As the United States doubles down on its intent to combat the negative effects of climate change, exchange traded fund investors have turned to socially responsible strategies.

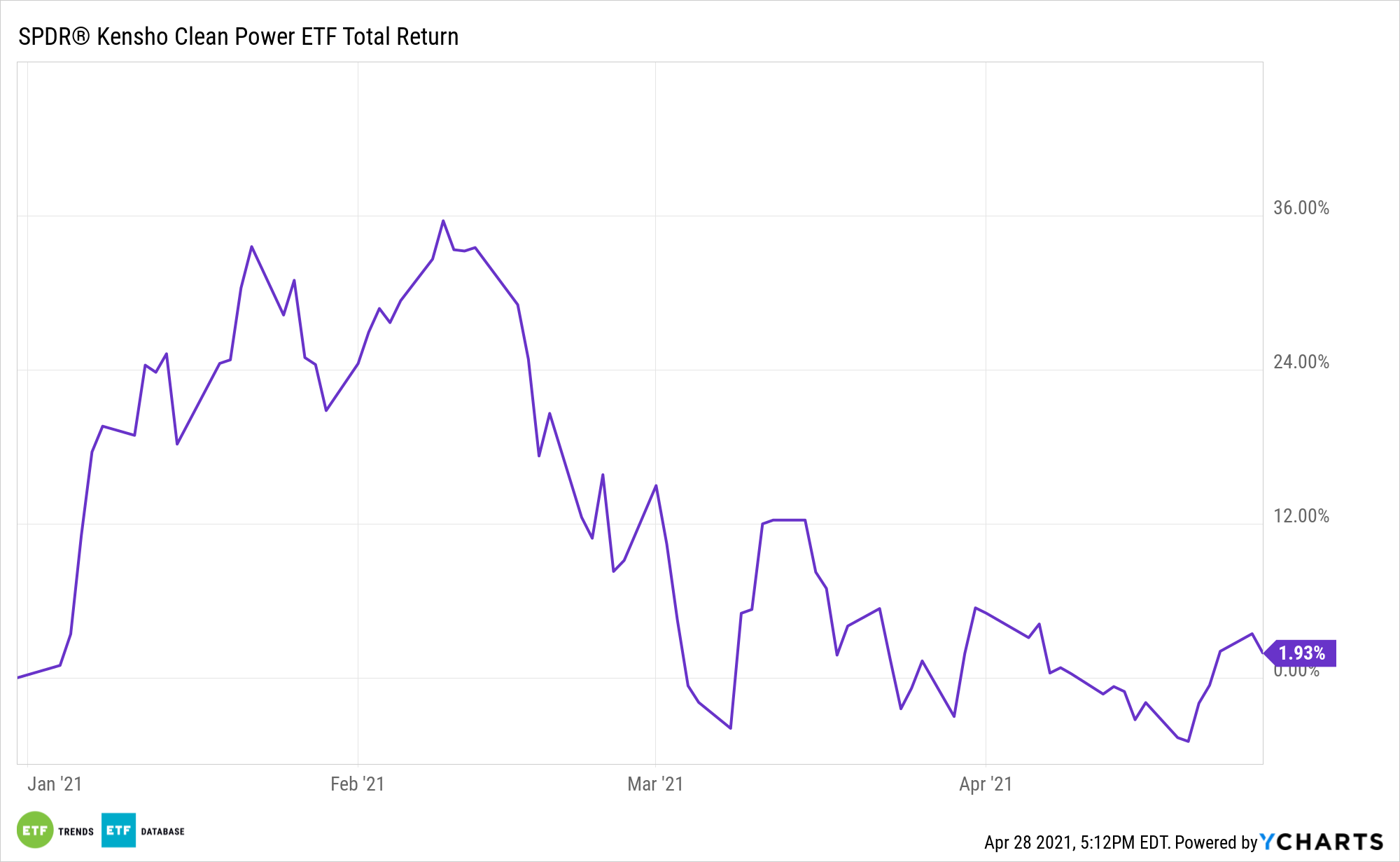

For example, as a way to help investors tap into socially responsible investment opportunities, State Street Global Advisors offers a suite of socially responsible and ESG-related ETFs. One fund, the SPDR Kensho Clean Power ETF (CNRG), seeks to provide exposure to the clean power industry in terms of both generation and underlying technology.

