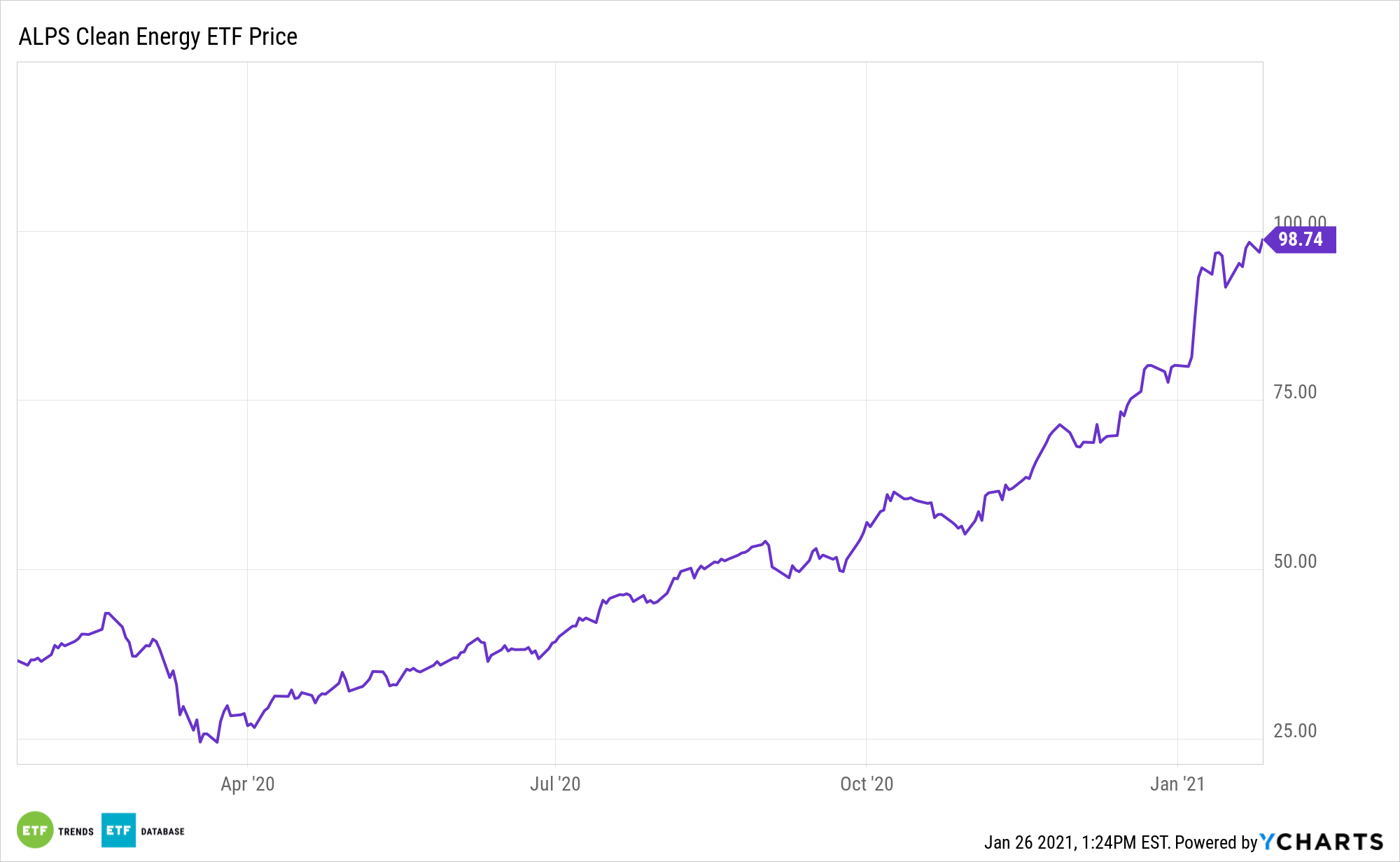

Owing to its relative youth, the renewable energy industry often hits an array of milestones, which is proving rewarding for exchange traded funds such as the ALPS Clean Energy ETF (ACES).

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

Another milestone was reached last year when Europe generated more electricity from renewables than fossil fuel for the first time on record.

“Europeans got more of their electricity from renewable sources than fossil fuels for the first time last year, according to an annual report from Ember and Agora Energiewende,” reports Jazmin Goodwin for CNN Business. “The report, which has been tracking EU’s power sector since 2015, found that renewables delivered 38% of electricity last year, compared to 37% delivered by fossil fuels.”

The ACES Clean Energy Thesis

Europe is one of the regions most committed to clean energy adoption. The continent speaks to the long-term, international opportunity with ACES.

Some industries known for their heavy carbon footprints are looking to change their ways and adopt alternative sources, but that move requires capital.

What makes ACES appealing for long-term investors is that these capital investments take time, often multiple decades. That means there could be a generational trend of rising renewable energy spending ahead.

“The shift comes as other sources, such as wind and solar power, have risen in the European Union. Both sources have nearly doubled since 2015, and as of last year accounted for one-fifth of electricity generation in EU countries, the report found. It’s also the reason why coal power declined 20% last year, making up only 13% of electricity generated in Europe,” according to CNN Business.

Data confirm the international allure of ACES.

“Global investors managing nearly $7tn (£5.2bn) of assets plan to almost double their spending on renewable energy infrastructure over the next five years amid deepening concerns over the fossil fuel industry’s climate plans, according to a report,” an article in The Guardian said. “A survey of institutional investors found that they are planning to increase their renewable energy investments from 4.2% of their overall portfolio to 8.3% in the next five years and 10.8% within the next decade to about $742.5bn.”

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.