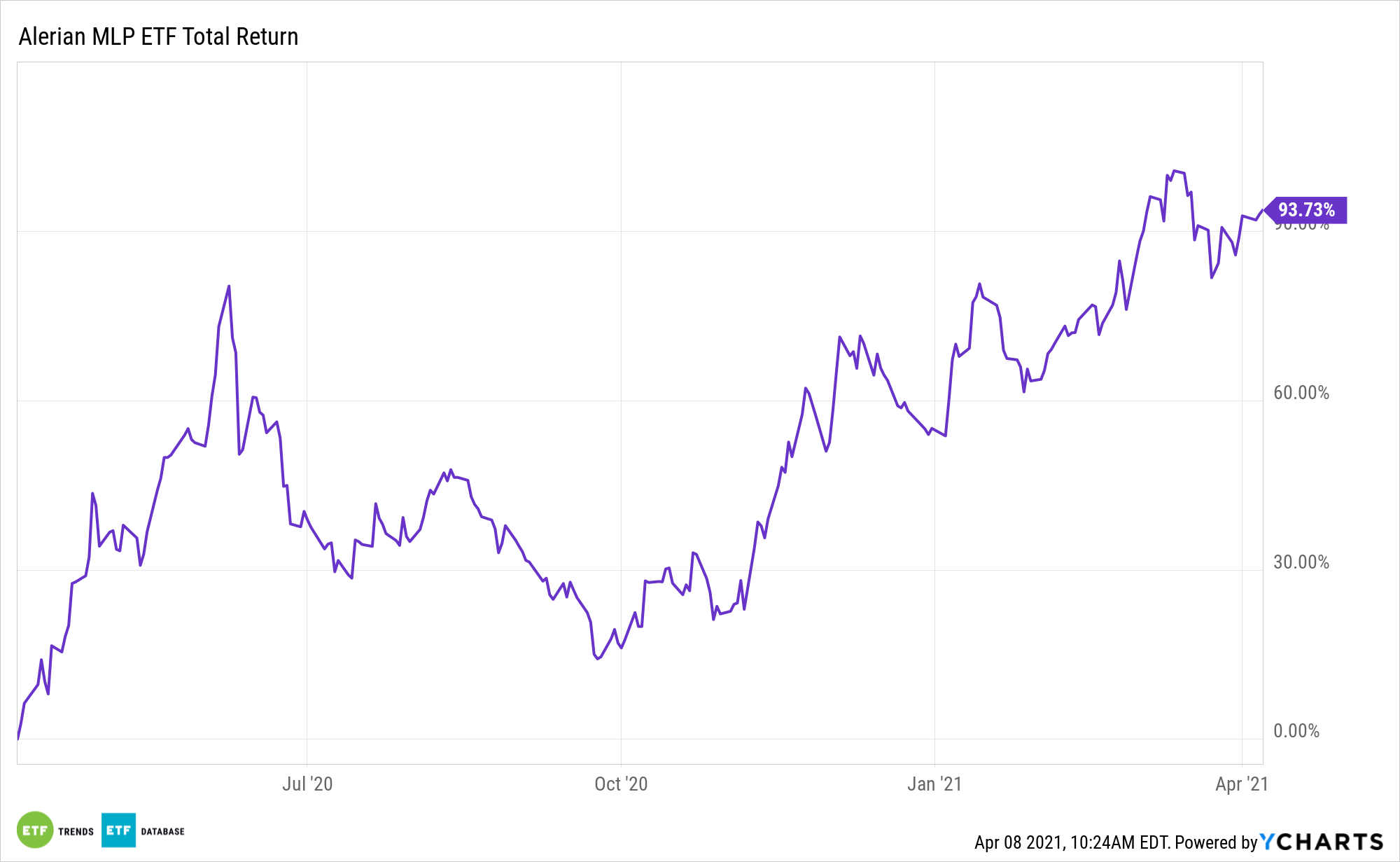

Master limited partnerships and the ALPS Alerian MLP ETF (NYSEArca: AMLP) are impressing to start 2021. More could be on the way as the energy sector steadies itself and interest rates remain low.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

See also: Alerian Natural Gas MLP Index – ETF Tracker

“For investors desiring greater income and anticipating continued momentum in value, MLPs and midstream stand to benefit given their energy exposure and discounted valuations relative to history,” reports Seeking Alpha.

AMLP: A Valid Value Idea

Energy’s status as a value destination further enhances the case for AMLP.

“Value names remain attractively positioned to benefit from the ongoing macroeconomic recovery and positive outlook. Importantly, the growth-to-value rotation remains in early stages relative to historical cycles,” adds Seeking Alpha.

Energy has been one of the top-performing sectors so far in 2021. Yet rather than getting a run-of-the-mill energy fund with a handful of heavy allocations toward big oil, investors can opt for an alternate play via AMLP.

MLPs have become very popular in recent years for primarily two reasons: (1) required quarterly distributions provide a steady stream of current income, and (2) because they are partnerships, MLPs avoid corporate income taxes at both the federal and state level as the the tax liability is passed through to the individual partners.

“Midstream continues to offer yields above historical averages. For the MLP indexes below (AMZ and AMZI), yields are slightly below the 5-year average but more than 100 basis points above the 10-year average,” continues Seeking Alpha.

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.