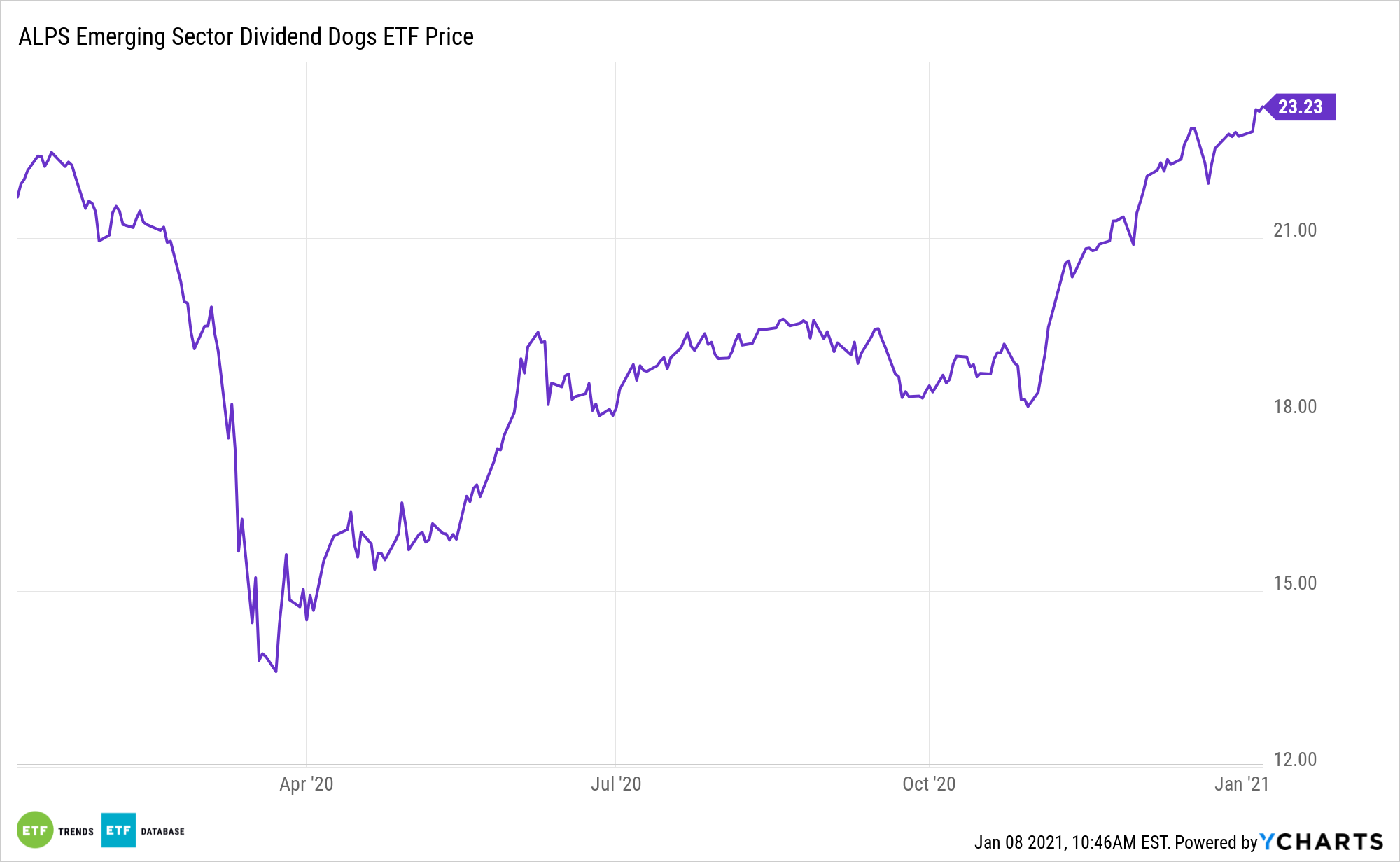

Attractive valuations on emerging markets equities, low bond yields, and a weak dollar could be the elixir the ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) is looking for.

EDOG, which debuted over six years ago, tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or “Dividend Dogs,” from the S-Network Emerging Markets Index, which holds large-cap, emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

One of the many asset classes forecast to benefit from regime change in the U.S. is emerging markets equities.

“For one, emerging markets are expected to have seen a relatively benign economic contraction in 2020—a 2% dip in gross domestic product—followed by a fast 6% rebound, according to Citigroup’s global equities strategists’ estimates. The U.S. is expected to dip 3% and rise 5% in 2021, in line with global growth. Meanwhile, EM valuations look reasonable,” reports Jacob Sonenshine for Barron’s.

Analyzing the EDOG ETF

Some market observers are growing bullish on emerging markets cyclical assets, a positive for the ALPS ETF given its exposure to energy, financial services, and materials names, among others.

EDOG’s status as a value play could be attractive in this environment because the gap between growth and value could collapse. The otherwise classic mean reversion approach to value may not hold, as many traditional industries face structural risks due to the changing economic environment.

“The average forward earnings multiple for the S&P 500 is almost 23 times. Wall Street considered 22 times rich in December, and the current multiple reflects an equity risk premium—the excess rate of expected equity returns over the soaring 10-year Treasury yield—of just 3.3%. Historically, the risk premium rarely goes below 3%. The lower the risk premium, the less attractive stocks are,” Barron’s reports.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.