On Wednesday, both the International Renewable Energy Agency (IREA) and the International Energy Agency (IEA) highlighted the need to drastically increase the number and scale of clean energy projects and policies to help alleviate price hikes and volatility within the energy sector.

The Climate Summit convenes every five years, with countries pledging greater emissions curbing at each five-year increment to bring emissions targets into a livable and sustainable climate change range by 2050. Pledges going into this year’s summit that begins on Sunday have been lackluster, and the U.N. fears that the Climate Change Conference is the last stop-gap to curb the upward slope of global warming, reported Reuters.

The IEA has said that clean energy investments need to triple by 2030 in order to push the needle on climate change and meet current goals of net-zero emissions by 2050.

“We need to massively scale up clean energy investment as the longer today’s mismatch and energy investment persists, the greater the risk of future price volatility and delayed climate action,” Mary Warlick, deputy executive director of the IEA, told the Singapore International Energy Week conference.

In order to reach the net-zero emissions goals, there would need to be an investment of 2–3% of global energy converting to green energy every year, according to climate economists. The cost of inactivity would be vastly greater to the global economy.

“The pace — at which renewables were expanding in countries — has now got to increase. And for that, you don’t need an incremental change in policies, you need a step change,” IREA’s deputy director-general Gauri Singh said in an interview.

Investing in Clean Energy With State Street

For investors looking to invest in inherently ESG companies, one such option is a pure play based on the clean energy sector, which has continued growth opportunities as companies seek to find more environmentally efficient ways to reduce carbon emissions and run their businesses.

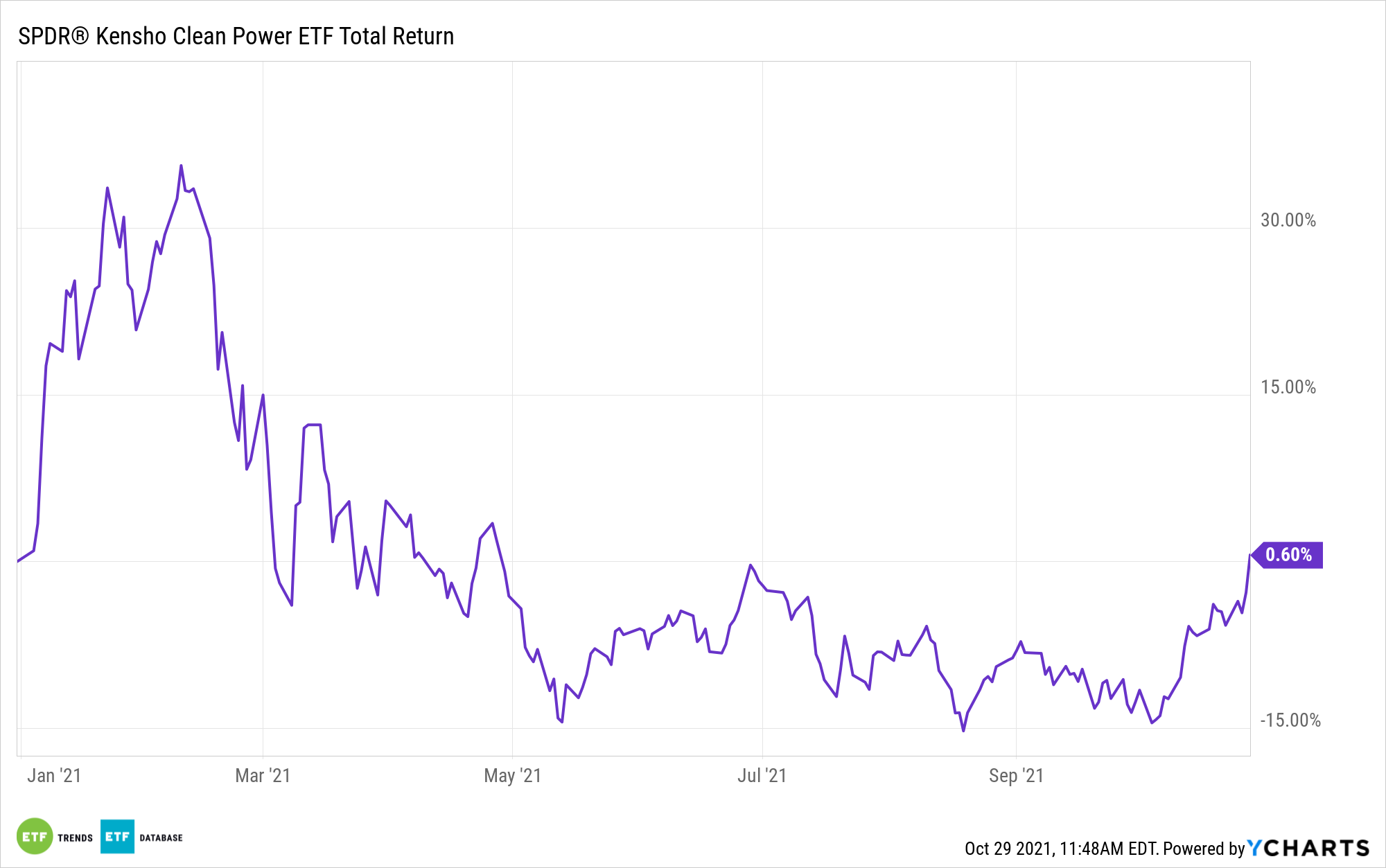

The SPDR S&P Kensho Clean Power ETF (CNRG) invests in clean energy and tracks the performance of the S&P Kensho Clean Power Index.

This benchmark combines artificial intelligence with a quantitative weighting methodology to invest in global stocks that drive innovation in the clean energy sector concerning both products and services. This includes firms manufacturing technology used for renewable energy and companies that have services and products related to the generation and transmission of renewable energy and supply chain companies.

CNRG allocates 18.57% of its portfolio to electrical components and equipment companies, 15.92% to semiconductors companies, 13.17% to electric utilities, and 10.82% to renewable electricity firms.

CNRG has an expense ratio of 0.45% and an AUM of $410 million.

For more news, information, and strategy, visit the ESG Channel.