As ESG grows in popularity among investors, companies are scrutinizing not just their environmental impact, but also the diversity of their workforces.

A recent report by Morgan Stanley found that a gender-diverse workforce was correlated with higher returns, with more diverse companies outperforming their peers by 3.1% per year.

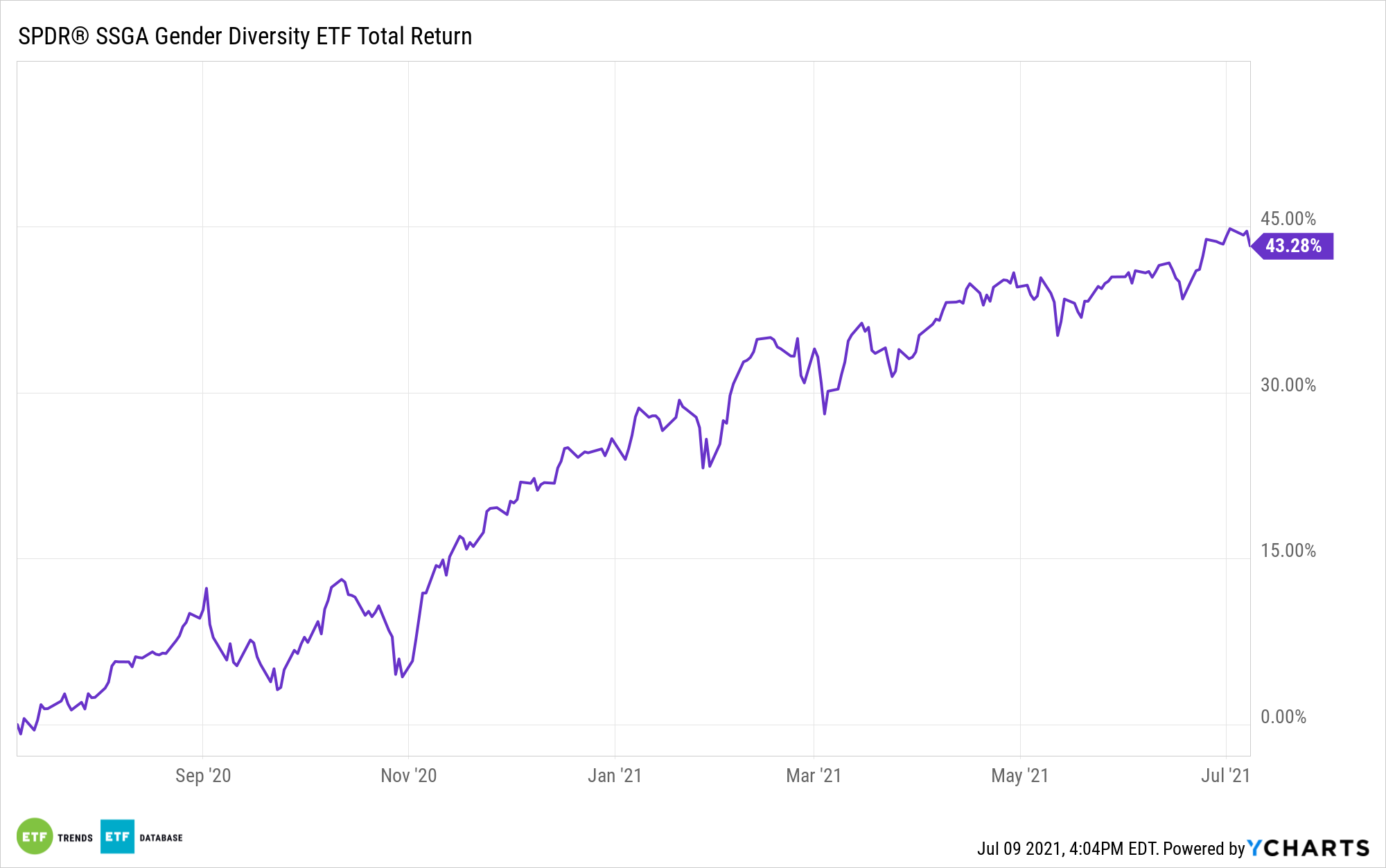

The SPDR SSGA Gender Diversity Index ETF (SHE) offers data-driven exposure to companies with the highest diversity amongst leadership positions within their industries.

SHE follows the SSGA Gender Diversity Index, an index that tracks large cap U.S. companies exhibiting gender diversity within their senior leadership.

The benchmark pulls from the top 1,000 U.S. stocks by market capitalization, utilizing three different gender diversity screens to narrow down its selection universe.

These metrics include the ratio of female executives and female board of director members to all executives and all board of director members; the ratio of female executives versus all executives; and the ratio of female executives (excluding those on the board of directors) compared to the number of executives in total (again, excluding board members).

For the purposes of the index, “executives” are defined as any Vice President position in a company and higher, or any Managing Director position and above in a financial sector company.

The top-ranking 10% of companies within each sector are selected and weighted proportionally, according to their free float market cap. Each stock has a maximum weight cap of 5%.

The top three sectors in SHE include information technology (29.54% of its portfolio); healthcare (13.46%); and consumer discretionary (13.09%).

Currently, the fund’s top three holdings include PayPal (6.41%), Texas Instruments Incorporated (5.06%), and Visa (4.40%).

SHE carries an expense ratio of 0.20%.

For more news, information, and strategy, visit the ESG Channel.