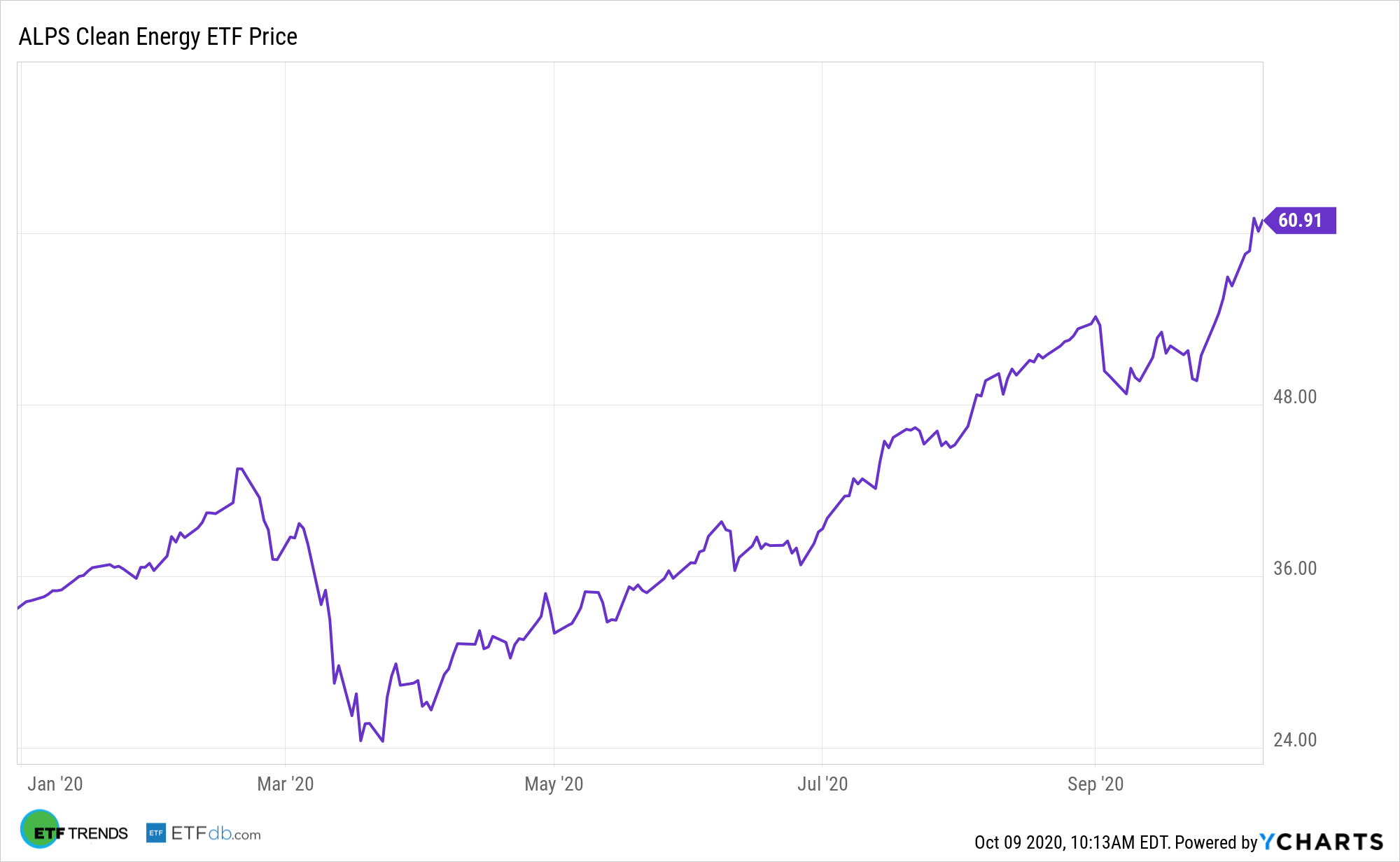

Already scorching hot this year, the ALPS Clean Energy ETF (ACES) could be in for more good times if the former Vice President Joe Biden wins the upcoming presidential election because investors widely believe a Democratic regime will be favorable to renewable energy stocks.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S. and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

One of the differentiating factors with ACES relative to legacy exchange traded funds in this category is that the ALPS fund offers exposure to multiple clean energy industries, including solar. Fortunately, solar is one of the fund’s largest industry allocations.

“If you look at Biden’s plan, he announced in July a very comprehensive $2 trillion spending plan that would focus on … building a green, clean infrastructure and getting us to an equitable, clean energy future, and that is going to hit every aspect of the economy,” said Chantico Global CEO Gina Sanchez in an interview with CNBC.

Sizzling Solar a Boon for ACES

Covid-19 certainly did a number on business sectors across the spectrum, but one area that didn’t suffer was electricity generation via wind and solar power. In fact, the use of wind and solar for electric power doubled in the last five years, which underscores the ability for renewable energy sources to thrive amid a black swan event triggering an economic downturn.

ACES’ solar components include companies that derive a significant amount of their revenues from the following business segments of the solar industry: solar power equipment producers including ancillary or enabling products. Declining costs a low interest rate in the U.S. are bolstering the case for solar equities, propelling ACES higher in the process. There are other drivers for ACES’ solar components.

“Growth will be underpinned by the societal onus for environmental sustainability, increasing consumer demand for power resiliency, and deflationary battery storage tailwinds with CA continuing to serve as the critical market,” according to Piper Sandler research.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.