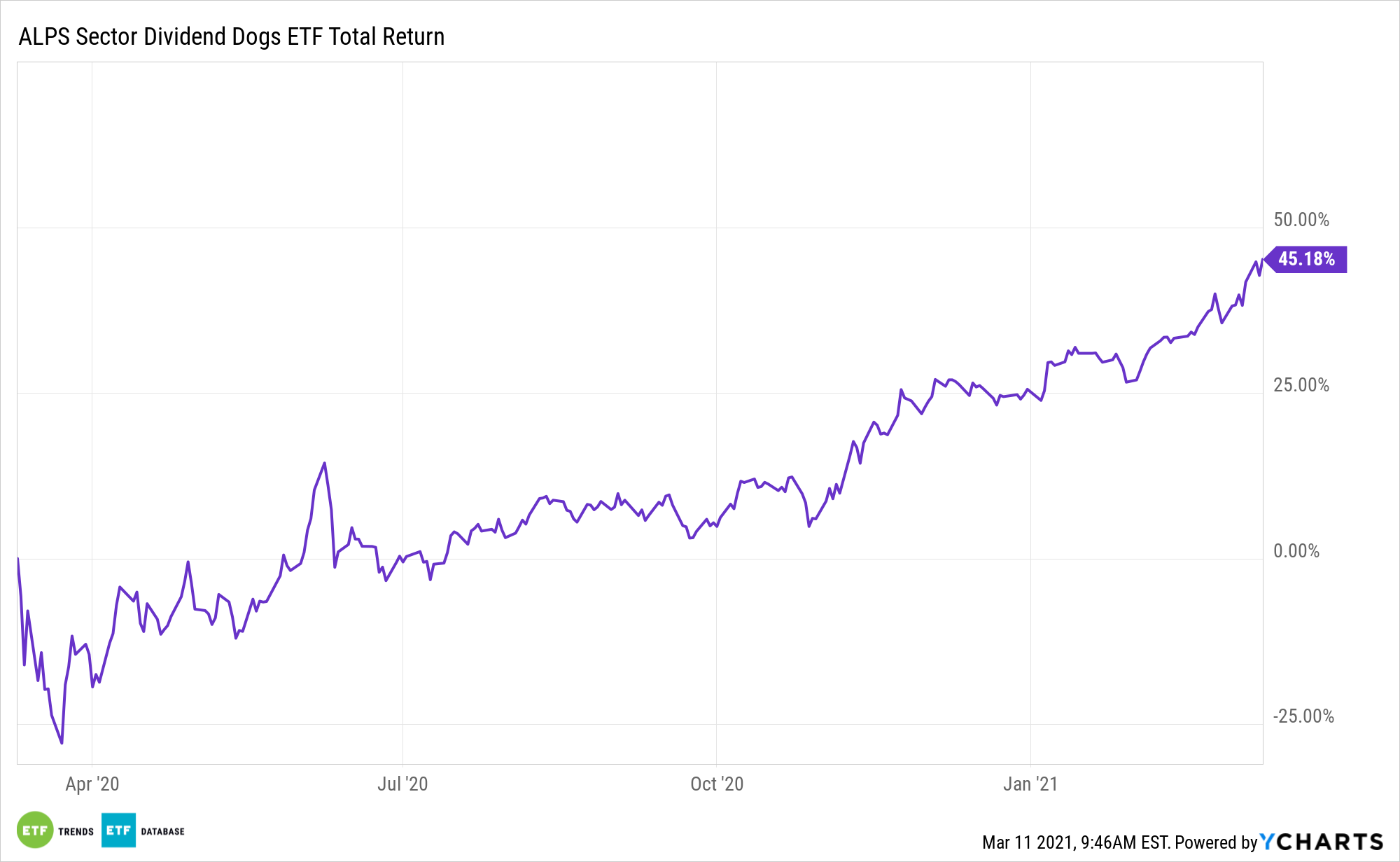

With cyclical value stocks trouncing growth rivals to start 2021, high dividend strategies such as the ALPS Sector Dividend Dogs ETF (SDOG) are worth revisiting.

SDOG tries to reflect the performance of the S-Network Sector Dividend Dogs Index, which applies the ‘Dogs of the Dow Theory’ on a sector-by-sector basis using the S&P 500 with a focus on high dividend exposure. SDOG’s equal-weight methodology is important because it reduces sector-level risk and dependence of some groups that are considered to be imperiled value ideas.

SDOG’s equal-weight sector methodology is relevant today because the fund is overweight resurgent energy, as just one example, while being underweight some of the growth groups now languishing at value’s expense.

“The resurgence of value stocks has been a dominant theme over the past few months, culminating in the largest monthly excess return over growth stocks in February (9% and a two standard deviation event) since 2008,” notes Matthew Bartolini, head of SPDR Americas Research. “And it hasn’t been just large-cap value that has produced strong above market returns. Up and down the cap spectrum and beyond the shores of the US, value has had a strong start to 2021, as well as over the past four months as the dual headwinds of election and vaccine timeline uncertainty were removed.”

Is SDOG Ready for Its Moment in 2021?

With so many market observers highlighting recent upside in value equities, some analysts are increasingly bullish regarding the outlook for dividend payers.

Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales). While they generally have solid fundamentals, value stocks may have lost popularity in the market in recent years. Still, SDOG is relevant today.

“A reflating of the economy, benefiting rate sensitive equites – correlation and beta profile (55%/ 0.30) to rates is higher than both the market and growth disciplines (34%/0.12 and 27%/0.11, respectively),” Bartolini continues. “Above market growth, plus attractive valuations at a time of stretched metrics elsewhere – Earnings-per-share growth (25%) is above that of growth styles (20%) and the market (24%). And relative valuations for S&P 500 value stocks are in the bottom decile across Price-to-Next-Twelve-Month-Earnings Ratio, Price-to-Book Ratio, and Price-to-Sales Ratio compared to top decile for S&P 500 growth stocks.”

Other high dividend ETFs include the SPDR S&P Dividend ETF (SDY), iShares Select Dividend ETF (NYSEArca: DVY), and iShares Core High Dividend ETF (HDV).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.