By Robert Smith, President

Florida Governor Ron DeSantis, a future GOP presidential contender, recently announced his plan to combat ESG (environmental, social, governance) influence in Florida by placing a “flat ban” on incorporating the globalist ESG platform into the state’s pension system’s investments. In doing so, the Governor stated that “we’re going to make sure that the fiduciary duty is defined very clearly and that they stick to that.”1 He went on to say – in a classic case of the pot calling the kettle black – that he “wanted to provide protections for people in the financial marketplace from being discriminated against based on an ideology.” The Governor’s statement illustrates the fact that many of our national leaders do not understand the basic purpose and application of ESG risk analysis, nor do they demonstrate a solid understanding of the foundational responsibilities of an investment fiduciary. More importantly, like many anti-ESG enthusiasts, the governor has ignored the interests and intent of most of his constituency regarding climate risk and a wide range of related environmental concerns.

Comments made in recent weeks by our political leaders illustrate that the real problem with ESG is not the tenets of ESG analysis, but that ESG as an investing discipline is simply not well understood. This has made it difficult for many investors and politicians to grasp what is really at the heart of ESG – risk management.

Unfettered Political Leanings Distort Fiduciary Duty

In our view, the public vitriol that has been directed at ESG is not well deserved and may in fact lead investors to suffer subpar investment performance. This is because most of the ESG antagonists have mistakenly come to believe that it is mostly about an imposition of unacceptable moral values. Many people that oppose the application of ESG risk analysis often cite the bias against fossil fuel investments and generally low allocations to the traditional energy sector found within sustainably focused funds as a cause for deep concern and a breach of fiduciary responsibility.

Investment fiduciaries must also satisfy their “Duty to Loyalty” to serve and protect their clients’ best interests and the need to act without personal economic conflict. Unless there are specific constraints or preferences expressed by a client, investment advisors are expected to fulfill this requirement through their understanding of investment trends and public sentiment as well as by developing a framework to evaluate the risk and return trade-off between a range of ESG factors, such as corporate carbon emissions, human capital management practices, and the application of controversial technologies.

Politicians Ignore Public Opinion

With this fiduciary requirement in mind, investment managers must often evaluate public sentiment about issues like climate change, renewable energy development, and corporate global warming responsibilities. The 2021 national Yale Climate Opinion Maps survey, for example, showed that 72% of Americans think global warming is indeed happening.5 Moreover, the survey showed that 77% of respondents support funding for renewable energy sources, and 70% expect corporations to do more to address global warming. (It’s worth noting that survey results for Florida, Texas, and the Sixth Congressional District of Kentucky were very much in line with the majority of American’s concerns over climate risks.) We believe the survey results offer investment managers guidance on the prevailing sentiment and interests of not only the general public but also of many investors. By considering and integrating information of this nature into the investment process we believe investment managers are adhering to their “Duty of Loyalty” in meeting their fiduciary responsibilities.

In addition to public opinion surveys, the assets that have flowed into ESG funds in recent years have captured the attention of an increasing number of investors and fund managers. In 2021 assets in U.S. ESG mutual fund and ETFs soared to a record $400 billion, up 33% from $303 billion in 2020. This burgeoning trend has also been evident in the number of new ESG-focused mutual funds and ETFs over the last several years. It is also worth noting that last year actively managed ESG funds were in such demand that, according to ISS Market Intelligence research, they attracted more investor flows than traditional actively managed funds.7 Moreover, organic growth for actively managed ESG funds was 9.7% in 2021, more than double the total for all actively managed funds. And while actively managed equity fund flows shrank 4%, new ESG stock fund flows grew at an 8% pace. Lastly, according to data from Refinitiv Lipper, 10% of the assets invested in funds worldwide are now in ESG funds.

The reasons for these impressive trends are largely reflective of investor demand for investment vehicles and methods that consider the environmental risks, societal imbalances, and management practices that may have adverse impacts on the capital value and long-term growth of their investment portfolios. As the environment and society changes, so too must our investment analysis, and the consideration of environmental, social, and governance (ESG) factors provides crucial insight. When used in conjunction with traditional fundamental financial research, ESG factor analysis enhances an investor’s ability to potentially get ahead of adverse or positive developments and events that may impact their investment portfolios. Indeed, companies have also come to recognize that assessing a range of financially material ESG risks and opportunities related to their business and industry can provide highly valuable insights to protecting their bottom lines. ESG factor analysis also encourages companies to look beyond the short-term mindset that can cloud and influence important public company core operating decisions and lead them to focusing on creating long-term sustainable business models.

