The Inflation Reduction Act, which was approved by a Democratic Party-led Congress and signed into law by President Biden in August 2022, is expected to help cut greenhouse gas emissions over the next decade by investing in clean energy initiatives. Coupled with spending approved through the Build Back Better Act of 2021 and other efforts, there are a number of potential catalysts for the emerging investment theme. As with many themes, there are an array of clean energy-related ETFs to consider.

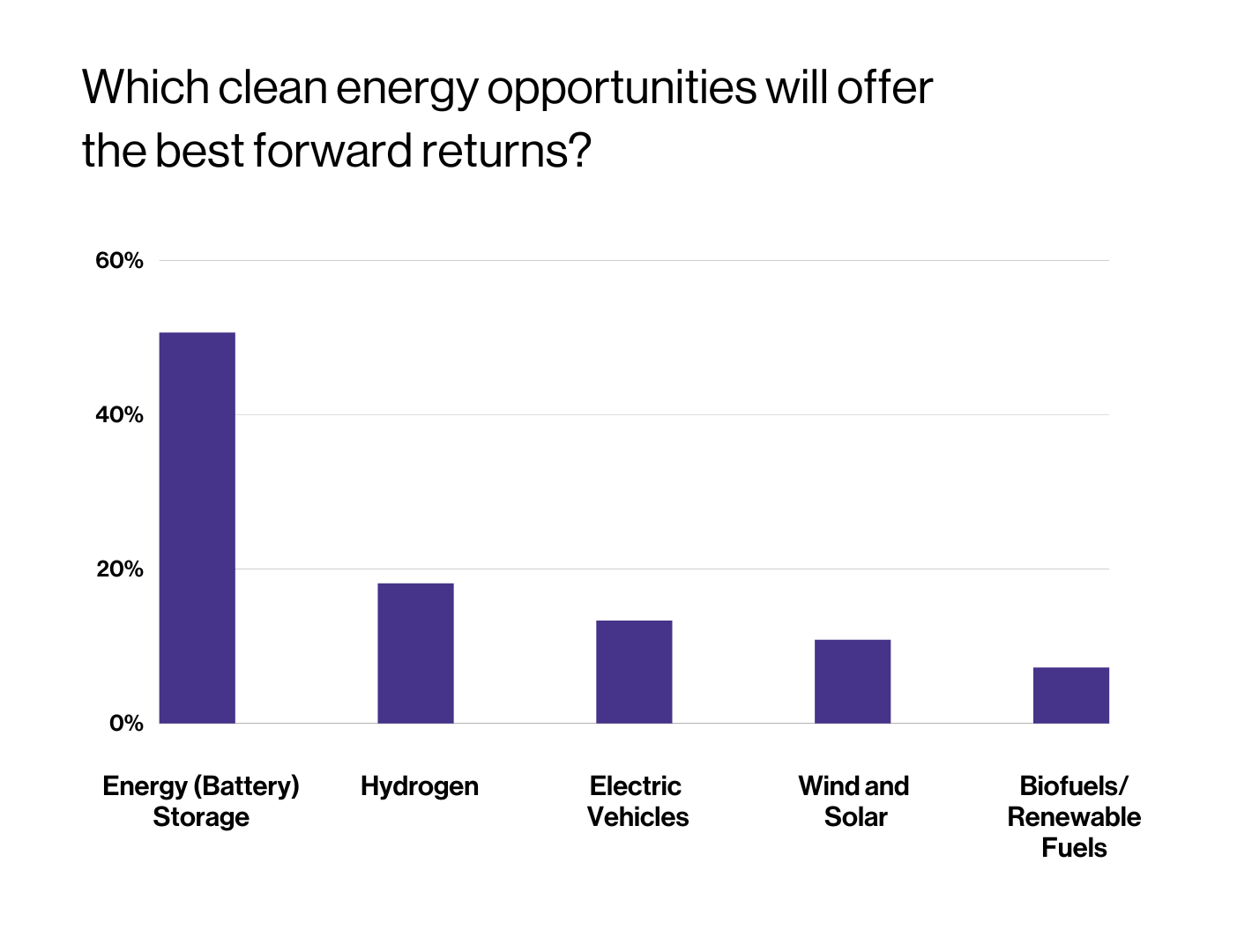

In an October webcast hosted with ALPS, VettaFi asked advisors, “Which clean energy opportunities offer the best forward returns?” The majority of respondents (51%) chose “Energy (Battery) storage,” followed by “Hydrogen” (18%), “Electric Vehicles” (13%), and “Wind and Solar” (11%). Broader adoption of electric vehicles, which produce zero direct emissions, is widely expected over the next decade. However, the battery storage and technology market is also expected to grow rapidly to support demand for electric vehicles as well as other energy storage solutions.

The largest related ETF, the Global X Lithium & Battery Tech ETF (LIT), is a $4 billion fund even though it incurred $1.5 billion of net inflows in 2022. LIT owns 40 positions, with a 15% stake in specialty chemicals company Albermarle, which generated sales growth of 91% in the second quarter of 2022 due to strong demand and pricing trends for lithium and bromine; Albermarle was expected to report third quarter results on November 2.

Another popular ETF tied to the battery storage theme is the Amplify Lithium & Battery Technology ETF (BATT). BATT has 86 positions, the largest of which is BHP Group. While BATT and LIT have overlapping positions, the weights differ. For example, BATT’s second-largest position is in Tesla, with a 6.4% stake. LIT owns a more modest 3.7%, with the automaker falling just outside of the top 10 holdings. Meanwhile, BATT had a 2.6% position in Albermarle.

Let’s compare the two ETFs further. BATT is considerably smaller in size with just $165 million in assets, but the ETF’s net flows were negligible thus far in 2022, unlike LIT’s. While U.S. stocks represent approximately a quarter of both LIT’s and BATT’s assets, LIT has more exposure to China (37% vs. 29%) and South Korea (11% vs. 6%), but less to Australia (9% vs. 16%). We think it is notable that BATT charges the lower fee of the pair (0.59% vs. 0.75%), but despite the cost advantage, BATT was down 30% for the year, approximately 900 basis points more than LIT. Indeed, LIT’s total return through the first 10 months was modestly below that of the iShares MSCI ACWI ETF (ACWI).

In February 2022, the WisdomTree Battery Value Chain and Innovation ETF (WBAT) launched and charges an even lower 0.45% fee, though demand has been minimal thus far. WBAT has $5 million in assets.

For those advisors who see greater potential in clear energy from other themes, the Direxion Hydrogen ETF (HJEN), the iShares Self-Driving EV and Tech ETF (IDRV), and the Invesco Solar ETF (TAN) are some funds worthy of a closer look. Meanwhile, broader clean energy ETFs, such as the ALPS Clean Energy ETF (ACES), offer a more diversified approach that incorporates companies focused on electric vehicles, energy management and storage, hydrogen, solar, and wind.

Topics like these are ones under consideration for discussion on stage at the Exchange ETF conference in Florida in February 2023. Advisors can join us by registering today and saving.

For more news, information, and strategy, visit the ETF Building Blocks Channel.