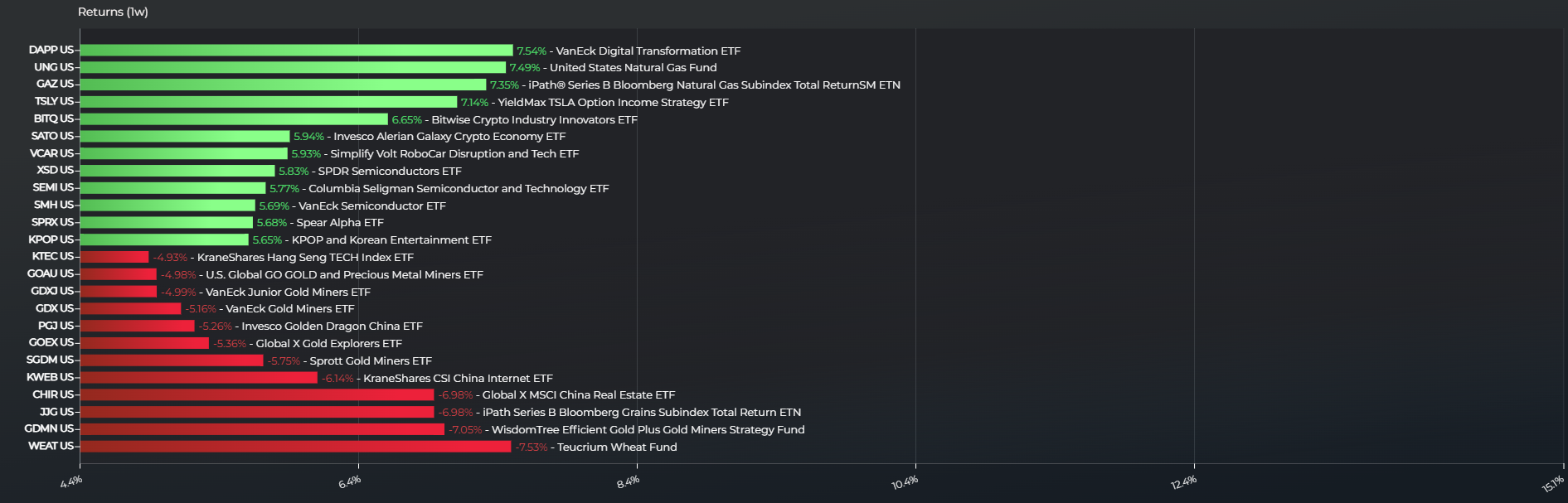

Crypto winter seems to really be thawing, according to the latest list of top-performing ETFs from LOGICLY. Three of the top eight ETFs including the top ETF focus on cryptocurrencies and the blockchain. Economic volatility tied to the debt ceiling may be driving investors towards those strategies as a kind of “safe haven.”

Whatever the case, crypto ETFs have risen to the top again. The VanEck Digital Transformation ETF (DAPP) lead the way over the last week returning 7.5%, investing across the crypto economy. So too does the Invesco Alerian Galaxy Crypto Economy ETF (SATO), which combines digital asset firms with Bitcoin exposure. SATO charges 61 basis points, returning 6% over the last week. Intriguingly, SATO also adds a 3.56% dividend yield to its package.

Rounding out the group of crypto ETFs, the Bitwise Crypto Industry Innovators ETF (BITQ) returned 6.6% over the last week. BITQ charges 85 basis points to track the Bitwise Crypto Innovators 30 Index. SATO tracks the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index. DAPP tracks the MVIS Global Digital Assets Equity Index.

Outside of Crypto ETFs

Outside of crypto, natural gas, semiconductors, and EVs took a number of remaining spots in the top-performing ETFs list. The YieldMax TSLA Option Income Strategy ETF (TSLY) returned 7.1% for the week, offering a covered call approach to TSLA. The SPDR Semiconductors ETF (XSD) also returned 5.8% charging 35 basis points to track its S&P semiconductor index. TSLY charges 99 basis points, actively investing since November 22, 2022. TSLY has reached $67.6 million in AUM since its November launch.

The KPOP and Korean Entertainment ETF (KPOP) rounds out the list of top-performing ETFs for the week. KPOP returned 5.6% over the week, charging 75 basis points to track its K-Pop-focused index. The ETF has also returned 10.7% YTD.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for SATO, for which it receives an index licensing fee. However, SATO is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of SATO.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.