By Steve Pitchford, Director of Tax and Financial Planning

Responsible investing has captured public attention in recent years. And with a plethora of responsible investing based products available, the opportunity to utilize those that are both consistent with an investor’s personal values and at the same time continue to meet the investor’s investment objectives has never been better. Below we will focus on the three most widely discussed types and the differences between each.

Responsible Investing

Responsible investing (RI) is any investment strategy which seeks to consider social/environmental issues in addition to financial return.

While the earliest forms of RI have been around since the 1960s, only more recently has responsible investing gained noticeable prominence in the investment world. The pace of growth in RI today is nothing short of remarkable.

According to the US SIF Foundation’s 2016 Report on US Sustainable, Responsible and Impact Investing Trends, as of year-end 2015, more than one out of every five dollars under professional management in the United States —$8.72 trillion or more—was invested according to SRI (Socially Responsible Investing) strategies.

Responsible investing adds a personal, values-based layer to traditional investing, and can often mean something different to each individual.[1]

Consequently, there is confusion among investors, and even financial professionals, on what exactly is the definition of a responsible investment. For example, if reducing tobacco use is important to investor A but not investor B, investor A would certainly consider an investment focusing on antitobacco company ads as a ‘responsible investment,’ while investor B would not.

A further cause of confusion is the many different names and terminologies used to describe responsible investing.

Some terms often used synonymously with responsible investing are SRI (socially responsible investing), ESG (environmental, social and governance) investing, impact investing, mission-based investing, socially conscious investing, sustainable investing, and green investing.

Describing each category under the responsible investing umbrella would be an exhaustive process and may only lead to further confusion given the overlap between the many categories.

For the purposes of this white paper, we will focus on three distinct (in our opinion) categories of responsible investing: SRI, ESG investing, and impact investing.[2]

Socially Responsible Investing

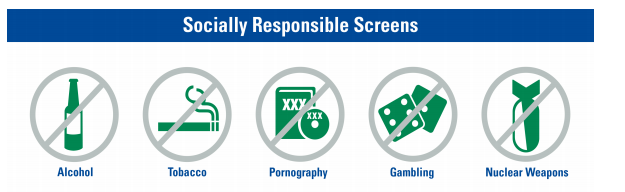

Responsible investing’s earliest iteration is known as Socially Responsible Investing (SRI). The most elementary form of SRI, first gaining traction in the 1960s, employs a negative screening tactic to exclude undesirable companies from an investment portfolio. “Sin stocks”[3] and other companies that have questionable environmental and social policies are most often those that are “weeded out.”

Common targets for negative screening include companies that are involved in alcohol, tobacco, pornography, gambling, or nuclear weapons.[4]

SRI continued to evolve and began including positive screening factors as well. For example, companies that have strong environmental impact performance records, utilize renewable energy, or that foster diversity and/or equal pay.

One clear benefit of SRI is the ability for an investor to avoid providing capital to a company not aligned with their personal values.

However, because the earliest forms of SRI often focused so exclusively on this personal values component, investment performance was sacrificed. Ignored was the economic impact of avoiding investing in certain companies, ultimately decreasing an investor’s probability of earning competitive returns.

Modern SRI products have more sophisticated screening tactics that offer an investor the opportunity to not only have a portfolio that reflects their personal values, but also one that can offer competitive investment returns.

SRI is still very popular today.

Environmental, Social and Governance Investing

An outgrowth of SRI, the term Environmental, Social and Governance (ESG) investing is often used interchangeably with SRI. However, there are fundamental differences between SRI and ESG investing.

ESG investing considers environmental, social and governance risks when selecting companies and countries in which to invest.

Environmental criteria looks at how a company interacts and impacts the natural environment. What

are a company’s policies on climate change, renewable energy, carbon emissions, and water recycling?

Social criteria examines a company’s relationships with its employees and the community. What are

a company’s policies on labor standards, human capital, privacy, and data security?

Governance criteria focuses on a company’s leadership, executive pay, auditing procedures,

internal controls, and shareholder rights. What are a company’s policies on pay, ownership,

corruption, and business ethics and fraud?

