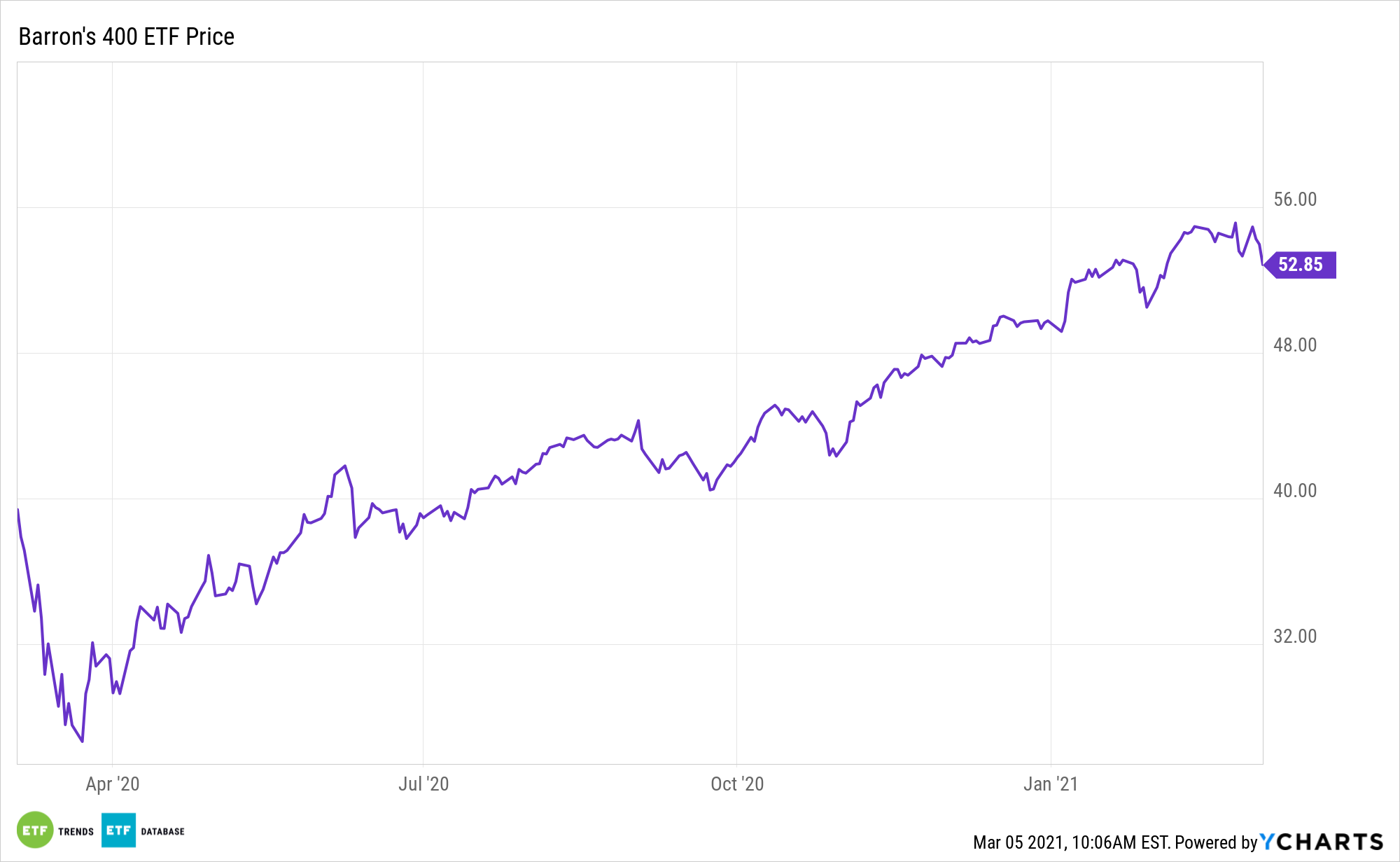

It’s often believed that quality comes at higher multiples, and that the thesis is even more true when considering smaller stocks, including mid caps. The Barron’s 400 ETF (NYSEArca: BFOR) can help solve this riddle.

BFOR tracks the Barron’s 400 Index (B400), which takes 400 stocks from the broader MarketGrader U.S. Coverage Universe by using a methodology that selects components based on the strength of their fundamentals in growth, valuation, profitability, and cash flow, and then screens components for certain criteria regarding concentration, market capitalization, and liquidity.

For long-term investors, BFOR is a prime idea for mid cap exposure.

“Investors who put their money in a portfolio of mid-cap stocks that were inexpensive and high-quality, have enjoyed an advantage over a strategy that holds high-quality names regardless of valuation,” according to Heartland Advisors. “In fact, the combination meaningfully outpaces the returns of the mega-cap dominated S&P 500 and adds to the long history of mid-caps outperforming large-cap stocks as a group.”

Bank on BFOR for the Long Haul

Mid cap companies are slightly more diversified than their small cap peers, which allows many to generate more consistent revenue and cash flow, along with more stable stock prices. Many are not so big that their size slows down growth.