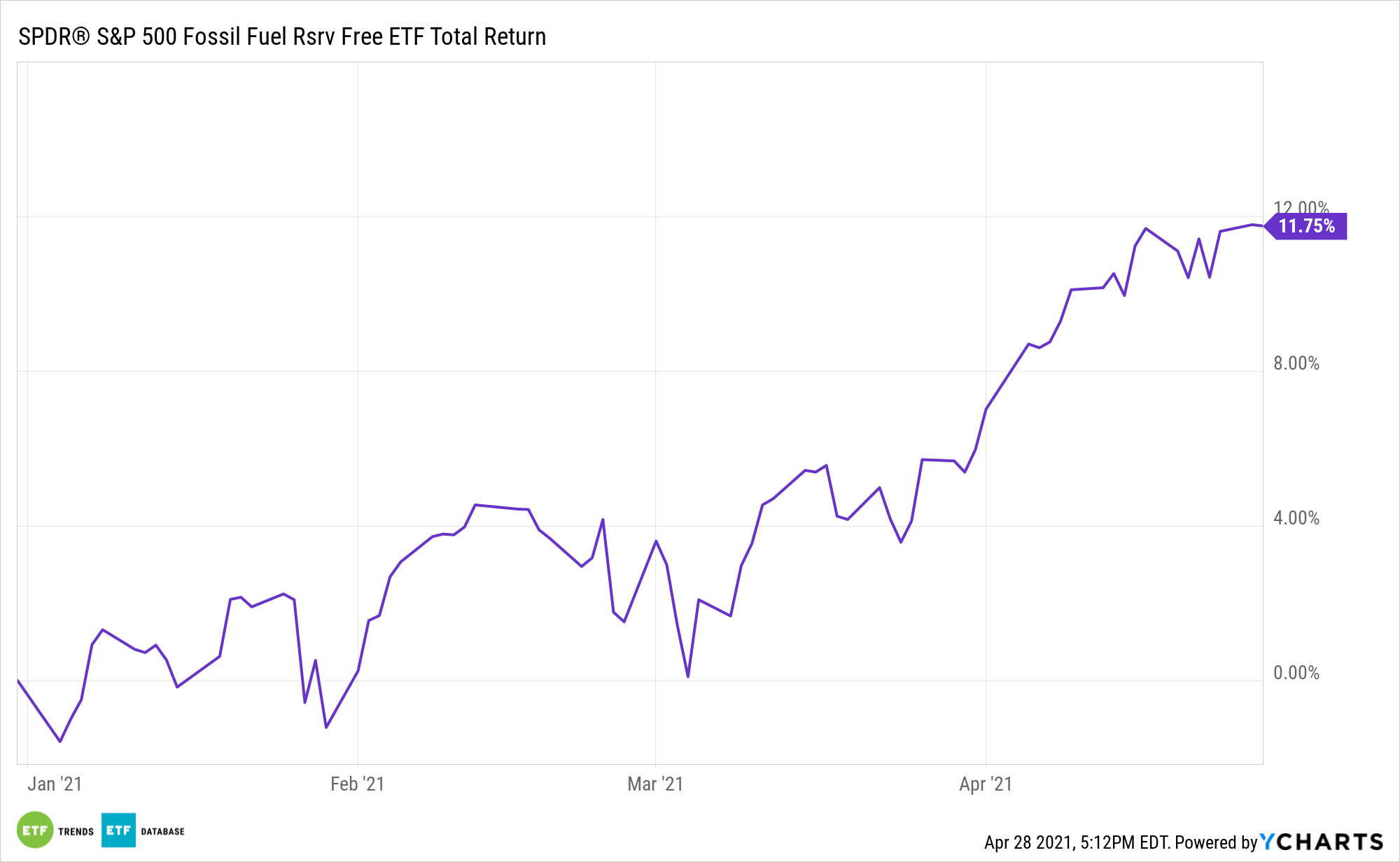

The firm’s SPDR S&P 500 Fossil Fuel Free ETF (SPYX) is now a $1 billion fund. As of February, the fund has had 32 consecutive months of inflows – not a single day of outflows in over two years. SPYX tries to allow climate change-conscious investors to align the core of their investment strategy with their values by eliminating companies that own fossil fuel reserves from the S&P 500.

For their part, sustainable mutual fund strategies could be particularly burdened by changes in the Biden tax plan.

“Those sustainable mutual funds are at risk,” Matthew Bartolini, Managing Director, Head of SPDR Americas Research at SPDR Exchange Traded Funds (ETFs), told ETF Trends in a call, pointing to what the Biden administration is doing to fund the climate plans via new tax proposals. “If they’re increasing long-term capital gains rates up to 43% on individuals making more than $1 million, that’s going to have a severe impact.”

Bartolini noted that 70% of all mutual funds have paid at least one capital gain distribution over the past three years, or what amounts to $12.6 trillion worth of mutual funds. On the equity side, it’s even worse. About 100% of all equity mutual funds, indexed or active, have paid at least one capital gain in the past three years, which covers $9.2 trillion in assets.

“We’ve seen a shift in how assets are being invested from the socially conscious investor, and obviously with the cost conscious investor. And now you’re going to have the tax conscious investor. That’s just going to accelerate the bull run of ETF growth. ESG is going to benefit, as well as low-cost,” Bartolini added, referring to environmental, social, and governance strategies and related ETFs.

For more news, information, and strategy, visit the ESG Channel.