Sustainably Focused Investing for Long-Term Success

ESG investing is neither a fad nor a new idea. ESG risk analysis and investing has been around for at least three decades. Amy Domini, Founder and Chair of Domini Impact Investments and one of Time Magazine’s “Most Influential People,” started one of the first socially responsible funds over 30 years ago. Her dedication, leadership, and investment record helped to launch what she and others have called in the field of ESG the “third major wave of change in asset management,” with Benjamin Graham’s value investing and modern portfolio theory being the first two.

To help anchor this movement, Domini worked collaboratively to introduce the first ESG company index in 1990. It was originally called the Domini 400 Social Index, and it was a public company stock market index based upon a well-defined set of social and environmental standards. Today this index is known as the MSCI KLD 400 Social Index, and it has produced an impressive and enviable long-term record of performance when compared to the S&P 500 and other traditional broad market indexes.

Investing requires making informed decisions based on things that have yet to happen. This is the primary benefit of integrating forward-looking ESG factor analysis within one’s investment philosophy and process. Although large short-term profits can often entice market neophytes, as we have seen in recent quarters with traditional energy sector investments, longer-term focused investing is essential for greater success. And while active short-term trading can make money, this involves greater risk for investors as compared to well diversified and patient investment strategies.

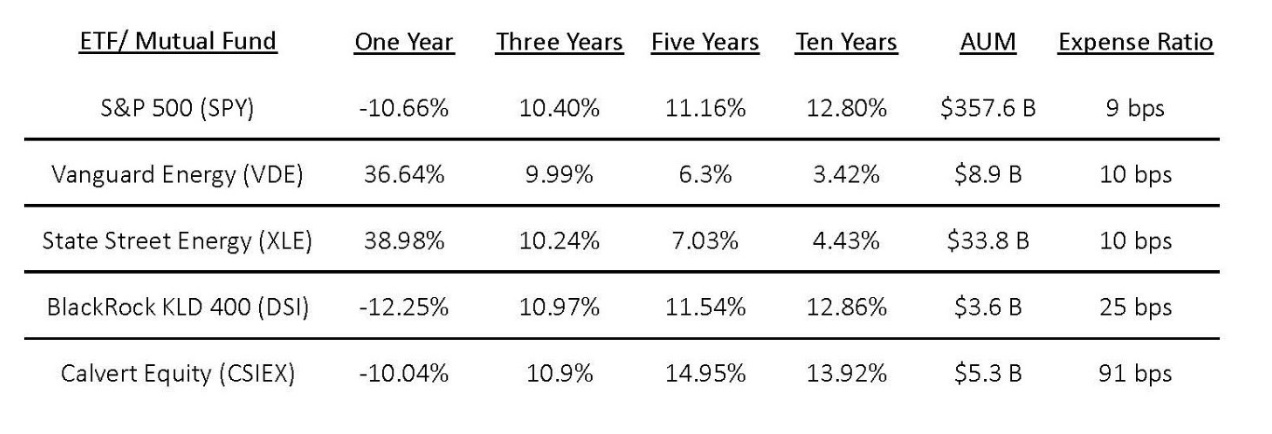

To illustrate this point, we compared the net of fees investment performance results over multiple annualized time periods for two established ESG-integrated investment funds with long-term track records versus the S&P 500 index fund. We also compared the investment performance of the energy

sector using two well-established energy index funds to evaluate their relative performance versus the broad market and the ESG integrated funds. Our comparative review is provided in the table below.

Our table shows that the broad market has recorded negative returns over the past year due to a variety of economic and market-related forces that led to the worst first-half results for any year over the last five decades. However, over the last 3-, 5-, and 10-year annualized periods, long-term investors have realized attractive double-digit returns well above the 10.7% annualized return for the S&P 500 index since it was introduced 65 years ago, despite the dramatic declines suffered over the last few quarters.9

To be sure, the energy sector has been the only bright spot for investors in what was a dismal first half of the year. Energy stocks benefited from soaring commodity prices, fueled by the war in Ukraine, COVID shutdowns across China, and the imposition of ill-timed restrictive energy policies by the Biden Administration. The strong performance of the sector this year stands in stark contrast to its fortunes over the past decade as the worst-performing sector within the S&P 500.10 This is clearly illustrated in the performance results of the Vanguard and State Street Energy Sector ETFs, which generated annualized returns over the last decade that were roughly one-third or less that of the broad market. The sector’s massive underperformance was created by excess global production, fueled by low-cost debt, which resulted in steep losses and prompted investors to abandon energy stocks in droves. It is also worth noting that with the recent political effort to publicly castigate ESG investors for their cautious concerns regarding the long-term outlook for fossil fuels, investors have seen a decline in oil prices, and recent indications are that June and July returns from this cyclically sensitive sector may be fading and reverting to their long-term averages.