“Investors are buying more of a good thing (quality as measured by earnings before interest and taxes/total assets) at a lower price as measured by price/earnings. The challenge comes from uncovering quality names that are overlooked by the broader market and still trading at a discount,” notes Heartland Advisors.

BFOR’s rules-based index was designed to provide investors a way to track some of the highest-performing U.S. companies based on the strength of their financial statements and the attractiveness of their share prices. To maintain the index’s growth at a reasonable price, the index is reconstituted and rebalanced twice a year. The rebalancing act also reveals what companies have fallen behind, along with firms that are on the up-and-up.

Due to a screening process that, as noted above, includes cash flow and profitability, BFOR dodges some of this year’s laggard sectors that are having cash flow problems.

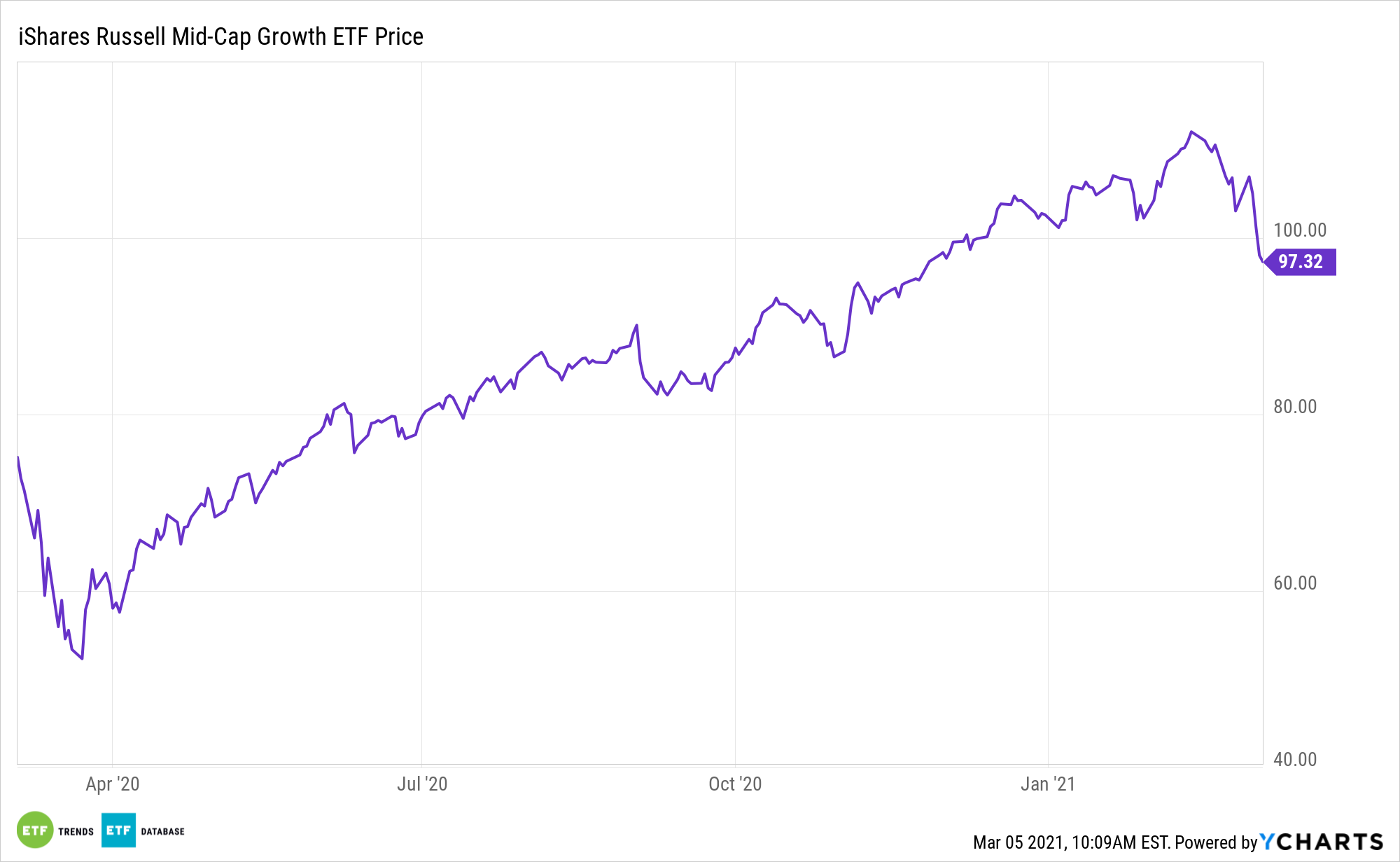

Alternatives to BFOR in the mid cap growth space include the iShares Russell Midcap Growth ETF (NYSEARCA: IWP), First Trust Mid Cap Growth AlphaDEX Fund (NasdaqGM: FNY), and the iShares Morningstar Mid Growth ETF (NYSEArca: JKH).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.