Clean energy and fintech are two of the premier disruptive technologies, yet in many cases, investors must get to them through individual funds. The ALPS Disruptive Technologies ETF (CBOE: DTEC) makes life easier for investors seeking exposure to both themes.

DTEC tracks the Indxx Disruptive Technologies Index, which identifies companies using disruptive technologies across ten thematic areas, including Healthcare Innovation, Internet of Things, Clean Energy and Smart Grid, Cloud Computing, Data and Analytics, FinTech, Robotics, Artificial Intelligence, Cybersecurity, 3D Printing, and Mobile Payments.

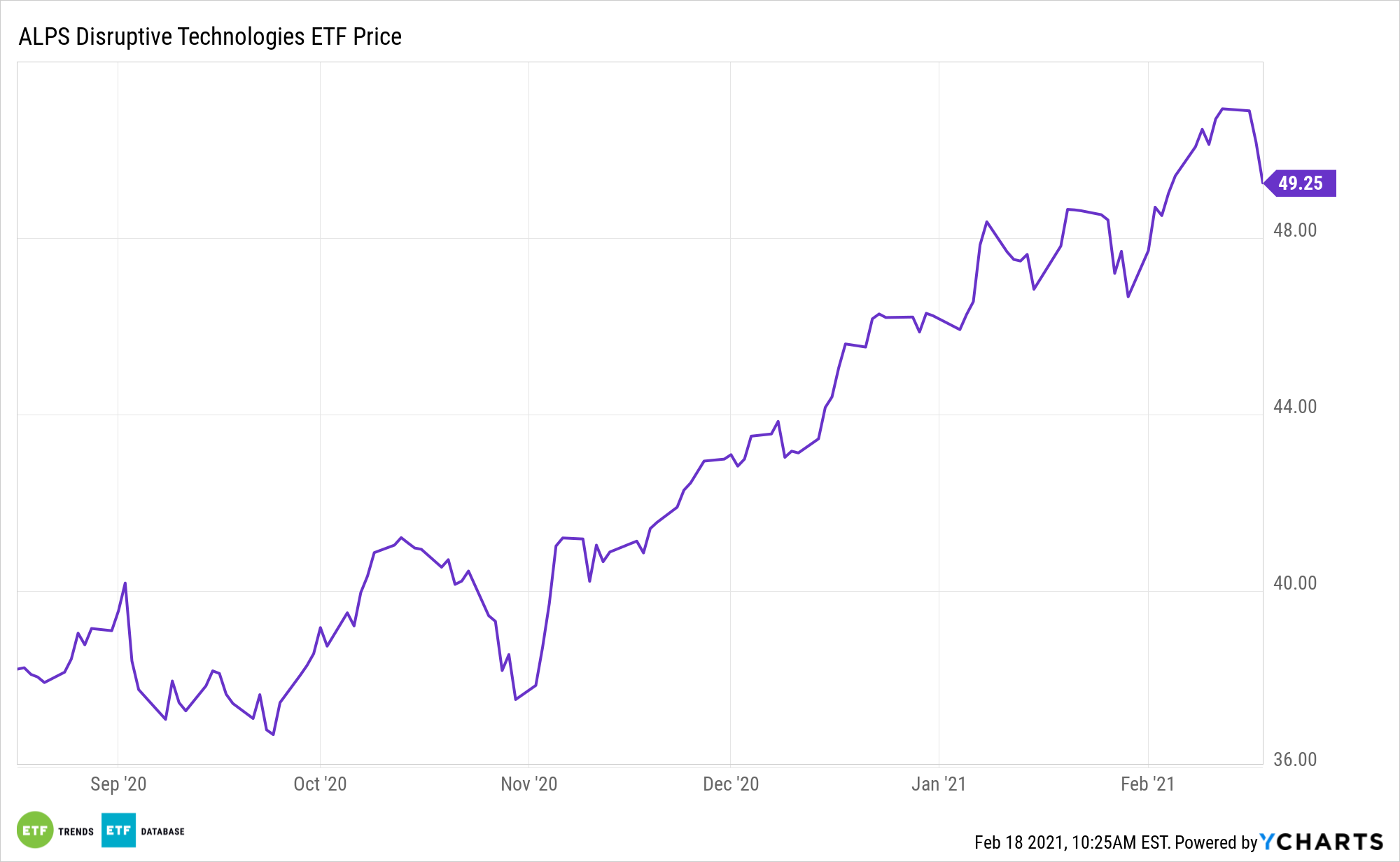

In fact, DTEC’s fintech and renewable energy components are propping the fund up in 2021, sending it to a year-to-date gain of 8.50%.

Adyen, one of DTEC’s fintech components, added 17% last week after announcing that net profits for the second half of 2020 rose on higher revenue and payments volumes. The Dutch online payments processor, which handles transactions for companies such as EBay and McDonald’s, expects to see continued growth, even as worldwide vaccination programs mean people will return to stores to shop.

Fintech Finesse and Clean Energy Efficiencies

Fintech firms are companies that are powered by innovations, working to disintermediate or bypass the current financial markets and challenge traditional institutions by offering new solutions that are better, cheaper, faster, and more secure.

Stocks in this category, including Square and PayPal, have a myriad of tailwinds. Square and PayPal are currently threatening major credit card networks. That threat is emerging more rapidly than many industry observers expected.

As for renewable energy, DTEC has that base covered, too, and that’s a good thing because the industry is scorching hot.

DTEC holding China Longyuan Power Group gained another 14% last week after reporting a 47.5% increase in overall power generation in January, with wind generation +50.8% on the month.

Europe is one of the regions most committed to clean energy adoption. The continent speaks to the long-term, international opportunity with DTEC’s renewables exposure.

Some industries known for their heavy carbon footprints are also looking to change their ways and adopt alternative sources, but that move requires capital.

What makes DTEC appealing for long-term investors is that these capital investments take time, often multiple decades. That means there could be a generational trend of rising renewable energy spending ahead.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.