In all, during the market tumult of this past year we found that the sustainably focused, ESG-integrated funds marginally underperformed the broad market due in part to their modest exposure to the energy sector. The KLD 400 Social Index ETF, which avoids companies with low ESG metrics and severe controversies, had a 1.60% allocation to the energy sector and 0.98% allocation the public utility sector, versus a 4.4% and 3.3% weighting in the S&P500 index, respectively. The Calvert Equity fund, which utilizes an ESG evaluation framework to guide their active corporate engagement and investment process, had no exposure to the energy or public utility sectors at the recent quarter-end. For short-term-oriented traders, the relative performance of the ESG-integrated funds of the last 12 months would be considered an investment failure worthy of contempt and abandonment, but for those “Buffet-like” long-term investors this period was a minor setback that did not compromise their competitive long-term returns. Despite their modest or zero allocation to the energy and utility sectors, the sustainable investment funds comfortably exceeded the performance of the broad market and trounced energy sector returns over the last 3-, 5-, and 10-year time periods.

The excess alpha provided by these seasoned funds clearly illustrates that over most long-term time frames, well-constructed index and actively managed ESG funds with disciplined investment philosophies do not cost market performance, but instead may offer greater rewards than traditional energy sector funds and the traditional broad market indices.

Final Thoughts

At Sage, we regard ESG-related risk assessment as an expansion of our fiduciary responsibilities. We take a balanced and pragmatic approach to considering the many financially material factors that confront corporations and their ability to build capital value for investors. Despite what many politicians are now claiming about ESG-focused investment management, we at Sage are neither “woke” capitalists nor high-minded moralists, but rather, we are the same pragmatic and fundamentally driven investors we have always been, integrating the wider lens of risk assessment afforded by ESG analysis. In thinking about the state of the public discourse over the intentions of ESG risk analysis, we should all consider the words of the late great comedic philosopher Groucho Marx: “Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly, and applying the wrong remedies.”

1) Creitz, Charles. “DeSantis announces plan to combat ESG influence in Florida.” Fox News. July 27, 2022.

2) “Rep. Roy introduces bill to stop taxpayer dollars in woke ESG funds.” Press Release. May 27, 2022.

3) “Sen. Rick Scott to State Pension Plan Administrators: ROI Should be Top Priority, Not Wall Street’s Woke Agenda.” Press Release. June 16, 2022.

4) Hayat, Usman. “Sustainable Investing and Fiduciary Responsibility: Conflict or Confluence?” CFA Institute. September 20, 2015.

5) Marlon, Jennifer, et al. “Yale Climate Opinion Maps 2021.” Yale Climate Change Communication program website. February 23, 2022.

6) Godbout, Ted. “Senator Seeks to Shut Down ESG Efforts from the ‘Whims of Woke CEOs’.” National Association of Plan Advisors. July 12, 2022.

7) Davis, Christopher. “The State of the ESG Fund Market.” ISS Market Intelligence. March 20,2022.

8) Ginsberg, Michael. “‘It’s A Scam’: House Republicans Prepare Next Salvo In War On Woke Capital.” The Daily Caller. July 19, 2022.

9) Knueven, Liz and Rickie Houston. “The Average Stock Market Return Over the Past 10 Years.” Business Insider. May 26, 2022.

10) McCormick, Myles and Nicholas Megaw. “U.S. energy stocks buck dismal trend with ‘massive outperformance’.” Financial Times. July 2, 2022.

For more news, information, and strategy, visit the ESG Channel.

Disclosures

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. The information included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. This report is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments

contain risk and may lose value. Past performance is not a guarantee of future results. Sustainable investing limits the types and number of investment opportunities available, this may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other strategies screened for sustainable investing standards. No part of this Material may be produced in any form, or referred to in any other publication, without our express written permission. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.