The Department of Labor has just concluded its 60-day public comment period on the rollback of two different rules adopted under the Trump administration that made sustainable investing impossible for retirement plan issuers, reported E&E News.

The old rules put in place by Trump’s administration placed a high degree of regulatory scrutiny on advisors and financial institutions that chose to align their investments with climate change concerns by forcing proof that any ESG funds invested in would not affect profits for clients. The other rule required financial institutions to justify any support of ESG proposals that were put forth by shareholders.

The rollbacks are being increasingly supported not just by environmentalists but also the financial industry broadly and some of the largest financial institutions. The new language takes the opposite stance in that any retirement plan issuers not only can support climate change initiatives but also should support such initiatives.

“The Labor Department’s rule proposal corrects the misperception that fiduciaries are at risk if they include any [environmental, social or governance] factors in the financial evaluation of plan investments — treating ESG factors the same as any other economic factors,” said Susan Olson, general counsel at the Investment Company Institute, a trade group with members such as BlackRock, Vanguard and JPMorgan Chase.

Long-term, climate change advocates believe that the rulings will have to go further and require active participation by all issuers, not just retirement, within the ESG arena, but for now, they believe it’s a step in the right direction.

Investing in ESG with SPDR

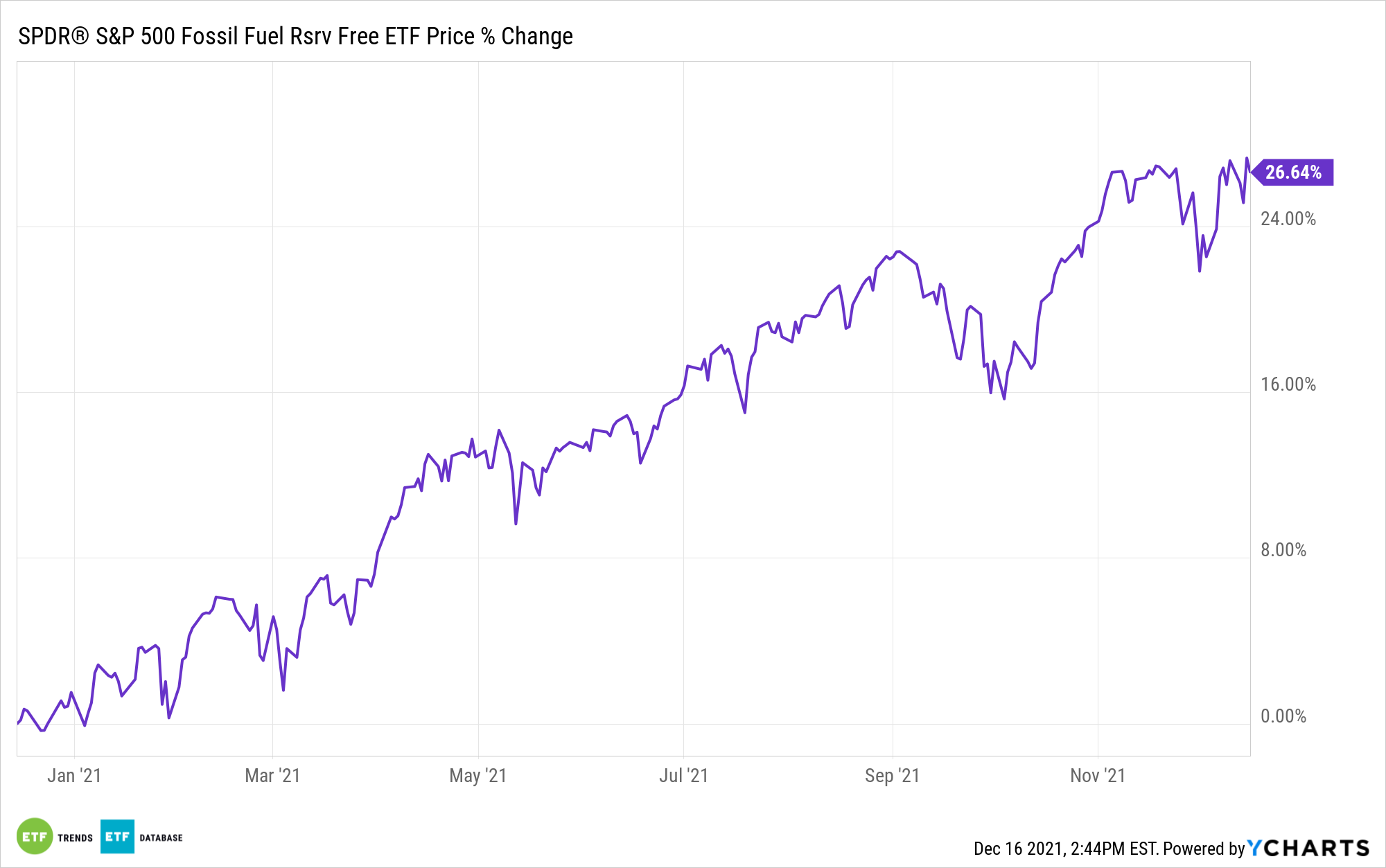

The ability of retirement plans to participate in ESG investing could bring a flood of new funding to the market. For investors looking for a way to invest broadly in the S&P 500 but tilted towards an exclusionary lens for fossil fuel exposure, they need only turn to the SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX).

The fund tracks the S&P 500 Fossil Fuel Free Index, a benchmark of companies within the S&P 500 that are “fossil fuel free,” defined as companies that don’t own fossil fuel reserves (thermal coal reserves and coal reserve byproducts, as well as oil or gas reserves).

That’s not the same as being devoid of all oil stocks. The fund still has minor allocations to fossil fuel companies, including Valero (VLO) and Halliburton (HAL). But without exposure to companies actually holding the physical oil, coal, or gas reserves, the fund’s energy allocation is much reduced. Energy comprises just 0.69% of the ETF’s sector make-up, as compared to 2.66% of the SPDR S&P 500 ETF Trust (SPY).

SPYX has an expense ratio of 0.20%.

For more news, information, and strategy, visit the ESG Channel.