Relative to SRI, ESG investing places a higher emphasis on financial performance. In fact, many investment companies and analysts believe screening for ESG factors is a fundamental aspect of evaluating the prospects of an investment’s long-term financial performance, independent of the “morals” of investing in a company.

As such, many investment analysts examine a company’s ESG factors as they would a company’s balance sheet, income statement, and cash flows.

While it is still an open debate whether screening for ESG factors positively or negatively impacts an investment’s financial return, the argument that screening for these factors being additive to long-term investment performance is intuitive.

For example, a company that meets one or several of the criteria for ESG investing may focus on benchmark goals rather than shorter-term quarterly profits, promoting a stronger longer-term growth trajectory for the company. Or, a company that focuses on pay equality will generally have a more stable workforce.

Impact Investing

Impact investing differs from SRI and ESG investing in its level of focus on direct and measurable environmental/social initiatives. Impact investments measure and report their progress on achieving their social/environmental cause, often subordinating investment performance to do so.

Impact investing is the most personalized and customizable form of responsible investing, allowing an investor to find an investment that fits specific causes they are most passionate about. For example, an impact investment can be as focused as exclusively funding venture capital financing for small to medium-sized business in Ghana.

One challenge associated with impact investing is actually locating the company or organization involved in a particular initiative an investor is passionate about. Unlike SRI and ESG investing, an investor cannot simply pick an impact investment stock from the investment universe. Instead, locating and funding an impact investment is often accomplished through research on options within the private market.

With the ability to find (or build) an impact investment for nearly every social/environmental initiative, impact investing is one of the broadest categories of responsible investing.

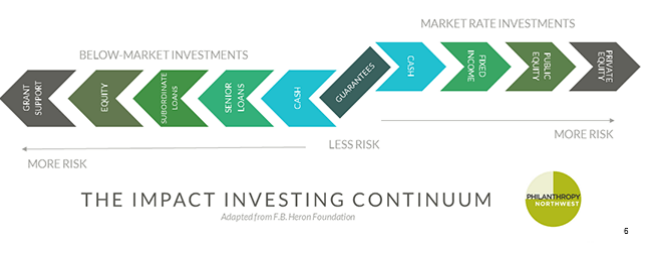

One way to group impact investments is by the emphasis placed on investment return.

While actual investment returns is nearly always of secondary importance with impact investments, many do aim to provide competitive investment returns. For example, a common form of impact investing is a private equity investment (that supports an environmental or social cause) that strives to generate return on the invested capital as well.

However, with other impact investing initiatives, the investor may be willing to accept a discounted return from the outset. As a simplistic example, an investor agrees to 10% total return on a debt security in an underserved market, where one would normally expect a 20% return.

While impact investing is still in its infancy relative to SRI and ESG investing, it is a growing field that many see as the future of responsible investing.

Should I Consider Responsible Investing?

This is a personal decision, based on your individual values, beliefs, and goals, both personally and economically.

While it can be difficult for responsible investing to be as directly impactful as more traditional charitable giving strategies, RI does provide a way for an individual’s investment portfolio to better reflect their personal values and at the same time, keep them on track to achieve their financial goals and objectives.

At Towerpoint Wealth, we are a legal fiduciary to you, and always work 100% in your best interests. We are here to serve you, and will strive to match your personal values with your investment portfolio, should this be important to you. If you would like to further discuss responsible investing with us, we encourage you to call, 916-405-9166

or email [email protected] to open an objective, no-strings-attached dialogue.

Originally published by Towerpoint Wealth

Towerpoint Wealth, LLC is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Towerpoint Wealth, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Towerpoint Wealth, LLC unless a client service agreement is in place.

Source:

Front Cover: Alexandru Sava, Febuary 28, 2016, Does Socially Responsible Investing Make Financial Sense?, digital image, The Wall Street Journal, accessed July 11, 2018,

https://www.wsj.com/articles/does-socially-responsible-investing-make-financial-sense-1456715888

![]()

![]()

![]()

![]()

![]()