As more money managers launch socially responsible fund investments that track environmental, social, and governance principles, investors should look to see whether or not these vehicles are really green.

There are varying opinions on how well companies deliver on ESG since there is no U.S. or global standard. Consequently, ESG investments may come in varying shades of green, with some even claiming certain products are being greenwashed.

Industry insiders are debating whether or not light-green, or “light-touch,” ESG funds are more about marketing than sustainability, MarketWatch reports. Implementing ESG data in a limited way is not “greenwashing”, or claiming something is sustainable when it’s not, since asset managers disclose fund goals and ESG criteria, along with a deeper dive in SEC prospectus filings. However, not all investors take the time to read the fine print. It takes even more time to catch up with asset managers’ shareholder advocacy.

Investors will care about how green their funds are if they think the ESG fund has a strict strategy to affect real world changes with a management team that pursues these goals. On the other hand, others may be just content that a fund is limited to a portfolio of high ESG-rated companies. In either case, investors should still conduct their due diligence when selecting an ESG fund to fully understand the fund’s approach to ESG criteria.

Todd Rosenbluth, director of ETF research at CFRA warned that ESG funds that want to mimic broader stock-market index returns may own higher-ranked ESG stocks in a particular industry but also select some names that might surprise socially conscious investors. For instance, a broad ESG fund may include fossil fuel names that hit the mark on the ‘S’ and ‘G’ criteria, but not the ‘E’ requirement.

“By being sector-neutral, you are going to have energy and you are going to have utilities, two sectors less-likely to be environmentally friendly. They may or may not be environmentally friendly, but they have strong governance or social characteristics,” Rosenbluth told MarketWatch.

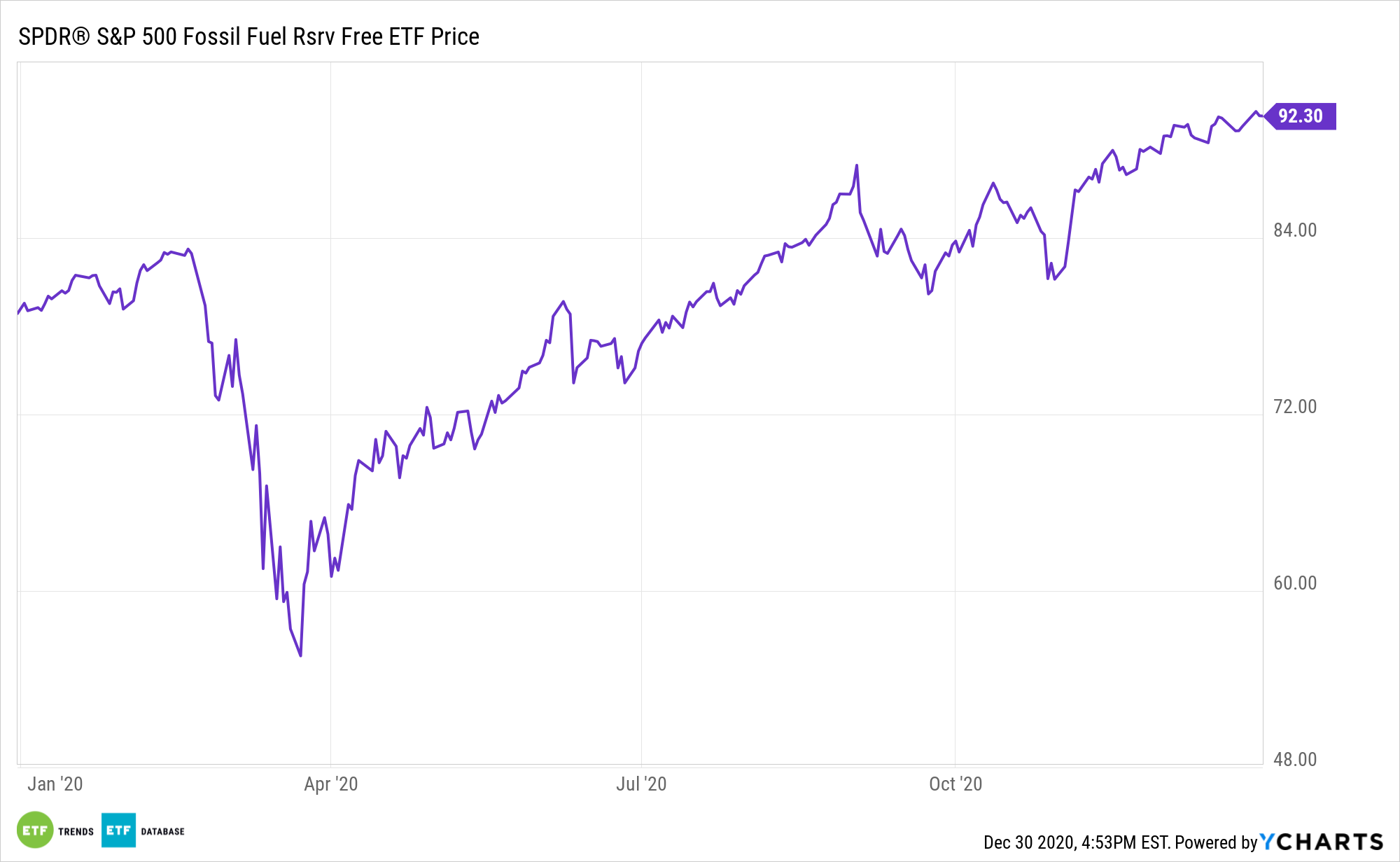

Matt Bartolini, head of SPDR Americas Research, highlighted their SPDR suite of fossil-fuel-free funds as a rules-based approach to divest from companies with fossil-fuel reserves in high carbon-producing industries. Specifically, the State Street Global Advisors’ SPDR S&P 500 Fossil Fuel Free ETF (SPYX) tries to allow climate change-conscious investors to align the core of their investment strategy with their values by eliminating companies that own fossil fuel reserves from the S&P 500.

“Eliminating all firms that interact with carbon would result in a heavily concentrated portfolio that may not be suitable for all investors. As a result, there is a small exposure to firms that may interact with carbon, but do not have proven reserves – consistent with the intended investment strategy to only divest from firms with fossil-fuel reserves,” Bartolini told MarketWatch.

For more news, information, and strategy, visit the ESG Channel.