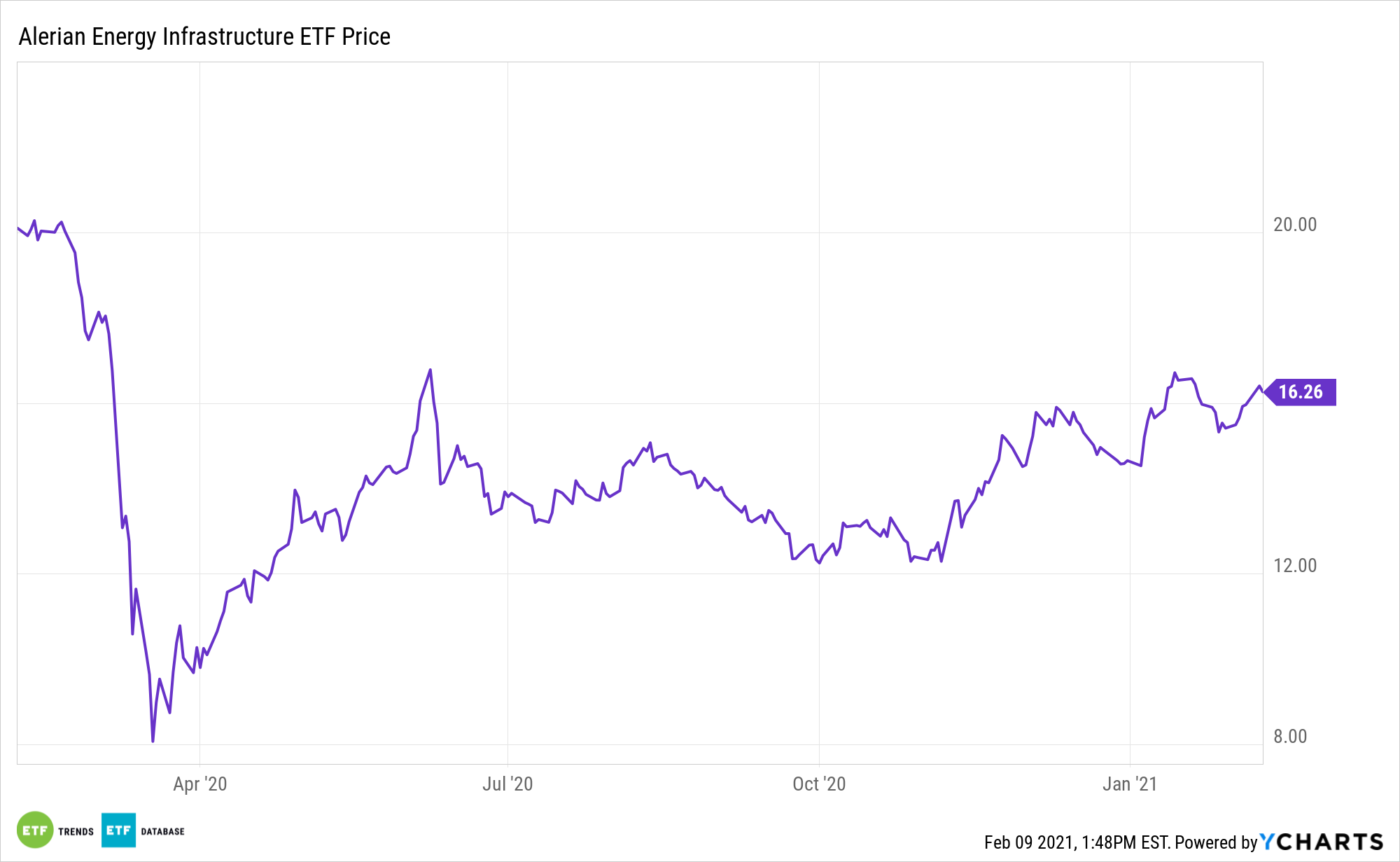

Traditional energy was the worst-performing group in the S&P 500 last year. Renewable energy equities soared in the meantime. But the Alerian Energy Infrastructure ETF (ENFR) is proving investors shouldn’t be quick to ignore traditional energy fare.

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

“The divergent returns between the energy sector and consumer staples sector — the top-performing and worst-performing groups this year, respectively — indicates that the market is betting on an economic comeback and return to growth,” reports Pippa Stevens for CNBC. “Investors are returning to cyclical areas of the market like energy, which are more sensitive to the macro backdrop than defensive sectors like staples.”

ENFR Proving Steady So Far

The energy sector has been rallying the past few months, with the S&P 100 Energy Index up close to 40%. Basic supply and demand factors will continue to play a part in oil prices in 2021 as the world continues to recover from 2020. Global investment firm Goldman Sachs is expecting price increases as a result of tighter supply in 2021.

“The rotation into cyclical sectors began during the fourth quarter of 2020 amid positive Covid-19 vaccine developments, and as economies began to reopen. Still, gains in the fourth quarter hardly made a dent for the energy sector, which closed out 2020 down 37% for its worst year back to its inception in 1989. Some of this year’s outperformance for energy is, of course, due to the low starting base,” according to CNBC.

ENFR is up nearly 10% to start 2021. ENFR offers a unique way to access the U.S. energy market, giving investors seeking to avoid cap-weighted products an alternative way to bet on oil stocks. ENFR is likely too targeted for those investors with a long-term focus, but can be useful as a way to tilt portfolio exposure toward a specific sector.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.